Key Takeaways from Q4 2024

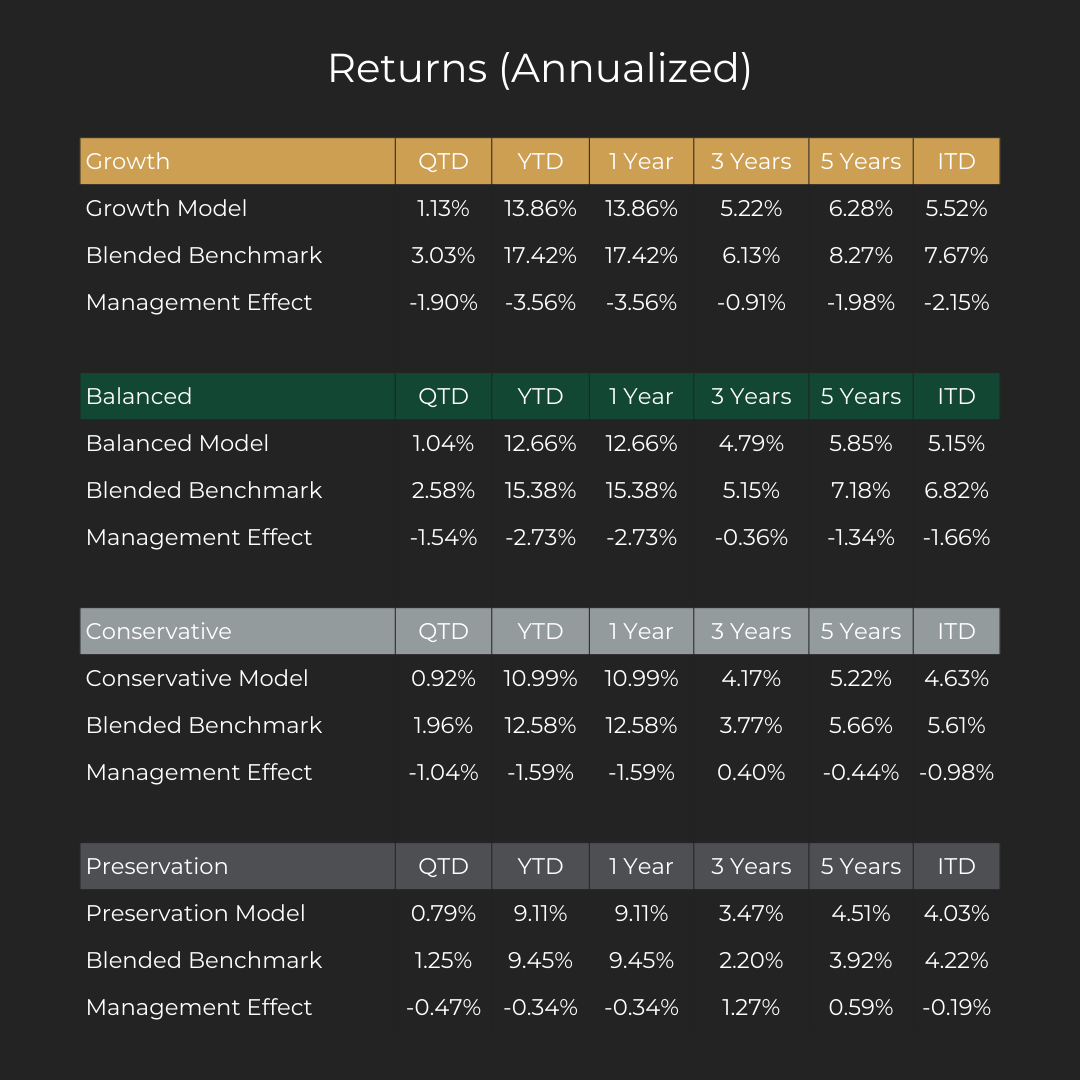

- RWM Growth Fund finished 2024 with a record net annual return of 13.86%.

- RWM Preservation Fund finished 2024 with a record net annual return of 9.11%.

- The US Dollar appreciated another 8.5% in 2024.

- President Trump’s tariff policies threaten numerous countries, including Canada.

- BOC and Fed cut rates as inflation declines.

- North America’s new jobs numbers smash estimates.

- Bitcoin to the moon.

- Mag 7 running out of steam?

Market Overview

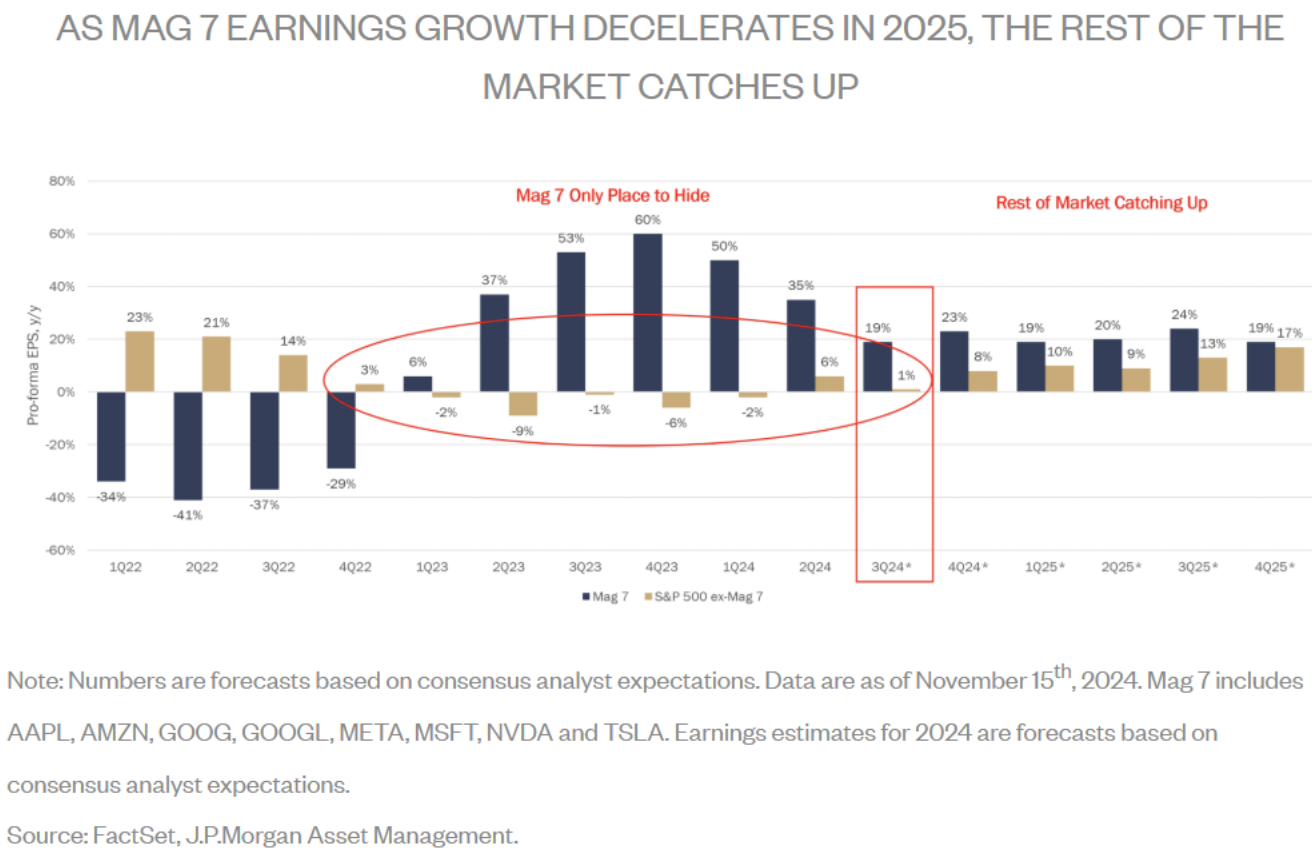

2024 was favourable for diversified investors, with equity, fixed income, and alternative asset classes delivering positive returns. Q4 continued the notable 2024 trend of the concentration of market gains in a small number of large-cap stocks, particularly in the technology sector. The “Magnificent 7” – Microsoft, Apple, Alphabet, Meta Platforms, Amazon, Nvidia, and Tesla – accounted for more than 33% of the S&P 500 total return and collectively returned over 60% in 2024. This concentration raises concerns about market stability and the importance of investor diversification. A market heavily reliant on a few companies can be vulnerable to sharp corrections if those companies face setbacks.

Beyond equities, other asset classes also saw notable movements in the fourth quarter of 2024. Crude oil prices increased to $72 per barrel by the end of December and continued to climb, reaching $74 per barrel in the first week of January. Meanwhile, the price of gold fell slightly to $2,624 at the end of December, down from $2,640 in November. Bitcoin’s market capitalization increased by 55% during the final quarter of 2024.

The Canadian economy faced challenges in Q4 2024, with high borrowing costs and a weaker labour market impacting growth. Economic activity rebounded in late 2024 as increases in exports and household spending offset lower business investment. Higher oil and gas output and crude exports supported growth in the fourth quarter, while lower production and exports of motor vehicles detracted from gains. The economy grew at an annualized pace of 1.0% over the third quarter, driven by consumer spending (a result of increased immigration) but offset by a drop in business investment. The unemployment rate rose to 6.8% in November, impacting consumer activity and confidence. Labour market data showed a longer-term softening pattern, with weaker hiring and increasing unemployment.

Despite these headwinds, there were positive economic indicators in Canada. Wage growth outpaced inflation, and 330,000 jobs were created in the past year. Lower borrowing costs, prompted by the Bank of Canada’s (BoC) interest rate cuts, helped ease pressure on households and spurred real estate market activity. The BoC aggressively eased rates throughout the year, cutting 175 basis points in response to weaker growth and maintaining target-level inflation. In Q4 alone, the BoC lowered its policy interest rate from 4.25% to 3.25% over two meetings. This, coupled with more substantial growth in the business sector, contributed to an anticipated GDP growth jump to 3.2% in Q4 2024.

The US economy exhibited resilience in Q4 2024, with consumer spending reaching record levels during the holiday shopping season and the labour market demonstrating strength in November. Nonfarm payrolls increased by 227,000 jobs, exceeding expectations. However, global economic concerns emerged, with worries over a potential European recession and political instability in France and Germany adding to market uncertainty.

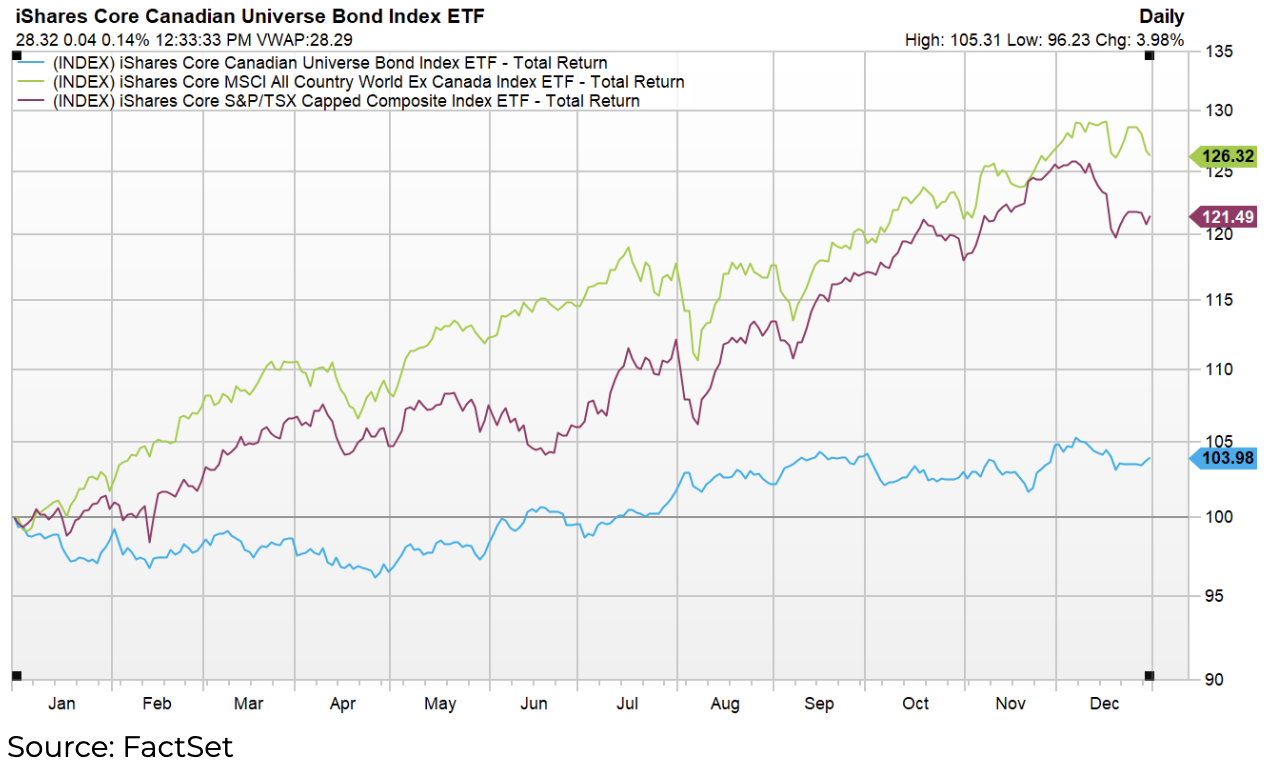

The above chart depicts Canadian bonds returning 3.98% in 2024. Canadian equities are up 21.49%, and Global equities minus Canada are up 26.32%, almost entirely led by just a few US mega-cap companies.

Fixed Income, Rates, and Currency

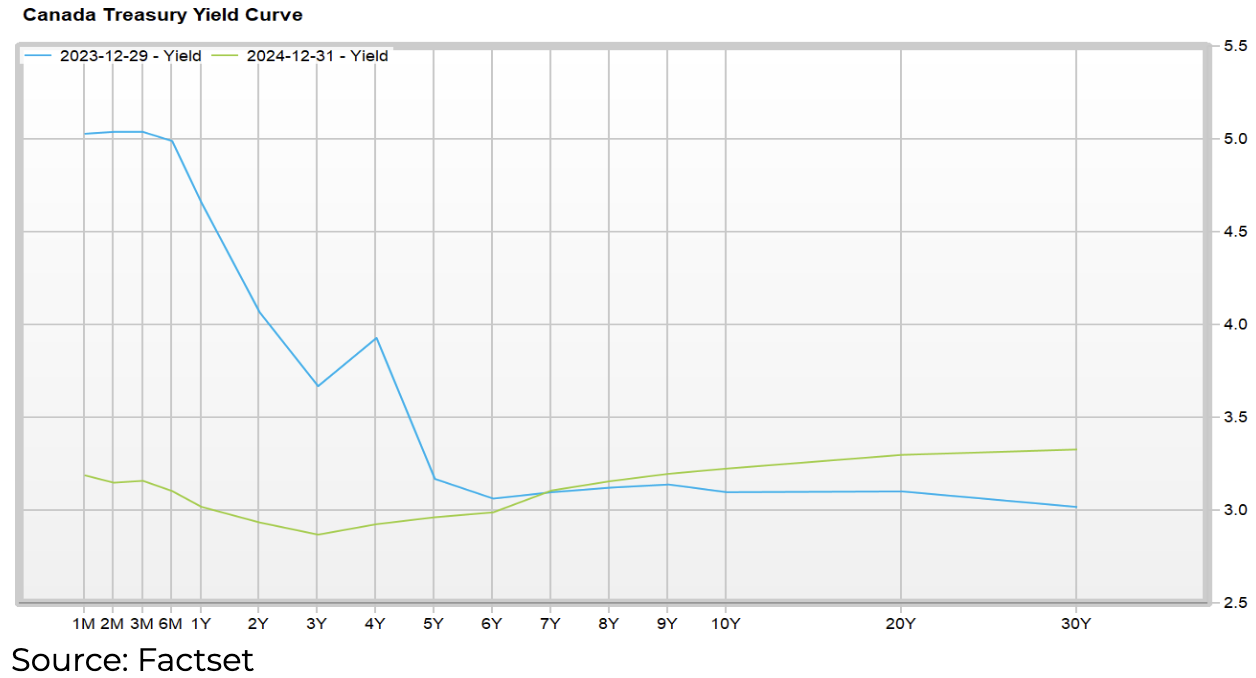

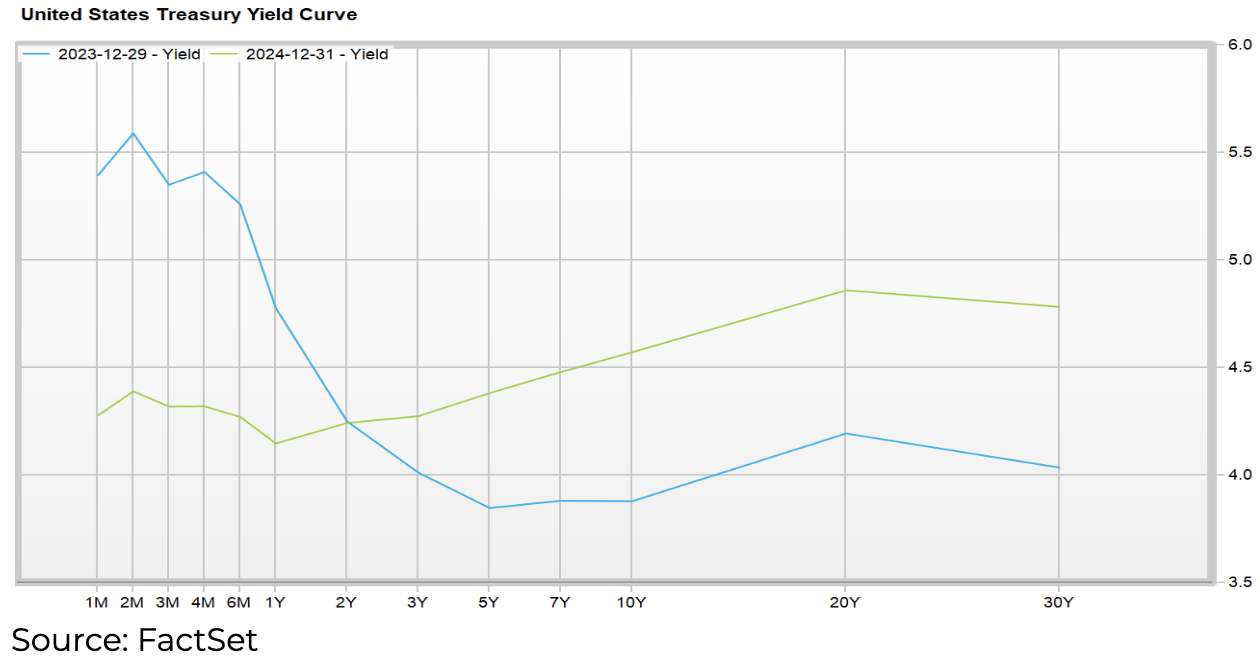

The FTSE Canada Universe Bond Index returned 3.98% in 2024, generating a real return for bonds as inflation subsided. The Bank of Canada responded to subdued inflation by aggressively cutting its overnight lending rate in 2024 by 2%. The US federal government also cut its fed rate but by much less. These cuts, inflation, and high debt concerns have led to the different yield curves below. South of the border, investors are demanding much more return for the time value of their capital. As you will note in the following graphs, the front end of the yield curve dropped dramatically in both Canada and the US, whereas medium to long-term rates stayed flat to up slightly. This may have implications for government policy as borrowing costs on the long end of the curve can have the most dramatic effect on borrowing costs for governments, exposing more scrutiny on deficits and budget decisions.

The Bank of Canada’s aggressive rate cuts, in contrast to the U.S Federal Reserve, which gradually eased rates. This divergence in monetary policy could have significant implications for the Canadian dollar and cross-border investment flows. A widening gap between U.S. and Canadian interest rates can put downward pressure on the Canadian dollar, making Canadian assets less attractive to foreign investors.

The US dollar, in general, has seen substantial appreciation since Trump was elected, and we suspect it will remain so for the foreseeable future. The USD appreciated 8.5% against the CAD in 2024.

Equities

Canada

The final quarter of 2024 was a dynamic period for Canadian equities, marked by a confluence of economic and political events that shaped market performance. Canadian equities reached new record highs but lagged behind their U.S. counterparts.

The U.S. election in Q4 2024 introduced a new layer of uncertainty for Canadian equities. The Republican victory in the US and potential policy changes, including tariffs on Canadian imports, could impact trade and economic growth. This political uncertainty, the rising U.S. dollar, and increasing interest rates all contributed to market volatility throughout the year.

United States

The US equity market navigated a dynamic landscape in the fourth quarter of 2024. While the year concluded with robust gains for the major indices, volatility surfaced, particularly in December.

Several pivotal events shaped the trajectory of US equities in Q4 2024. Donald Trump’s re-election as president ignited optimism in global financial markets. Investors responded positively to the prospect of his administration’s policy agenda centred on tax cuts, trade protectionism, and deregulation. This election outcome fueled a broad market rally in November, with small-cap stocks leading the charge and the Russell 2000 surging by 11% to reach a record high.

The Federal Reserve embarked on a rate-cutting cycle in the latter half of 2024, implementing a 50-basis point cut in September, followed by two 25-basis point cuts by year-end, resulting in a total reduction of 100 basis points. However, the Fed’s signalling of a more gradual pace of rate cuts in 2025, attributed to persistent inflation, triggered a stock market sell-off in December. This shift in outlook for 2025 contributed to a sharp rise in Treasury yields during the quarter.

Inflation proved a persistent challenge, exceeding the Federal Reserve’s 2% target and reaching 2.7% in November. Core inflation has yet to come under 3% in the United States. This inflationary pressure and policy uncertainty influenced the Federal Reserve’s cautious approach to monetary policy as 2025 approached.

The US dollar strengthened in Q4 2024, following a similar trajectory after the 2016 election. This appreciation was linked to market expectations that the new administration’s economic and trade policies would favour US growth relative to other countries.

US Large caps were up 2.5% in Q4 and an astonishing 25% for the year. This was the second of two very strong performances for the S&P500, primarily driven by the Mag7. Mid and small caps were up 1% in Q4 and 15% and 11% respectively in 2024.

Communication services, consumer cyclical, and financial services emerged as the top-performing sectors in Q4 2024. This strong performance can be attributed to increased consumer spending, expectations of economic growth driven by the new administration’s policies, and potential benefits from deregulation. Technology also exhibited robust performance, propelled by the exceptional gains of large tech companies. Conversely, the basic materials, healthcare, and real estate sectors faced headwinds and recorded the weakest performance.

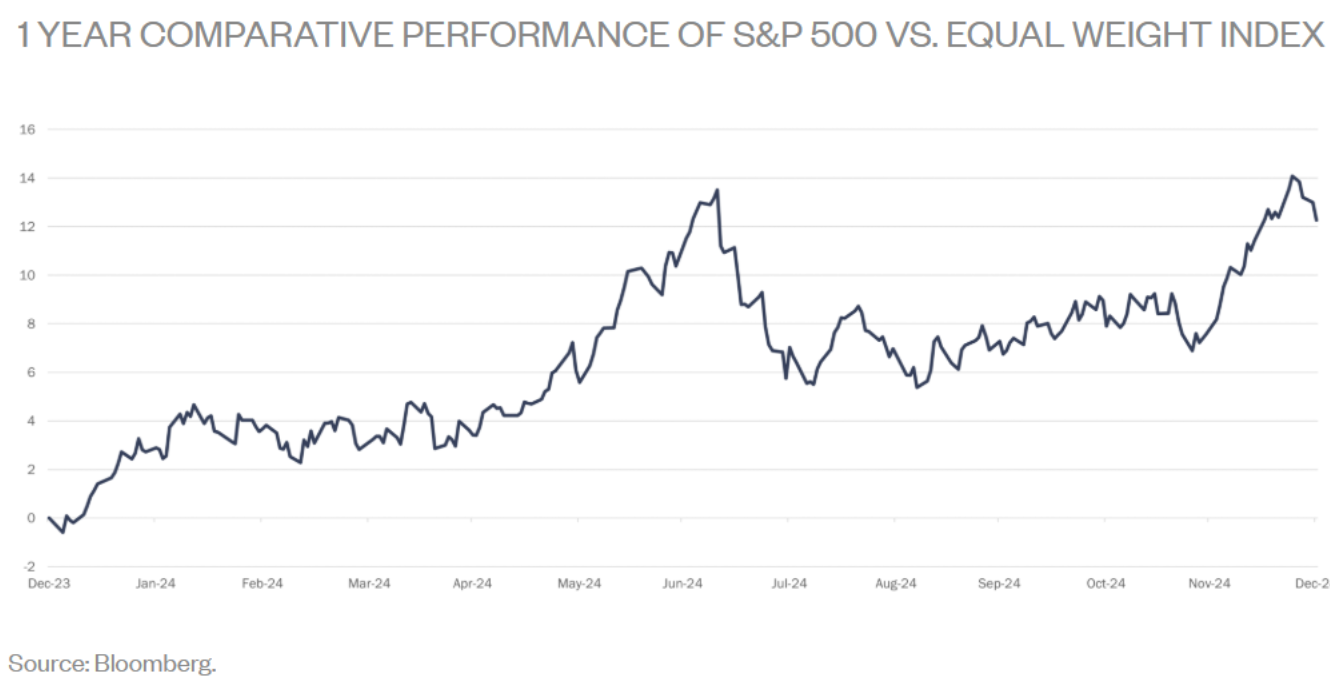

Looking ahead, the outlook for US equities in Q1 2025 is poised between opportunity and uncertainty. The US economy is expected to remain robust, but challenges such as persistent inflation and potential policy shifts under the new administration could introduce volatility. Investors must carefully assess these factors and adopt a balanced approach to navigate the evolving market landscape. The potential for market broadening beyond the dominant mega-cap stocks could present attractive opportunities. The chart below illustrates just how dominant the performance of the mega caps has been relative to the rest of the large caps.

The chart below, provided by our colleagues at Wealhouse Capital Management, shows that the exuberance towards the “Magnificent Seven” stocks since the beginning of 2023 is not irrational. The group has had positive earnings growth, while the rest of the companies on the S&P 500 have struggled to grow their profits. The consensus expectation is that this trend will change in 2025 as the rest of the market catches up to these mega-caps.

The US economy and equity markets continue to benefit from strong growth and low unemployment. Risks include inflation and government policy, which are yet to provide a clear path for the market to rally behind.

Global and Emerging Markets

Developed nations, excluding Canada and the US, underperformed US equities in Q4, with the MSCI Emerging Market Index and the MSCI EAFE Index declining. Global economic growth moderated in 2024, with advanced economies experiencing a more pronounced slowdown. Weak economic data from major European economies, notably Germany, raised concerns about a potential recession. For 2024, the FTSE All-World Index was up 16%.

Emerging Markets (EM) presented a mixed performance in Q4 2024. While the overall growth rate slowed compared to the previous quarter, some regions showed resilience and benefited from specific factors. Southeast Asia demonstrated strong growth fundamentals, attracting capital flows due to the U.S. Federal Reserve’s rate cuts. Some Latin American economies faced challenges due to increased policy-related risks, which could reduce capital inflows despite the lower U.S. interest rates. Chinese equities rallied in Q4, driven by hopes of further economic stimulus measures. China was up over 35% in 2024.

Our outlook for emerging markets in 2025 is generally positive, with expectations of faster growth compared to 2024. However, continued divergence across EMs is anticipated. Lower U.S. interest rates are expected to benefit EMs with strong fundamentals, while those with higher policy-related risks may face challenges. The most important factor, though, will be China’s economic performance. China’s economic recovery and policy decisions will continue to play a significant role in the overall EM outlook.

Portfolio Attribution & Positioning

Growth Portfolio:

The Growth Model returned 1.13% this last quarter. A strong US dollar, Canadian equities, and US equities were the most significant contributors to Q4’s positive performance, while the fund’s allocation to fixed income had a negative return.

The Growth fund was up 13.86% for the year. Our US and Canadian large-cap stocks performed best in 2024. Although our hedged real estate allocation was favourable for the year, it had the lowest relative return, as did our mid-cap allocation to Turtle Creek.

In Q4 2024, we made the following changes to the Growth Fund:

Increases:

- Canadian Equity

- US Equity

- Investment Grade Credit

- Increase Multi-Strategy

- Public Real Estate

Decreases:

- Emerging Market Equity

- Preferred Shares

The Investment Committee made slight changes to the Growth Model this quarter. We profited from a robust Q3 for Emerging Markets and Preferred Shares and decided to rebalance into other equity geographies and styles. We increased our market-neutral allocations, which aligns with our philosophy that as equities continue to climb to historically high valuations, their risk vs reward trade-off worsens and, therefore, they deserve less capital. The Investment Committee remains unanimous that although we aim to keep up with this strong bull market, we have no desire to participate fully in the possible downside during a market correction.

Preservation Portfolio:

The Preservation Fund was up 0.79% in Q4. As with the growth fund, a strong USD and Canadian Equity provide much of the return. Hedge Real Estate and International Equity were both negative.

For 2024, the Preservation Model was up 9.11%. In a year with a lacklustre performance from Canadian bonds, our strategic allocation along the yield curve and the superior relative performance of our largest fixed-income manager, Foyston, Gordon & Payne, netted positive alpha in this sector. Canadian equities also contributed significantly to the fund’s performance.

The Investment Committee left the portfolio’s fixed income allocation unchanged in Q4, decreased our overall equity holdings, and placed more capital in strategies that are more independent of future market direction, in line with the primary objective of the Preservation Model: capital preservation.

2024 Performance

Our funds had record years in 2024 from an investment return perspective regarding most key investment management metrics we track. Below are some of the important ones.

- Both the Growth and Preservation funds had record market upside capture of nearly 80%. Given how little of the “Mag 7” we hold, the seven stocks responsible for most of the returns in global equity indices last year, we are pleased with this result. As market breadth expands (more stocks contribute to investment returns), we expect this number to continue to improve.

- This higher participation in positive market periods didn’t come at the expense of our historically low downside capture, which remained in the 60s for the Growth fund and was only 37% for the Preservation fund.

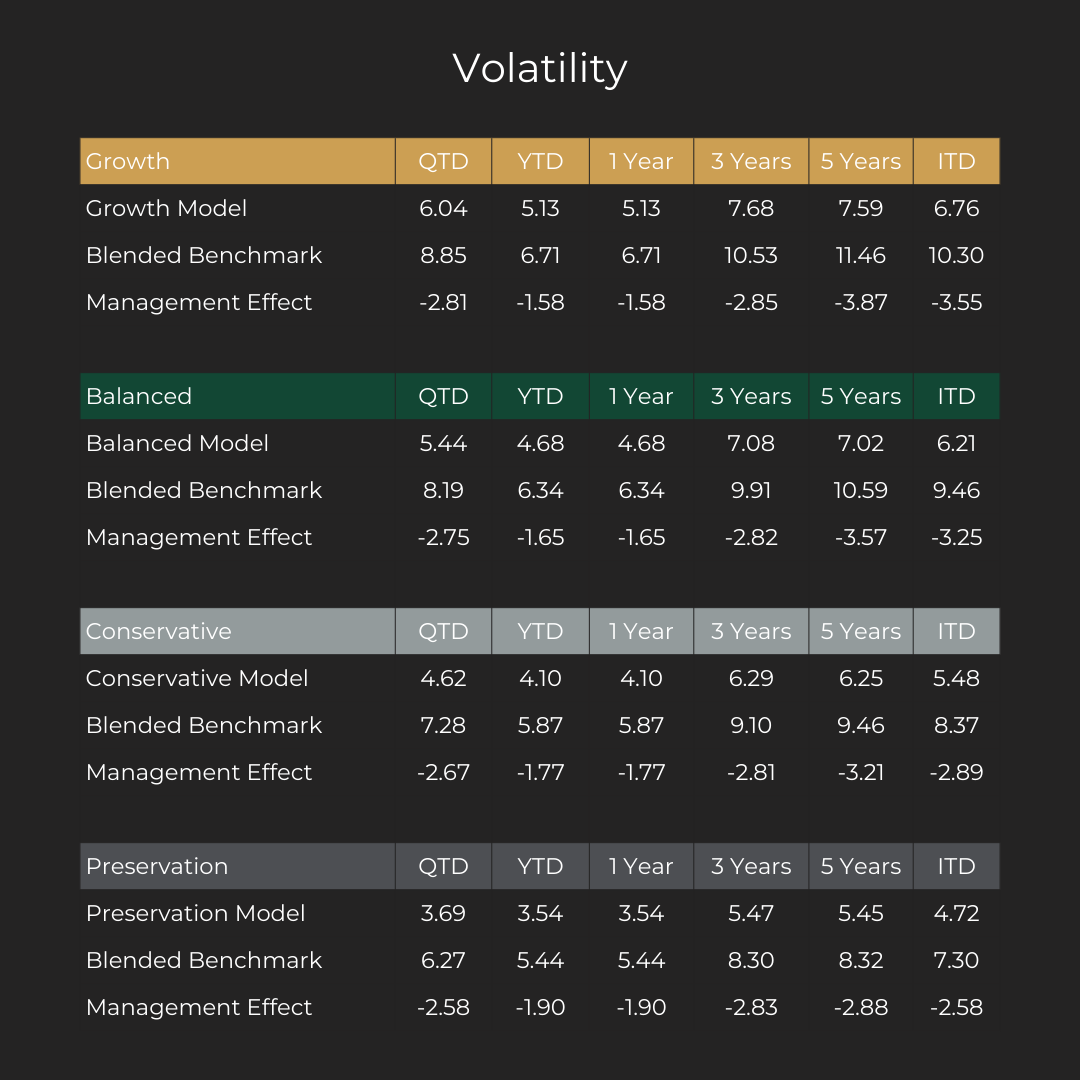

- Last year’s Growth fund’s volatility, or risk, in the form of standard deviation, was only 5.1%. That’s less volatility than what should be expected from a portfolio comprised of 100% bonds. The Preservation fund’s volatility last year was just 3.5%.

We remain committed to providing our clients with the best risk-adjusted returns we can generate and the care their investment capital deserves.

Coming Improvements

One of the challenges to the relative performance in our investment pools has been two key effects. One is our strategic underweight to US equities due to our adherence to the Cyclically Adjusted Price Earning ratio, which history has hovered well above the 90th percentile relative to history for long periods. The other is a result of including diversifying strategies in the form of market-neutral, long-short and private credit, which can produce strong risk-adjusting returns and important diversification but can also neutralize the upside in large rallies (but has also neutralized much downside in the portfolios as well). Expect to hear from our team shortly on our efforts to provide a higher level of customization for clients looking to benefit from a greater level of market orientation (and greater expected volatility) or absolute return (less expected volatility).

Your account information has been updated in your client portal. If you have questions, don’t hesitate to contact your adviser or our client service team at rwmclientservices@raintreeWM.com.

As of December 31st, 2024