“We have two classes of forecasters: Those who don’t know—and those who don’t know they don’t know.”

– John Kenneth Galbraith

Outlook for Markets in 2025

With only days left in 2024, it’s fair to call this year remarkable for financial securities. The momentum we saw in the second half of 2023 accelerated this year due to a stronger-than-anticipated global economic performance. Let’s examine what happened this year, hoping to narrow a range of expectations for 2025.

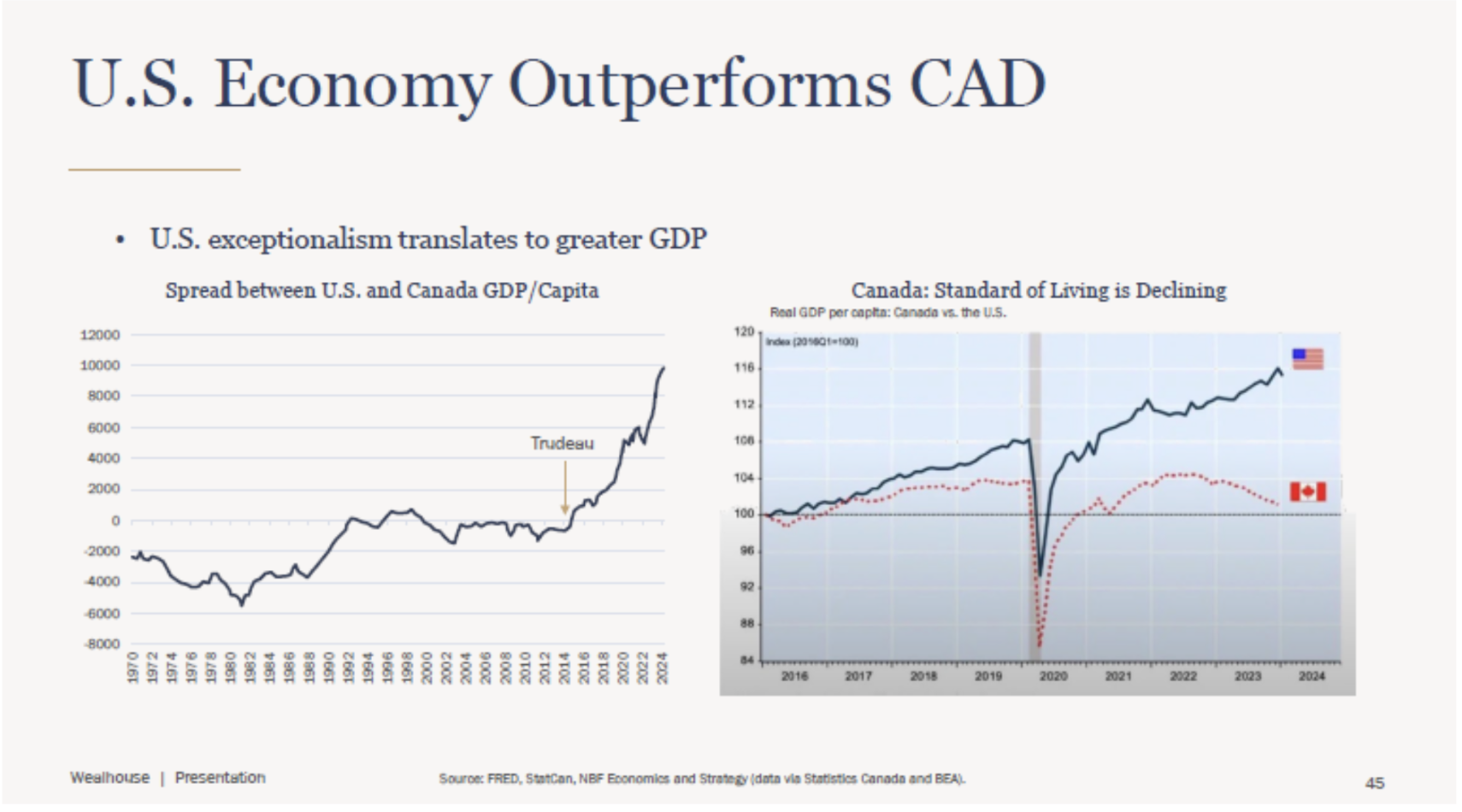

The US has again greatly supported the global economy with strong economic growth. Elevated interest rate levels have had little effect in slowing down the US machine, unlike their impact here in Canada and other OECD countries, which immediately feel the effects of their central bank policies. The gap between US exceptionalism and a struggling Canadian economy has widened further this year, as illustrated in the continued divergence of our two countries’ GDP/Capita.

The US’s insensitivity to rate hikes is seen in the economy’s consumer and corporate sectors. Consumers benefit from mortgage rate insensitivity as nearly all mortgages in the US are 30-year terms, unlike 5-year terms here in Canada. So, although the current rate for a new 30-year mortgage is around 7%, most US homeowners locked into very low rates during the pandemic and are paying, on average, only 4%. 30-year terms are too long to be meaningfully affected by shorter-term interest rate changes.

Corporate borrowing is also locked in at low rates. Investment grade credit has skyrocketed from 3 to 9 trillion in the last 15 years. Over 90% of that debt was issued with a fixed rate and, from the borrower’s perspective, is unaffected by interest rate increases. This is evident in the fact that since central banks started raising rates in 2022, total interest rate payments have gone down, not up, as the economics textbooks would suggest. Corporations, in aggregate, haven’t had to issue much new debt at these high-rate levels relative to their capital structures. If corporations aren’t borrowing more to invest, you would expect capital expenditures to decrease. Still, they have gone up counterintuitively—a sign of their high profitability and cash-rich balance sheets.

As expected, the increase in capital expenditure is mainly seen in the two most significant drivers of recent US growth: Artificial Intelligence development plus the infrastructure needed for it, and the government’s expansionary fiscal policy, the Inflation Reduction Act (don’t let the name fool you) and the CHIPS Act, to name two large bricks on the US budgetary accelerator. Much of the capital expenditure comes from the top ten companies in the S&P 500.

Since the rise in rates, the Federal Reserve has been abysmal in predicting inflation and GDP growth trajectories. They haven’t realized that hawkish monetary policy alone cannot significantly affect their economy without a combined contractionary fiscal policy. The latest GDP figures show the country is growing at a rate of 2.8%, well above its long-run potential GDP rate of 2% (the growth rate an economy should grow at when all land, labour, capital, and entrepreneurial ability is fully employed) The latest Core CPI number, the Fed’s preferred gauge of inflation which strips out food and energy prices from CPI, came in at 3.3%. Total CPI is at 2.7% and seems to be moving higher recently, which may be exacerbated by upcoming seasonal inflation generally observed over the next few months. After years of high interest rates, inflation is still above its 2% target, a level successfully maintained for the previous 30-year period. With all the economic tailwinds pushing the US growth, there’s no reason to believe it will come down soon. The market has priced in a higher rate scenario for much longer now; today, the long-term fed funds rate is predicted to bottom at 4%, with only three cuts in all of 2025. Canada is expected to continue to cut much more and bottom near 2%.

In aggregate, the US consumer seems unaffected by higher borrowing costs and has increased its percentage contribution to GDP since the beginning of the interest rate increases. The most recent data on the consumer, most of which is now calculated weekly and even daily, shows strong retail spending in a broad range of categories. Airplane travel, dinner and hotel reservations, debit card spending, and movie and theatre attendance show no signs of decline. There are even compelling signs of a rebound in the US housing market. In Canada and the US, household debt to income has decreased since 2019. There seems to be concern in the media about the increasing total dollar value of credit card debt; however, credit card debt to income is still below the level in 2020. The dollar amount of savings for people in the top 80th percentile of income has increased since the third quarter of 2023 and is flat for the bottom 20. This is most likely due to the strong bull market this year and the incentive to save money at such a high risk-free rate. The only real cause for concern is among young adults, mostly in their 20s and early 30s, where we see a sharp increase in delinquency rates on credit card debt and auto loans. This is unsurprising, as this cohort tends to have much higher debt-to-income ratios.

Corporate profits are near all-time highs as a share of GDP, unlike here in Canada, where our consumers are currently in better relative shape than our business. Bankruptcies have gone up, and default rates on loans did increase when the Fed started raising rates, but they have begun to fall as weaker businesses with rate-sensitive balance sheets have largely been eliminated. This is confirmed by the tight spreads observed within the junk bond market.

What to Expect for 2025

The Economy

As a falling GDP per capita indicates, the average Canadian is not building wealth. The most recent GDP figure shows that the Canadian economy grew annually by just 1% quarter over quarter. Although not a significant headline number, there are signs that the underlying fundamentals are strengthening, and past quarter readings have been revised higher. The Canadian consumer is a large percentage driver of our GDP growth. With inflation now at 1.9%, the recent 0.50% overnight interest rate cut from the Bank of Canada, and a wave of government stimulus expected over the coming months, the Canadian consumer may continue to lead the steady walk forward for Canada throughout 2025. The biggest concerns heading into 2025 revolve around our biggest trade partner, the US. US-imposed tariffs and large treasury yield spreads could hurt our exports and foreign investments, putting us into a recession, given our muted domestic growth.

The global energy requirements for the next five years and beyond are tremendous. A hyperscale data center requires 1 gigawatt (1 billion watts) of power. The current US national capacity is 17 gigawatts; the conservative estimate is that 35 gigawatts will be needed for the next 60 months. The US is leaps and bounds ahead of the world in terms of data center development; it has over 5,000, more than the rest of the world combined (We have around 330 here in Canada). This is an essential part of the thesis that the US will lead the world in AI development and economic growth for the foreseeable future.

Most economic forces that drove US growth in 2024 should continue in 2025. Private sector spending, especially on construction for manufacturing, should remain high, and the upcoming federal administration shows little signs of having less expansionary fiscal policy than the current administration. President-Elect Donald Trump has made some promises that could be pretty inflationary. Conservative estimates suggest that US CPI will still not reach the target of 2% by the end of 2025. Trump’s policy agendas of 25% tariffs on imports, lowering corporate taxes to 15% for domestic manufacturers, and the elimination of workers from strict immigration policy would very likely lead to higher inflation and consequential interest rate hikes. The motto goes, “Take Trump seriously, not literally.” However, if the US President does follow through on all his proposed policies, we should expect very adverse outcomes for financial markets in 2025.

Deficits and Debt

Mounting government debt levels seems problematic for many of the globe’s economies. It’s certainly an issue here in Canada. As for the US, it’s the top threat that might disrupt this period of US exceptionalism. Government spending over the last half-decade has skyrocketed, as has the debt auction sizes to pay for it. In 2024, the US government issued 29% more treasuries than the year prior. Monthly interest payments are double what they were just three years ago, and now 13% of government spending goes into servicing debt.

Most debt issued in the last two years has been in T-bills and shorter-term bonds. This short end of the yield curve has the highest investor demand. Investors piled into T-Bills in the form of High-Interest Saving Accounts, where they could earn a risk-free rate of 5%. The problem for the government with short-term loans is the rollover risk. The higher for longer, and maybe even longer still, environment means the government will likely continue to pay the highest interest possible on their yield curve, as that’s where the demand lies.

This obvious risk of dropping rates too quickly is the largest one: the reignition of inflation. History is full of cautionary tales of how that is the last thing any central bank should want to have happen. Besides inflation, another major issue may arise with the US debt crisis if rates drop too much too quickly. Foreign countries, led by China, used to be the largest buyers of US treasuries. However, their share of ownership has been declining since 2016. Today, only 25% of US debt is owned by foreign countries, and they are now net sellers. The new largest buyers of US treasuries are households and pension funds, gobbling up those high T-bills and 2-year bond coupons. The largest buyers, once other countries, who bought treasuries to hold USD and risk-free assets with little regard for the yield they generated, are now investors who, by nature, are yield-sensitive buyers. What happens if interest rates fall and yields no longer entice these households and funds? How would the US deficit be funded, and at what rate and point on the yield curve would most of that borrowing occur? What if US debt is downgraded in 2025, and additional forced selling occurs? How high could rates go? At what rate does it no longer make sense to own many stocks?

Yield Curves and Dollars

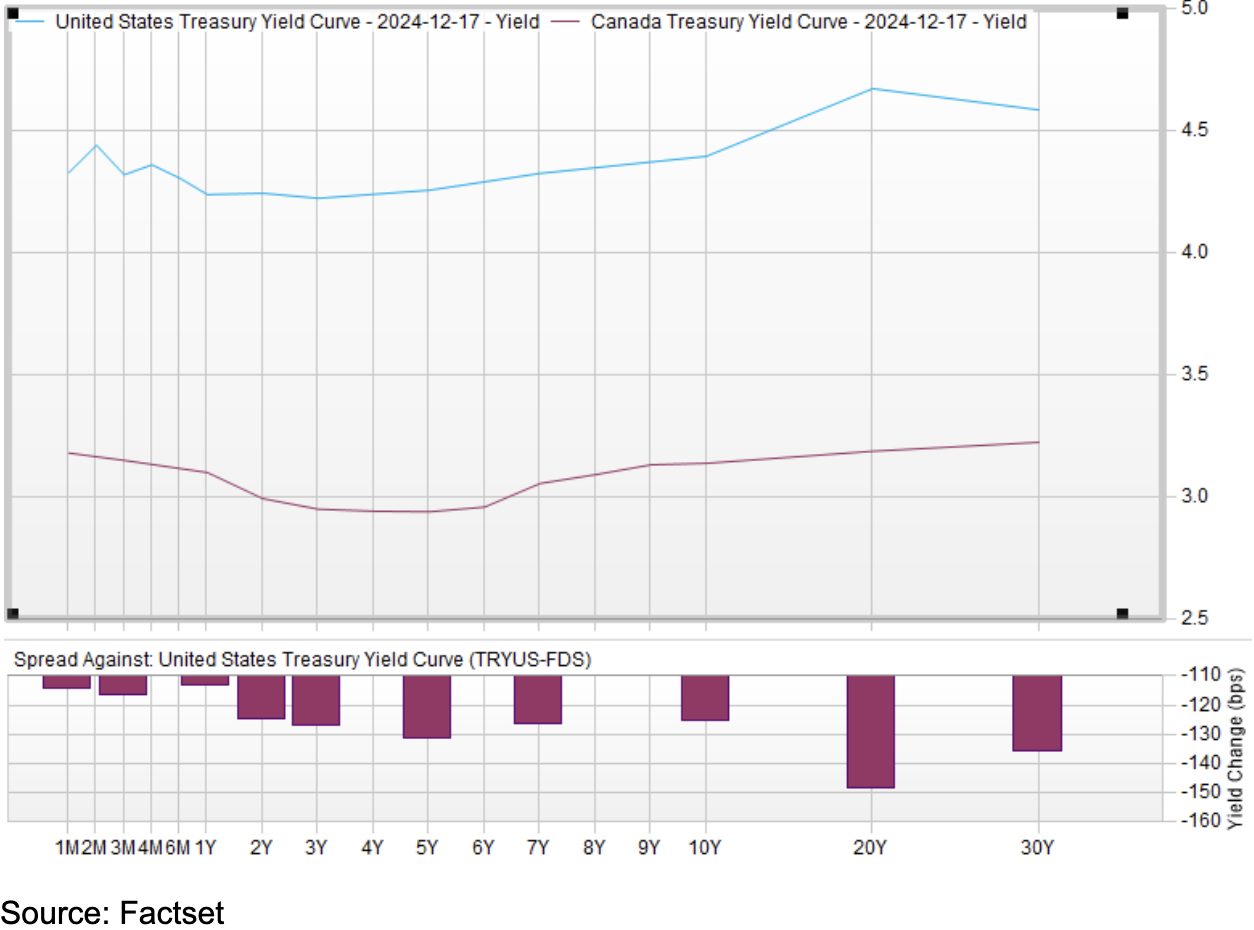

Torsten Slok, Chief Economist at Apollo Group, has done a remarkable job sharing his somewhat contrarian but ultimately correct observations over the last two years. Due to strong US economic growth and fiscal issues, he foresees high rates on both the short and long end of the curve throughout 2025. The chart below depicts the US and Canadian Yield curves on Dec 17th, 2024. The spreads between the US and Canadian yields are vast due to their unique circumstances and the market’s varying views on their future inflation and growth trajectory.

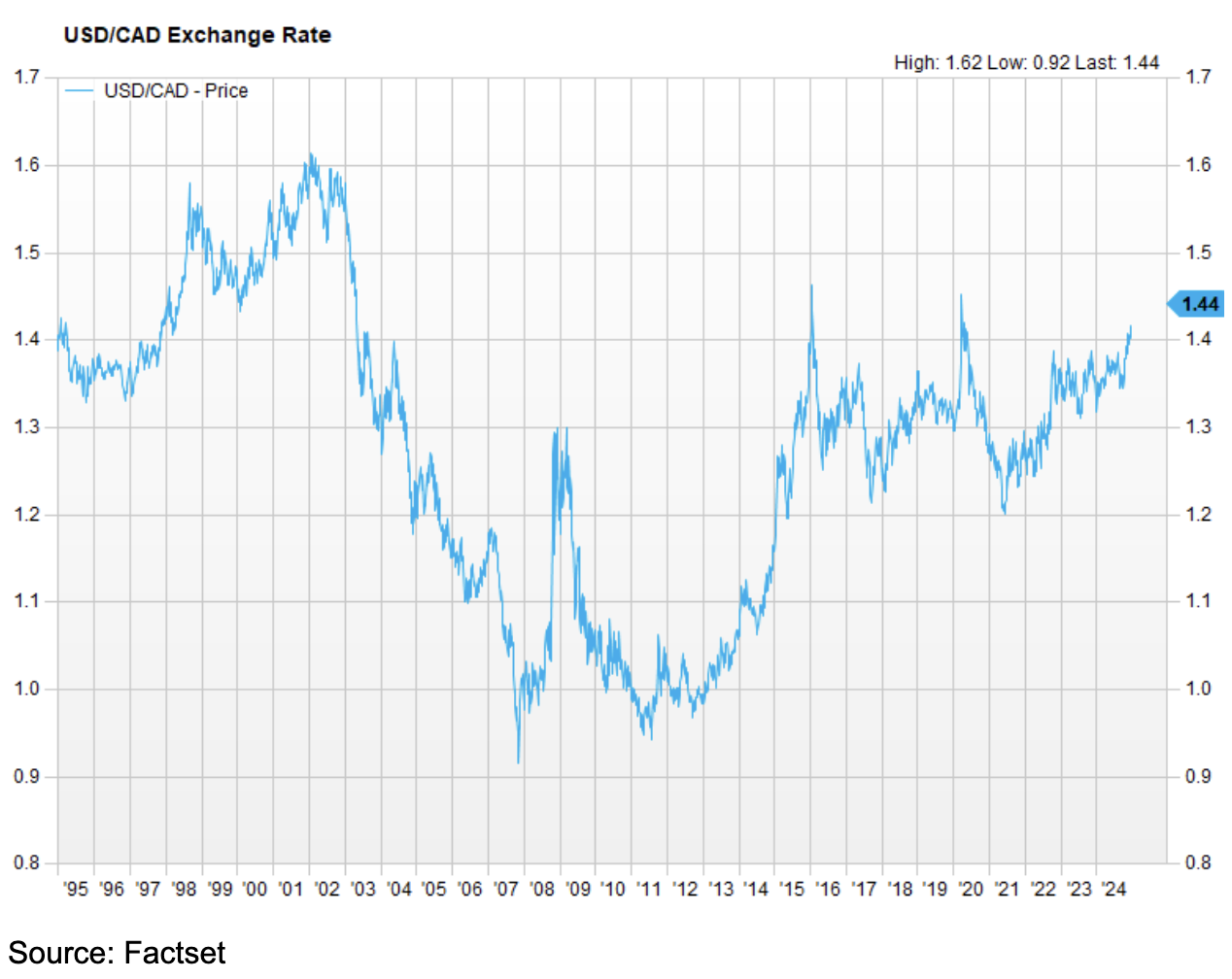

Historically, only a 50 BPS spread on the short end of the curve has been shown to affect the exchange rate of the two countries. The longer the spread persists, the more it can affect the relationship. The chart below shows the USD/CAD currency pair over the last 30 years. Many of the USD? Currency pairs look similar as other nations cut rates quicker and have much lower yield curves than the US.

This chart shows that the USD recently broke out of a 2-year channel and could be much higher in 2025. Currency movements are hard to predict, but you can be sure that tariffs on Canadian goods and a lower relative rate of return on foreign investment into Canada would hurt the value of our currency. If the 2002 lows are reached in 2025, the Canadian dollar will be worth just 60 American cents.

Public Equity

The US’s relatively high growth has led to high demand for large-cap stocks, especially Megacaps stocks; it’s hard to find a global equity ETF comprising at least two-thirds of US stocks. The success of a few US mega-cap stocks has been the most significant driver of returns for a diversified cap-weighted equity investor, both directly and indirectly. There are still a lot of tailwinds for these companies moving forward; the ambiguity surrounding AI and what it can do for us in the future remains both a risk and a huge potential return driver. However, the total market cap of US stocks over GDP is now 205%; the previous peak was during the dot com bubble, where it only hit 135%. The bottom line is that, as a group, equities are very, very expensive.

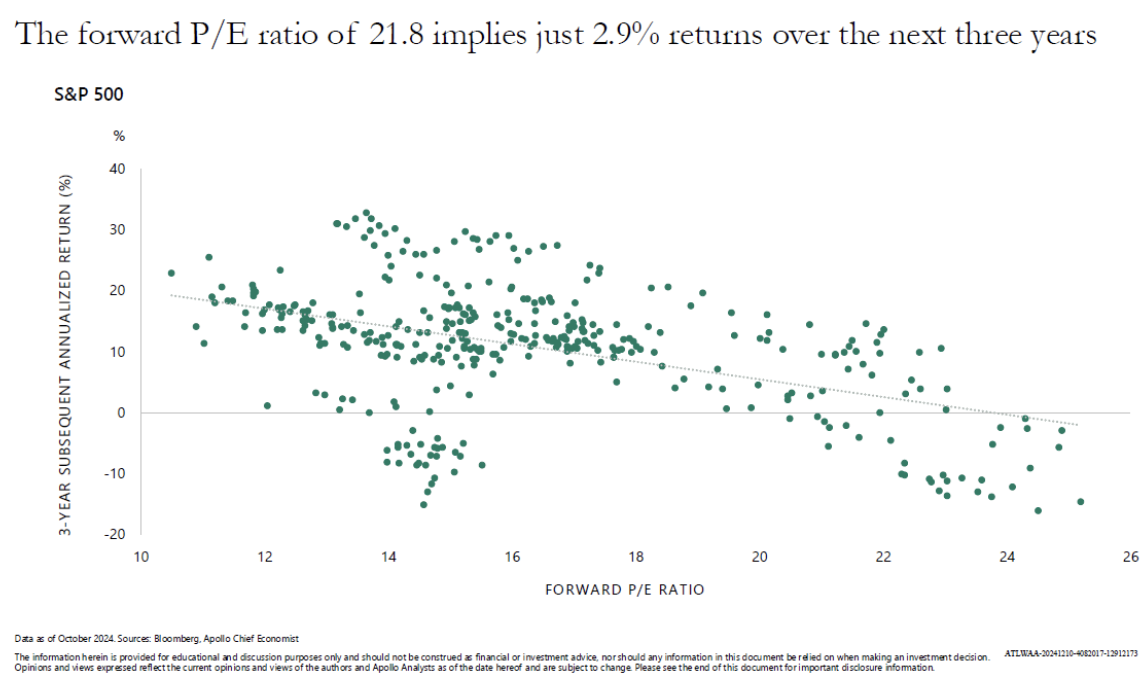

The above chart depicts the relationship between historical expected future earnings relative to the price paid for those expected earnings and the average return percentage over the subsequent three-year period once those levels have been breached. For the S&P 500, the future P/E ratio is now 21.8, which suggests an expected return of just 2.9% over the next three years.

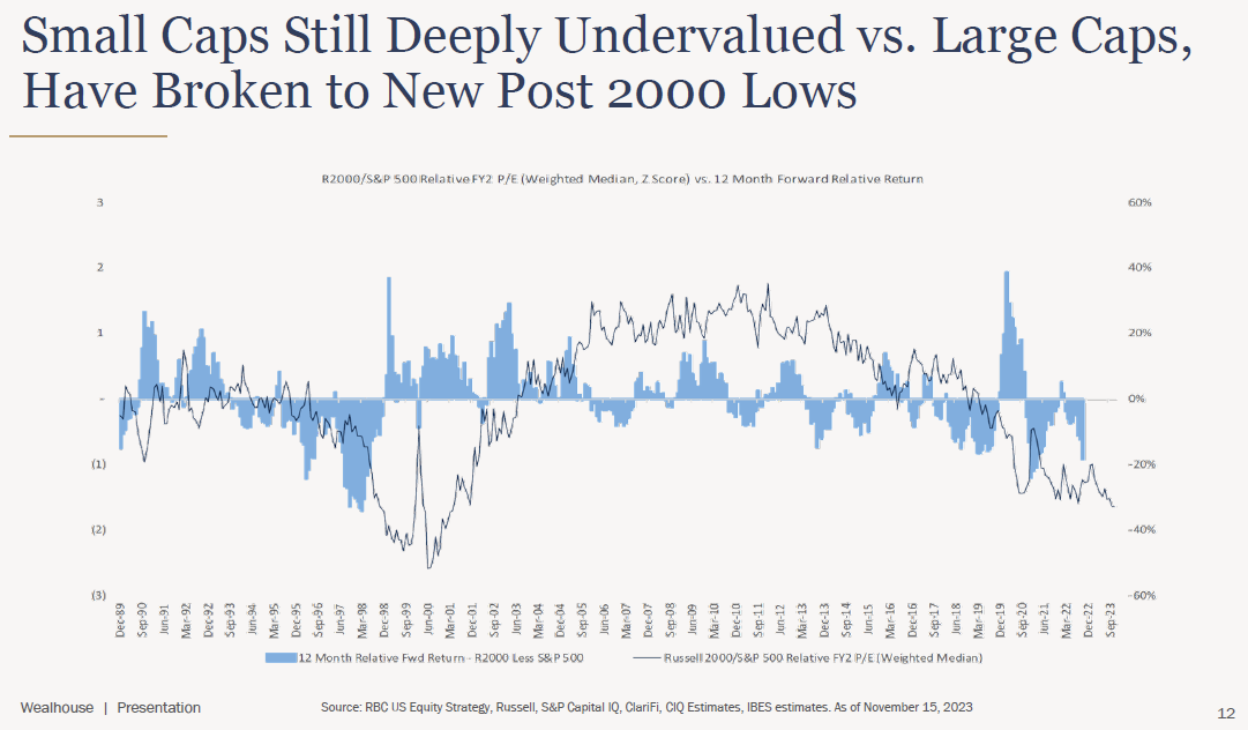

However, “the market” is just a sum of its parts, and some remain very attractive. As our colleagues at Wealhouse Capital Management rightly point out, small caps are still undervalued relative to their larger peers. There has been a record amount of passive investment this year, which historically has presented many profitable opportunity sets for active management. In 2025, equity markets may offer higher rewards to active managers who can separate the best opportunities from the crowd than passive managers who click the buy everything button.

Public Fixed Income

Spreads in Canada and the US are super tight, meaning the yield you get from a corporate bond vs. the yield you would get from a government bond with the same maturity isn’t all the same. This signifies a healthy bond market for all low-credit-risk companies.

The main thing to focus on in 2025 will be the maturity wall. When do companies have to refinance next and trade lower coupon debt for the new higher market rate debt? This is constantly being reevaluated with every inflation and economic statistic. When companies need money next, what will rate levels be, and can they afford that?

Private and Alternative Investments

Private Equity markets have been strange for the last couple of years. The massive returns in 2020 and especially 2021 had funds, in retrospect, paying too much for these vintages packed with high-flying SaaS companies. Higher rates and a lacklustre IPO market have exacerbated this problem by reducing the pool of potential buyers. This has left investors demanding cash distributions from their investments with few avenues for fund managers to generate them. In comes the solution of the secondary market, a market where funds and individual investors can sell their private holdings for the price the secondary market dictates, as opposed to the price the fund manager and fund investors with long investment horizons want to sell at to avoid a loss. Secondaries funds are quickly multiplying and taking down large deals at considerable discounts to their Net Asset Values.

The IPO market is expected to pick up considerably in 2025. In a falling rate environment, the re-emergence of Mergers and Acquisitions has seemingly begun. Many lower-valuation companies seem ripe for Leveraged Buyouts, which will also be a tailwind for Private Credit.

Higher for longer is a very good thing for Private Credit. BDC Senior Secured Private Credit funds continue to offer a higher yield than high-yield bonds, at much less risk, as their historical default rates suggest. Most of these loans are floating-rate loans that adjust to the Secured Overnight Financing Rate, or SOFR. If this rate is expected to remain higher for longer, so will the yields on these loans.

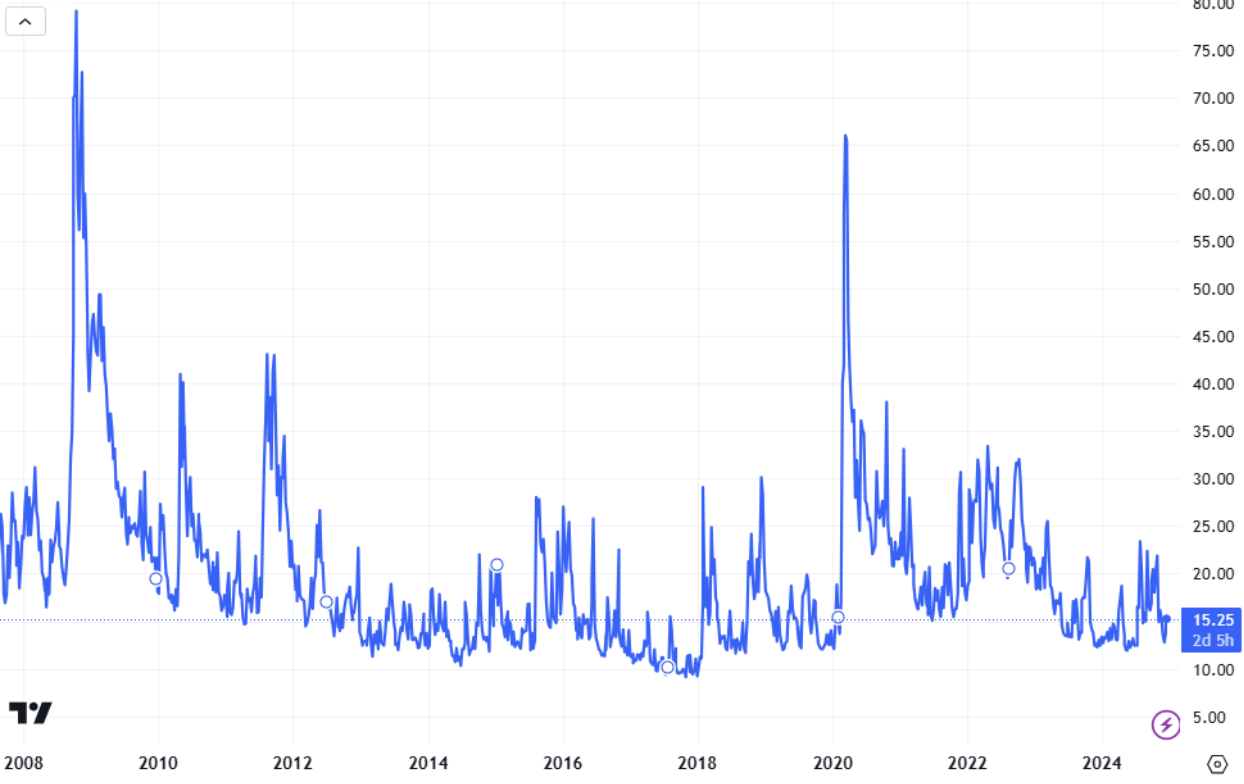

Many hedge funds lack a key component to their success: volatility. The VIX continues to trade at the bottom of its long-term range, experiencing only small, short spikes in 2024.

Given the sizeable up-and-right move equities had in 2024, mainly from the narrow leadership of a few mega caps, a return to higher-than-average market volatility in 2025 seems likely. Higher volatility, lower margin costs, and more winners and losers from less passive investing could bode well for Market-Neutral, Long/Short, and Event-Driven hedge fund strategies.

A Final Word

Of all the risks mentioned so far, the most critical risk to focus on is and always will be the unforeseen risk. What in 2025 could happen that the market has assigned a near zero probability of occurrence? These risks are impossible to quantify; the only defence against them is a well-diversified portfolio. The standard 60% stocks / 40% bond portfolio is not enough diversification for the known risks, let alone the unforeseen ones. Higher rates or a credit crisis will crash the bond market, and bursting stock bubbles will sharply lower stock values. However, many lowly correlated alternative securities can help protect portfolios from significant losses. Focus on the downside, and the upside will take care of itself. Happy Holidays!