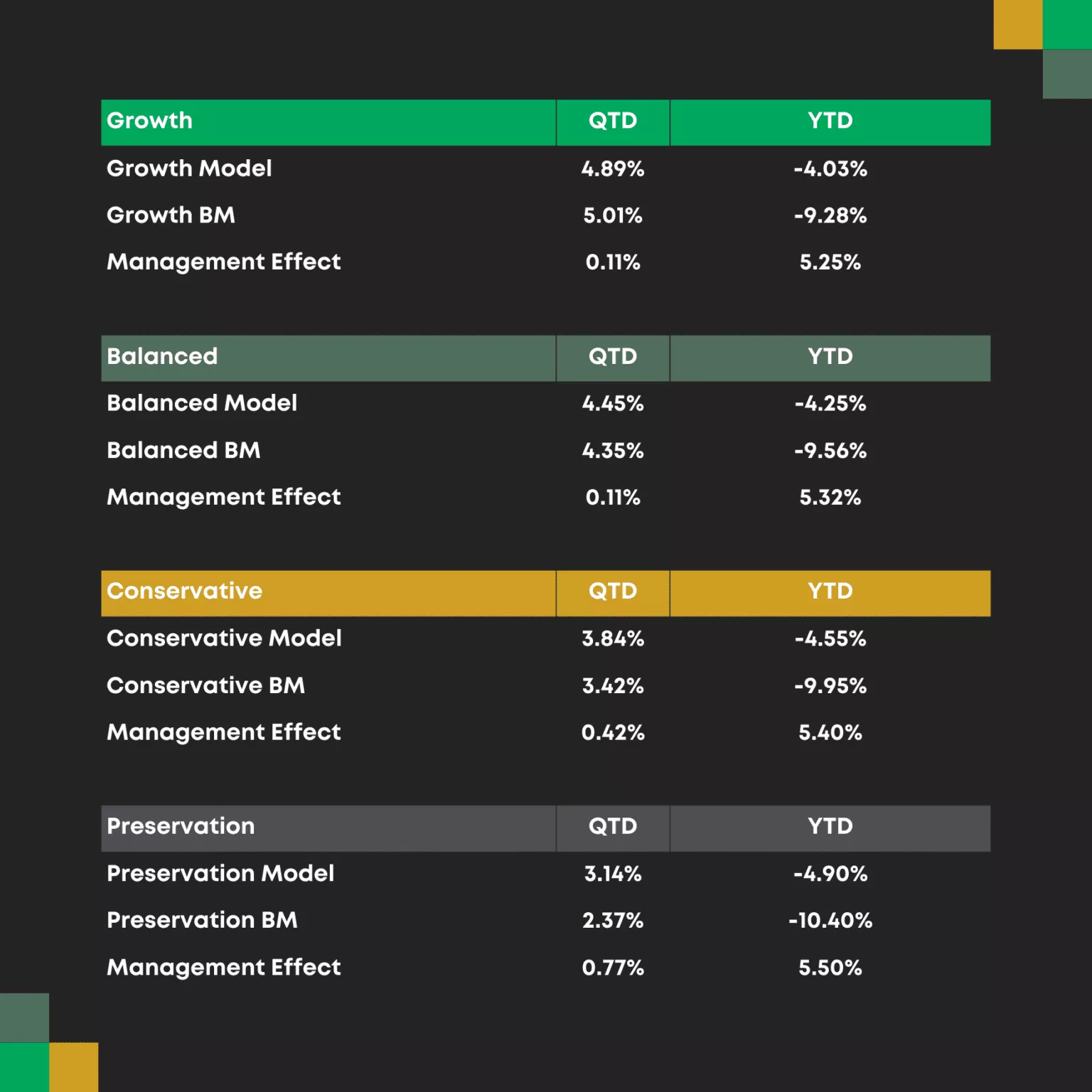

Performance and Management Effect

Commentary Highlights

- All of Raintree Wealth Management (RWM) Portfolios outperformed their respective benchmarks in a challenging year across asset classes. Our focus on managing risk and controlling downward volatility proved resilient during 2022.

- China abandons zero-COVID policy, and the economy reopening happens faster than expected.

- Canadian employment remains strong, the unemployment rate decreased by 0.1% to 5.0% in December.

- The last quarter of 2022 delivered positive returns on major asset classes such as equities and fixed income, continuing into 2023.

- Long-term yields dropped as inflationary pressure moderated. US 20-year yields drop approximately 35 bps, boosting risk-on-assets returns.

Market Overview

Last year was marked by significant market volatility due to continued inflation challenges globally and central bankers’ actions to tame it. Despite that, our portfolios outperformed their respective benchmarks in 2022. The past year was unique in that equities and fixed income moved very closely (and negatively) together, as the driver for both were mainly the same: Inflation and tight monetary policy. It marked only the 4th time in the last 150 years in which both stocks and bonds declined in the same calendar year. Our alternative strategies, such as our Long-Short position, effectively protected our portfolios from the severe losses and volatility of 2022. Not only offsetting losses from equity and fixed income, but also protecting the portfolios from higher volatility. Our asset allocation proved resilient for most of the year, and we exit 2022, far more optimistic than we entered the year from the perspective of future upside in both global equities and bonds.

Now looking into the last quarter of the year, all portfolios outperformed their benchmark with the exception of our Growth Portfolio which slightly underperformed. Canadian and U.S. markets rallied, delivering 5.97% and 5.56%, respectively and China and Europe also had significant equity rallies. A number of analysts are characterizing this as a bear market rally (a bounce up along a longer trend downward). Considering that we experienced one of the most aggressive rate hiking cycles in history, especially with the FED (U.S. Monetary authority), the year ahead could experience some continued volatility and headwinds to equity valuations.

Interest rates dominated the headlines, as central bankers attempted to reel in inflation. As we can see in the chart below (Figure 1), not only the shape of the yield curve turned from “normal” (interest rates going up the longer the bond duration) to inverted (interest rates going down the longer the bond duration), a well-known indicator of a future recession, but long-term yields such as 20-years and 30-years increased 220 bps (2.20%) and 210 bps (2.10%) respectfully, which had tremendously negative impacts on the prices of those bonds. This is the most aggressive monetary movement in decades, hampering bond values in North America and increasing the cost of borrowing across the spectrum, from governments to corporations to consumers.

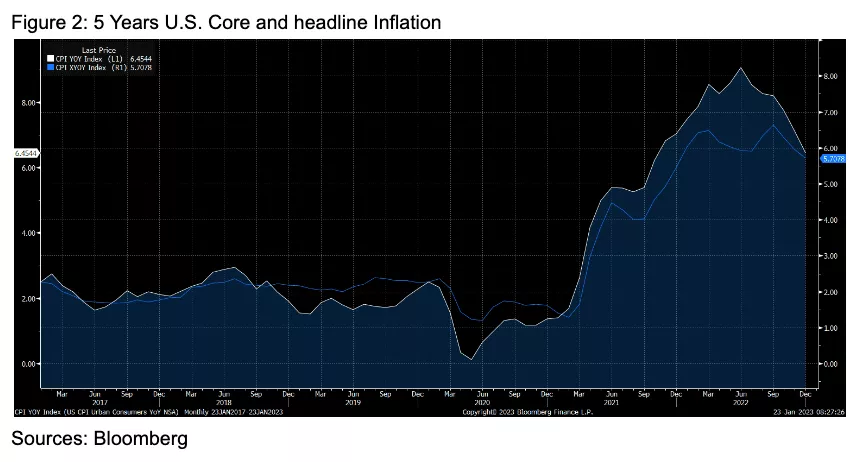

Such aggressive monetary tightening is largely the result of the resilience of inflation that has been haunting consumers since 2021. Figure 2 visualized the spike in inflation developing in 2021 and carrying into 2022. You can also see a major move downwards in the last quarter of the year. Weakening inflation is the primary explanation for the quarter-end rally in bond and equity markets.

Canadian Equities

Our Canadian equity holdings delivered an impressive 6.38% in Q4 2022, outperforming the TSX Composite Index by 42 bps. This asset class was a main contributor of performance for the Growth and Preservation models. We decreased allocation in core Canadian equities and added to Canadian small-cap as we believe price dislocation and asymmetry of returns favours exploring this side of the cap spectrum. Our total allocation in Canadian equities increased in net terms after this portfolio rebalancing.

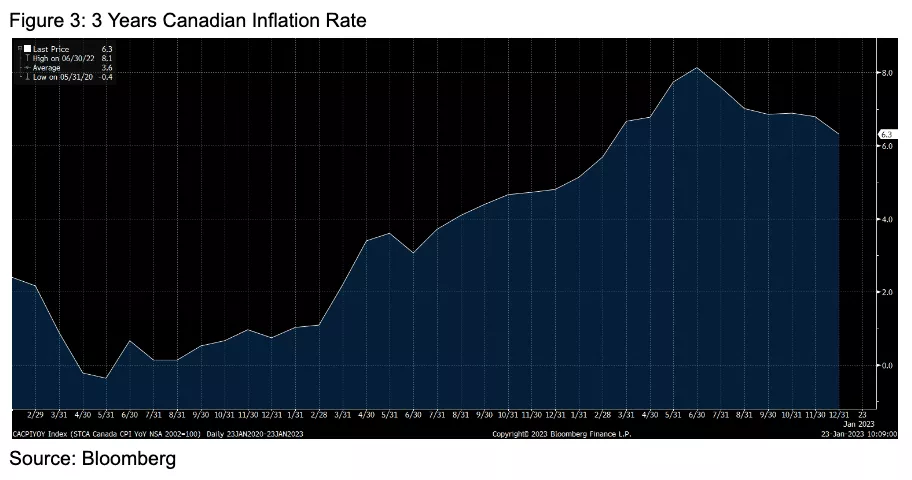

The latest inflation data was better than expected and suggests that we are past the peak of inflation and heading into a period called disinflation, where the inflation rate decreases over time. This differs from deflation, where inflation is negative, and prices decrease over time. The annual inflation rate dropped from 8.1% in June 2022 to 6.3% in December 2022. This rate is still well above the Bank of Canada’s inflation target of 2% (the exact range is 1% to 3%), but it does show some improvement and the downward trend seems to be meaningful.

Rising interest rates are generally good for the financial sector, especially banks and insurance companies and are highly detrimental to historically high debt sectors such as technology. Canada has, at least in comparison to the U.S., a relative advantage as its equity markets are heavily concentrated in financials (~31%) and lightly concentration in information technology (~6%). In the U.S., this order is flipped with Information technology weighting (~26%) and financials (~12%).

The Bank of Canada raised rates by 50 bps twice in the last quarter of 2022, bringing the target rate to 4.25%. Markets still expect another raise of 25 bps in 2023. Still, the critical question now is how long central banks, including the Bank of Canada, will sustain this higher level of rates rather than how high they intend to take them. Capital-intensive industries such as real estate are already adjusting to this new reality, with property benchmark prices dropping by 13% from peak prices in February 2022. The Canadian unemployment rate dropped to 5.1% by the end of the year, showing signs of resilience. The labour market will be a crucial input for our monetary authority when making further rate calls. Lower unemployment and higher wages pressure inflation further, which hurts equity and fixed-income markets; therefore, good news, such as lower unemployment, can be bad news to investors given these conditions.

US Equities

Last year was a difficult one for US equities. 2022 delivered not only less-than-desirable returns but also high overall levels of volatility for U.S. stocks. We came into 2022 concerned that valuations were too high, and that thesis proved correct. While we still believe that inflation remains a major concern, U.S. equity markets look more fairly priced compared to what we saw in 2022. Instead of relying only on performance numbers, let us take a better look into the fundamentals that make us cautiously optimistic about future performance.

Price to earnings – 2022 started with the S&P500 trading at a price-to-earnings ratio of 25.8, which means that considering no earnings change and no cost of capital over time, U.S. markets would require incredible 25.8 years to break even. The past year ended at a much more reasonable P/E level of 18.2, giving us some downside protection. This multiple compression was caused by earnings expansion and price decline. We know that a recession that will likely come will decrease profit margins and hurt earnings, but even considering that a 29% drop in ratio level makes us more optimistic for years ahead.

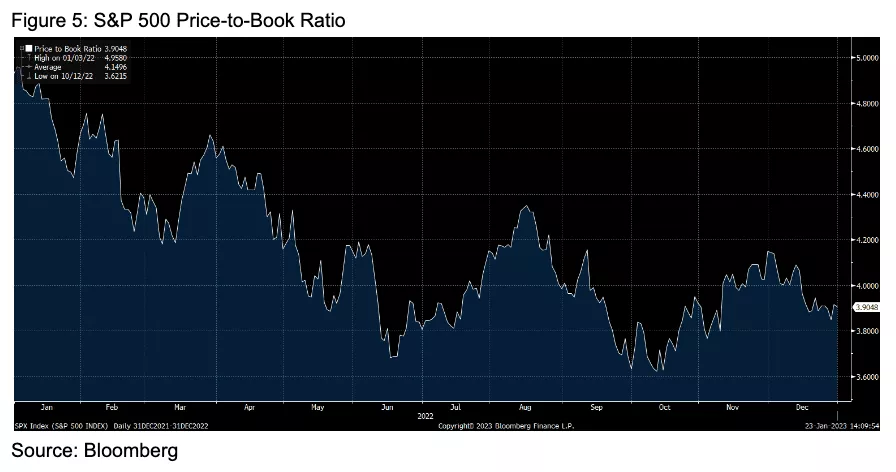

Price to book – Price to book measures how expensive the market value of a stock or index is in relation to its book value. The year started with a price-to-book of 4.93 and ended at 3.90. This a significant drop, driven mainly by the market value of equities dropping thought the year despite increasing retained earnings built through the year.

Despite price metrics coming off over the last year, we need to consider different factors, such as increasing financial costs that companies will face and earnings adjustments that will likely occur, especially if a recession, which is largely expected by the market, is confirmed. Considering all of that, we still believe that equity markets look more attractive today than 12 months ago, but there is still room for downside in the shorter term as the market digests interest rates and margin compression.

In a year full of upward inflation expectations adjustments, Q4 brought some hope. Headline inflation peaked in June at 9% and ended the year at 6.5%. Core inflation, which excluded volatile inputs such as food and energy products, peaked in September at 6.6% and ended the year at 5.7%. We are still far from the FED’s target inflation rate of 2%, but any improvements have been welcomed and celebrated by the market in the form of upward price action, especially when not expected. We continue to expect that inflation, rates and employment drive market sentiment well into 2023.

Small-Cap Equities

In November, we announced adding small cap to our portfolios. This was a result of our view that small cap looked reasonably valued relative to historical valuations and those of the large cap segment. Although the strategy had little return effect due to timing of deployment, we remain optimistic that this strategy can add return and diversification to our portfolios.

Small caps are particularly sensitive to changes in inflation and interest rates. If the FED pivots (change its monetary policy) this year, this segment could be highly positively and affected. If the pivot takes longer, holding small caps will still provide a positive carry due high earnings level when compared to its market capitalization. Changes in earnings due to higher financial costs could bring some risks to the thesis, but our view is that benefits outweighs risk in this particular case.

Fixed Income

Fixed income posted one of the worst years in decades, which for many investors was unpleasant considering that equities had a turbulent year. Needless to say, the traditional 60/40 (60% equities and 40% bonds) portfolio had a troublesome year. Our most conservative portfolio, Preservation, has additional strategies other than fixed income contributing to return and volatility controls in years like 2022. That being said, fixed income is the reason our preservation portfolio performed slightly worse than our growth mandate.

What drove most of the turmoil in the fixed income market was central bank rate increases in response to runaway inflation. By raising rates, this creates financial pressure on the economic system which should eventually cool inflation. As interest rates increase, bond values decrease – which drove most of the trading in 2022. Going into 2022, we set our portfolios to be underweight fixed income in general, and we positioned short-term and more government oriented, which kept the impact of rising rates more muted.

Towards the end of the year and into this year we think fixed income is a little more interesting – we have lengthened our duration and increased our exposure to corporate credit. We also decided to increase allocation to corporate bonds and preferred shares as yield levels now look attractive as rates increased and credit spreads widened, adding to yields. The downside risk is much more limited due to increased yields.

Despite the reputational issue that the FED and Bank of Canada created when they downplayed the resilience of inflation, we think it important that we still take a cautious approach to our allocations as there may be surprise rate hikes ahead, or they may leave rates higher for longer. If rates continue to show they are cooling the economy as we expect them too, fixed income could be a strong-performing asset class moving forward.

Global and Emerging Markets

This has been a busy quarter for International and Emerging Markets (EM). China has finally reversed its zero-COVID policy and is gradually reopening to the world. This should spur greater activity for its domestic markets, especially as China’s main economic engine, real estate, struggles with property developers’ low confidence level and record high percentage of empty units.

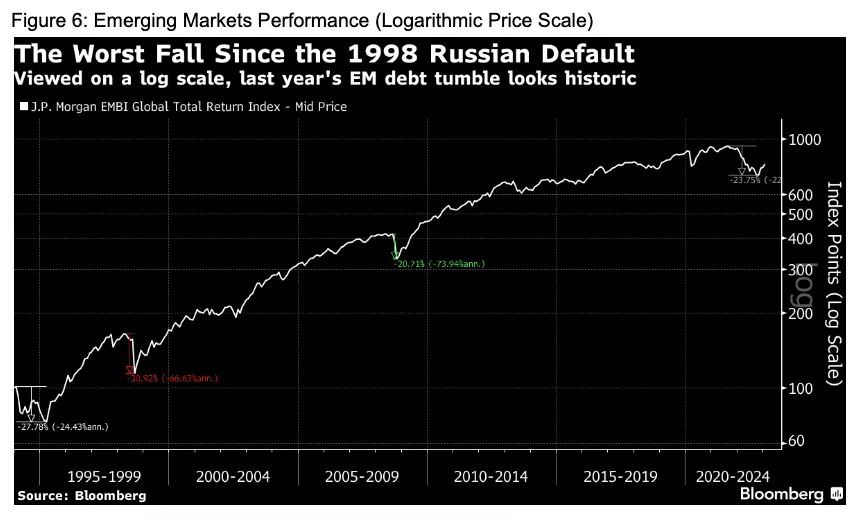

Our EM holding performed in line with the benchmark and delivered a strong quarter with a 7.7% return in Q4 2022. It wasn’t enough to offset losses in the other three quarters, but the momentum has trickled into 2023. Overall, emerging markets equity ended up with a total return of -15% for the year, the worst year since 1998, when Russia defaulted on its debt. Despite this downturn in performance, emerging markets remain an attractive investment option relative to developing countries; as China reopens, equity prices look very attractive and developed countries remain in fragile shape due to high inflation and tight monetary policy.

As part of our strategy for 2022, we increased our allocation to Emerging Markets (EM) after the second half of the year. This was a great decision that has paid off and continues to bring value to our clients. The risk we took when shifting resources towards EM has been justified by relative valuation in relation to other geographical locations, such as U.S. and Europe.

We also stayed overweight in our developed international position, which is largely Europe and Japan. Energy prices in Europe are back to the pre-Russian invasion of Ukraine levels. To put things into perspective, Europeans were paying for natural gas prices, at the peak, more than US$ 400 per oil barrel energy equivalent. It is formidable how Europe execute such a complex plan to face the energy crisis and count on some luck as they are having warmer than usual winters. European equities looked inexpensive on our asset allocation model and we maintained an overweight position into 2023.

Final Thoughts

At Raintree Wealth Management, we pride ourselves on our long-term approach to investing rather than chasing short-term bets. Our expertise allows us to build portfolios that match our client’s risk profiles and return objectives.

After a year of disappointing results in the financial markets, fixed income offers more interesting yields than they have in almost a decade, and equity markets are better prices and entry points to invest. , Additionally, market volatility and dislocation offer opportunities for our tactical and alternative strategies. We will evaluate markets closely and make necessary adjustments to our portfolios as needed.

Heading into 2022 we were very concerned about what may play out in the markets. Today we see longer term value across asset classes and are more optimistic about longer term portfolio returns. All things considered, we still expect a bumpy year ahead as markets digest inflation, interest rate, earnings and other economic data. How far central bankers have to go with interest rates (or will go) and how long they will hold rates will be vital to dictating shorter term market performance.

As always, we want to thank our clients for trusting us. If you require anything at all, please contact our client services team at rwmclientservices@Raintreewm.com.