The Fear Index (CBOE Volatility Index)

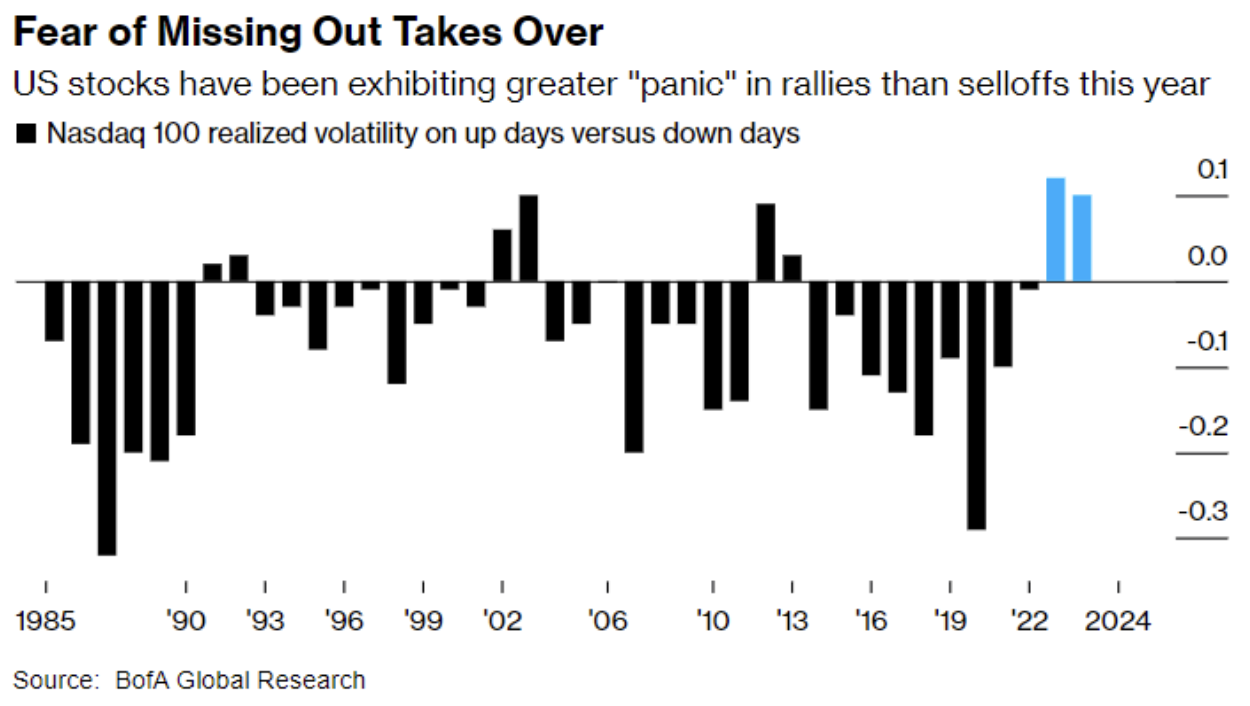

We could probably guess what Warren Buffet thinks about the market today, where the only evidence of fear is the fear of not being greedy enough.

This is evident in the recent action in the CBOE Volatility Index, commonly referred to as the VIX, which measures the implied volatility in the market through stock option pricing. Another name for the VIX is the Fear Index, as it typically rises significantly when markets sell off, as traders buy put options (giving them the right to sell at a specific price in the future) as insurance on the stocks they own.

However, the VIX has been behaving quite differently recently. For the past few quarters, it has been in all-time low territory, but we often see it rise off those lows in response to heavy call option (rights to buy stock at a certain price in the future) buying during positive market sessions. Market participants see that the market is up and take bets that stocks will go higher, usually much higher, in the form of “out of the money” call options, whose value is more heavily comprised of implied volatility and less intrinsic value.

This bullish behavior increases the VIX and, usually, stocks with it, as call option writers buy more stocks to offset the risk of their trade.

There aren’t many betting against the US stock market these days. The US economy is leading the developed world in growth and stability, showing little signs of slowing down despite years of hawkish monetary policy. All the market Bears (those who think stocks are overvalued and not worth owning) seem to have packed up and gone home. Even professional Bears, like activist short investors, have seemingly given up and don’t have the stomach to step in front of this market momentum. The chart below shows a decrease in short-selling campaigns even as stock valuations continue to move higher and higher from their long-term averages.

Positive market sentiment seems extremely high, which begs the age-old market sentiment question: If everyone is bullish on stocks, then they must own them; if everyone already owns them, who is left to buy them at higher prices? This is a healthy fear that Warren Buffet would likely encourage us to consider.

Canada Cuts Rates, Finally!

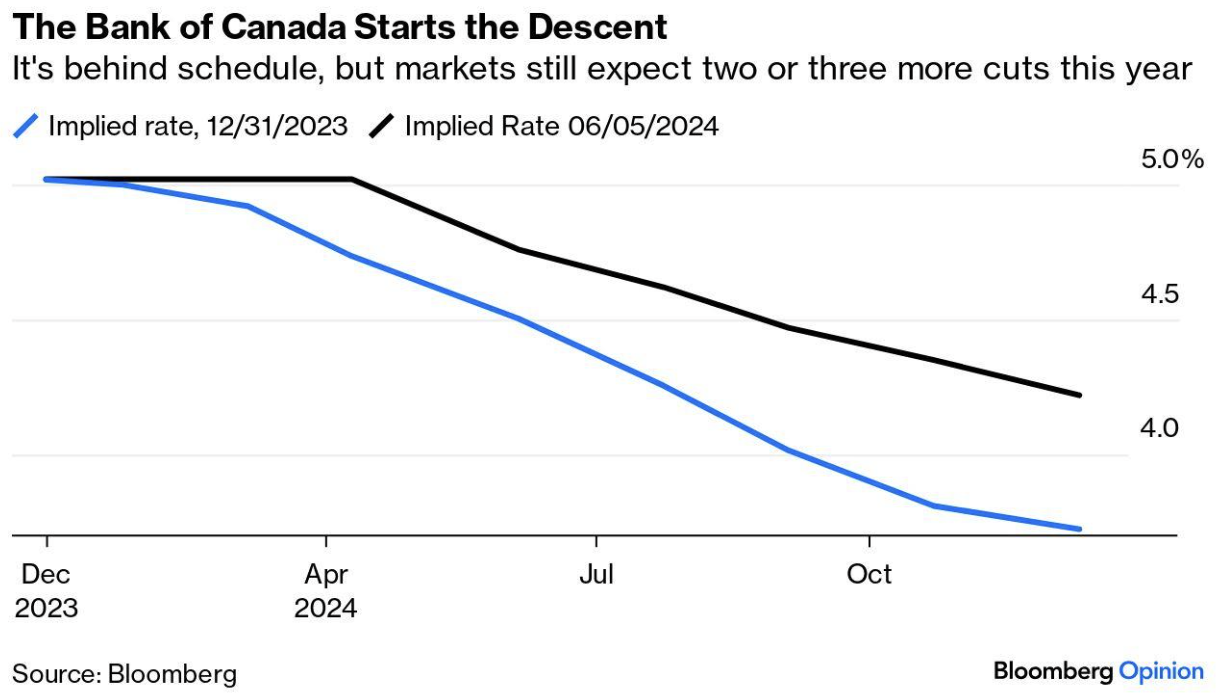

On June 5th, the Bank of Canada offered some mild relief from its multi-year restrictive monetary policy by cutting its overnight lending rate by 25 BPS. In the Bank’s opinion, inflation is close enough to its 2% target to justify this decision, and it will likely continue cutting throughout 2024. Lower rates will provide much-needed relief for consumers and businesses, which in turn should benefit investors.

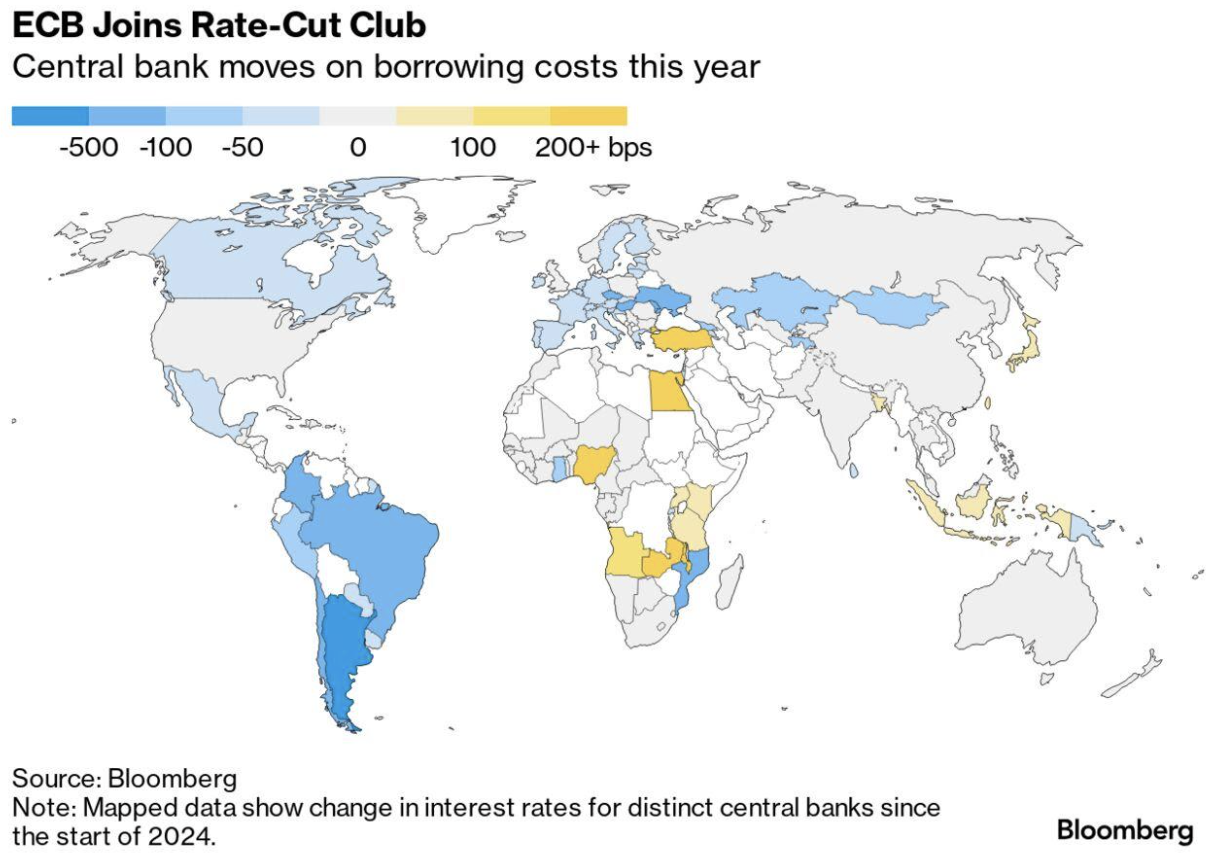

The ECB cut their rate the following day, joining Canada and over one dozen countries across the globe to cut rates so far this year, with many more expected to do so soon.

We did it! Congratulations, central bankers! Inflation has been resolved, and we’ll be back to how things were in no time!

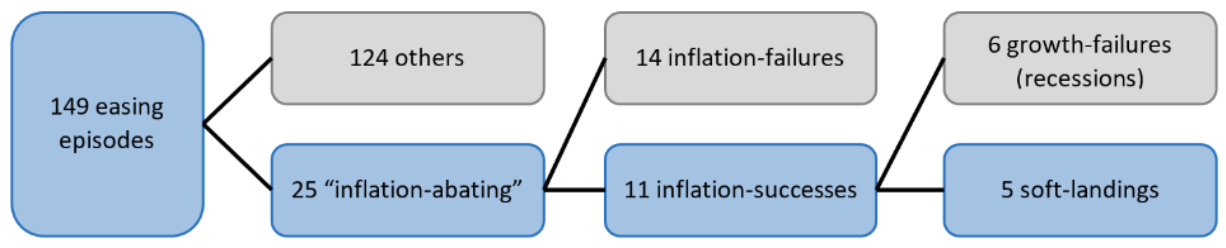

Not so fast, say Francois de Soyres and Zina Saijid, two economists at the Federal Reserve Board. After analyzing historical monetary policy decisions, they concluded that, more often than not, central banks that start cutting interest rates as inflation slows down fail to contain consumer prices.

They found 25 episodes in 13 advanced economies where policymakers eased policy when core inflation was trending downward but still above the desired level. Only 11 of the 25 resulted in inflation success, leaving 14 failures to tame inflation. Only 5 resulted in a “soft landing”; that is, they could control price levels without a technical recession.

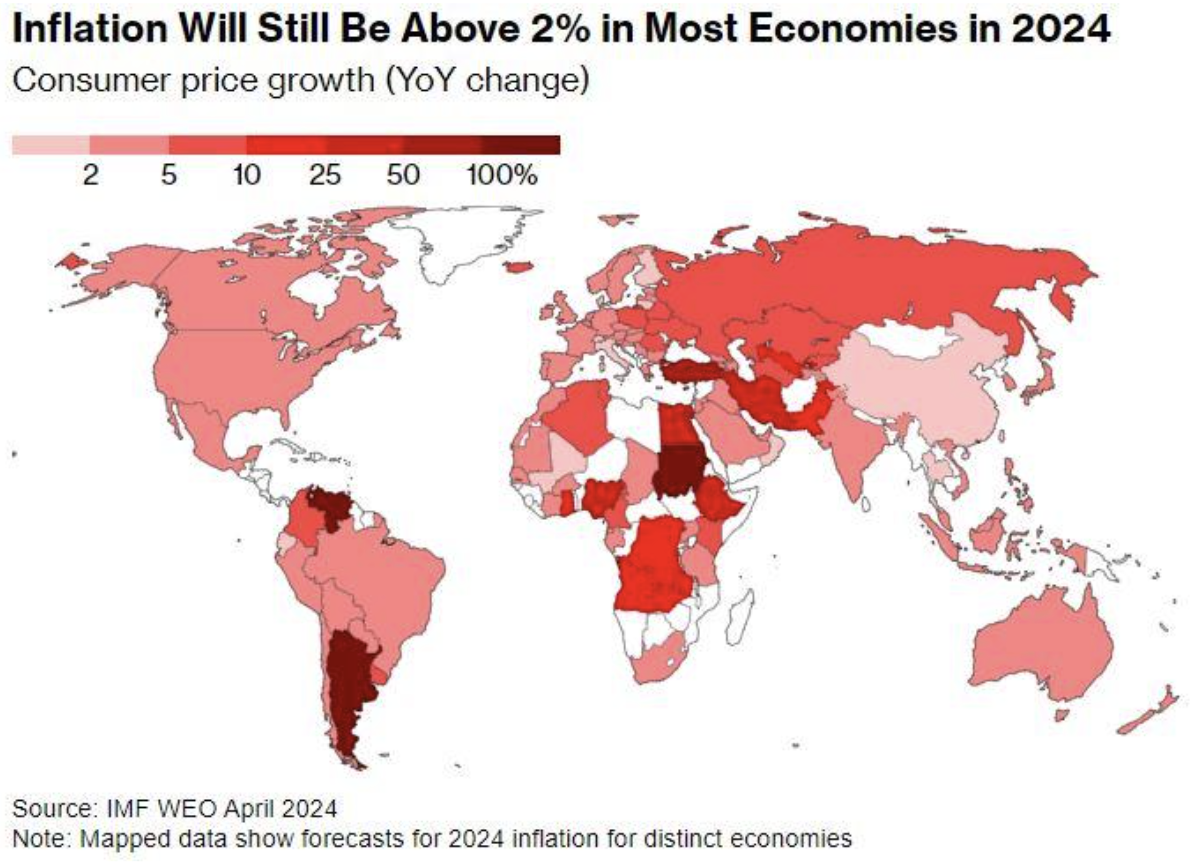

“Cutting interest rates as inflation starts to slow” seems to be a unanimous global policy decision today. The graph below from the International Monetary Fund illustrates that global inflation should remain above 2% targets throughout these 2024 cuts.

Who Will Get It Right?

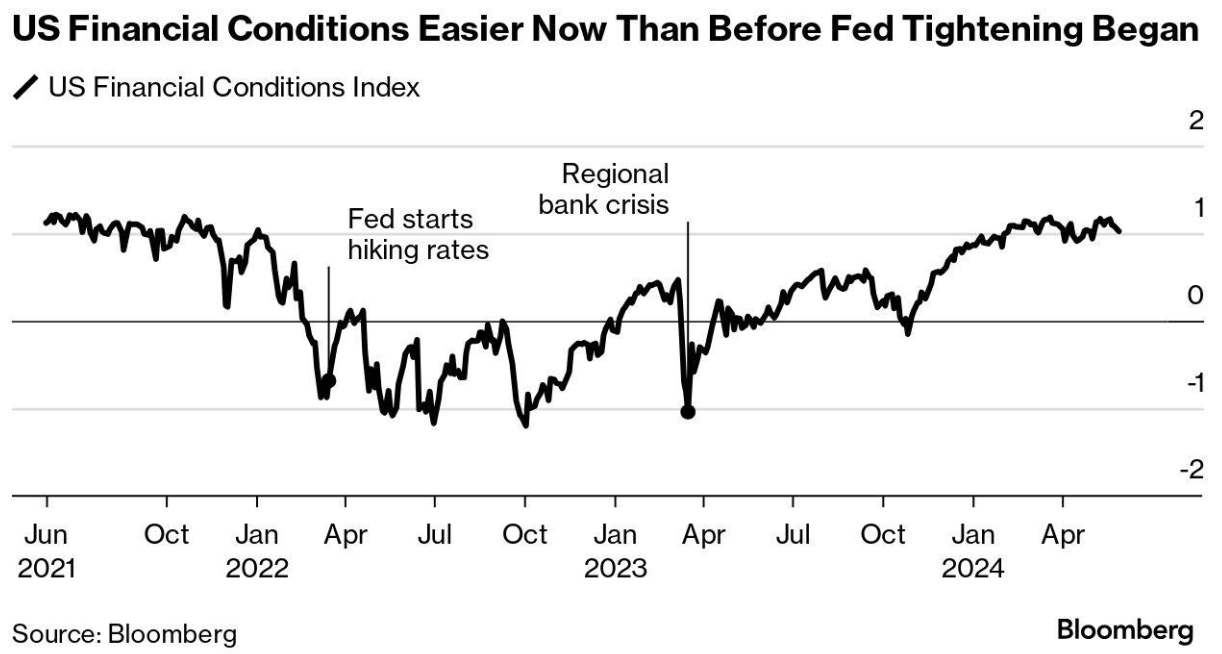

Which countries will beat the odds and get it right, and who will get it wrong? I imagine all the central bankers think they will get it right, but it will depend on many factors, a major one being how easy financial conditions are in their economy as a whole. Central bank policy is just one tool to help smooth out an economy. Fiscal policy and financial markets play an equally important role. The US is a prime example; yes, they have high rates, but they also have an expansionary fiscal policy that involves high government spending/borrowing and booming financial markets. Bloomberg’s Financial Conditions Index, which predicts current levels of financial stress in the economy to help assess the availability and cost of credit, suggests that financial conditions are better now than when rates were at 2%. This begs the question, will US Fed policy ever significantly impact inflation on its own, or will it eventually need help from the public and private sectors? Currently, no rate cuts are predicted for the US before December 2024.

Conclusion

Canada looks to be in a better position to cut rates at a steady pace while maintaining healthy consumer price levels.

Compared to other rate-cutting nations, such as Great Britain or the Eurozone, there are fewer tailwinds here that could quickly reinvigorate our economy to the detriment of price levels. The most likely path for the BOC will be a steady, more predictable rate decline, but like all central bankers, they will have to keep a close eye on the data to ensure current trends don’t change.