Overview

“As goes January, so goes the year.” It’s a well-known Wall Street prognostication that has a ton of merit. The Strock Trader’s Almanac shows that positive returns in January lead to positive annual returns for the stock market over 84% of the time. Throw in an election year, and the correlation is 100%, with the S&P500 returning an average of over 16% in these years.

Beyond 2024’s positive return expectations, what else can the events of this past month tell us about what may happen next for the economy and financial markets?

From changes in interest rates to how prices are rising, and even the ups and downs of big tech companies, there’s a lot to unpack. Plus, there’s the puzzle of why China’s efforts to attract investors aren’t quite hitting the mark. Let’s dive into these factors and see what they might mean for our wallets and the economy.

March Interest Rate Cuts Looking More Unlikely

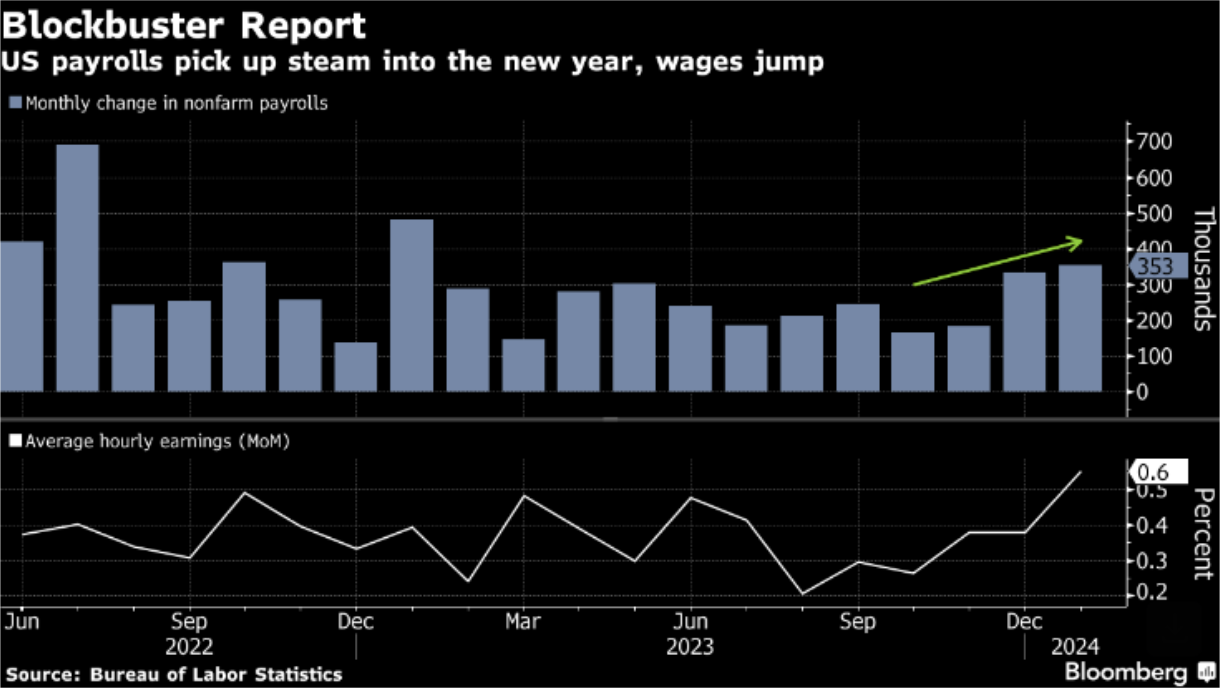

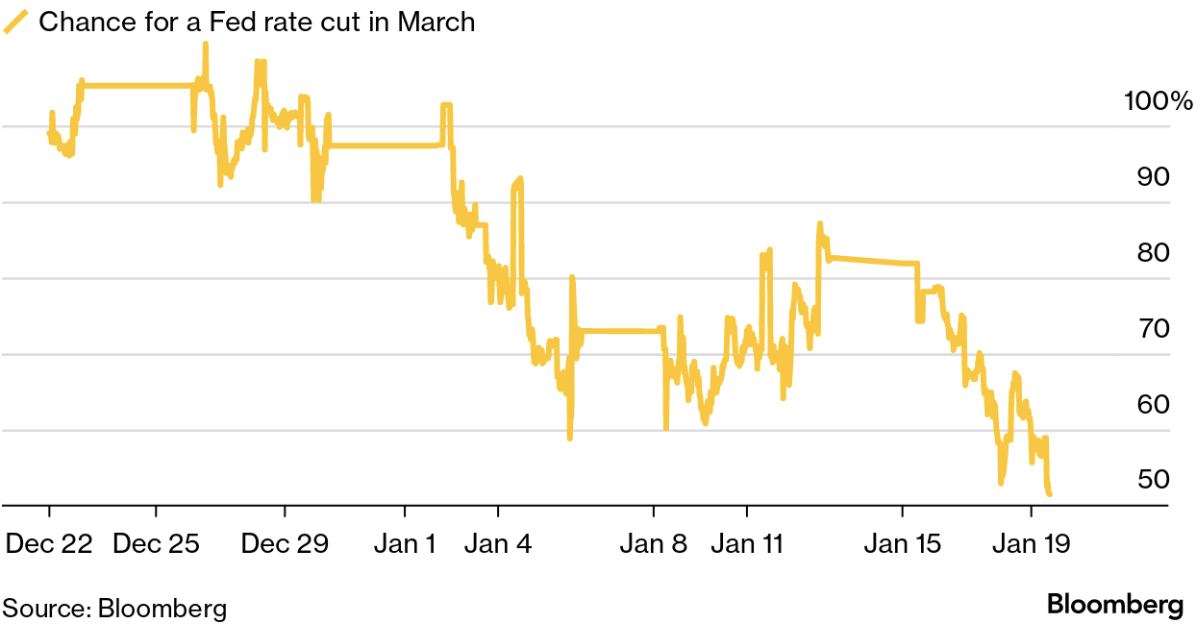

For December, US Nonfarm payrolls increased 216,000 (later revised upward) and unemployment held at 3.7%, this put an end to a three-month streak of increasing unemployment. In January, a blowout number of 353,000 new jobs were added, the most in a year. Both months saw a steep decrease in the labour force participation rate, which contributed to a substantial 4.5% increase in wages, year over year. This activity in the job market, coupled with Fed Chairman Jerome Powell’s press briefing comment, “I don’t think it is likely that the committee will reach a level of confidence by the time of the March meeting has completely changed the narrative of when the fed will cut rates. Rate traders began the month with almost complete certainty that there would be a rate cut in March; the latest expectation numbers suggest it’s now a coin flip. The best explanation for the current hot jobs market is that last quarter’s bond market rally has significantly reduced costly refinancing of corporate debt, allowing businesses to hire more than they previously planned.

Traders Forced to Doubt What They Thought

March Rate Cut From Fed Now About Even Odds After Being Fully Priced In

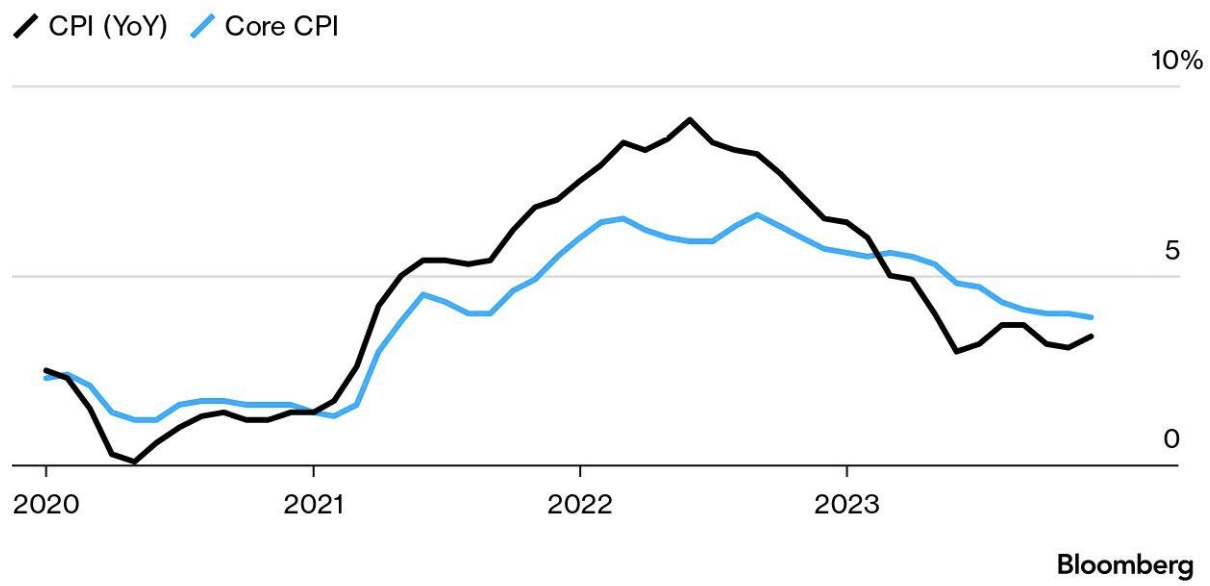

January showed US CPI for 2023 saw a 3.4% annual gain. The much-watched Core PCE, which strips out food and energy components, was up 3.9%, up 0.3% in December. Noncyclical inflation, like services and entertainment, is still relatively strong. Cyclical inflation, such as manufactured goods, has been tamed and is at target, however, easier financial conditions could cause a sudden rise in this component of inflation, which would severely alter plans for a 2024 soft landing. A rare economic cycle scenario that now over 85% of market participants believe will occur and that Treasury Secretary Janet Yellen claims the US has already achieved. We have experienced disinflation over the quarters but it is happening at a very slow rate.

Inflation’s Bumpy Path

Interest rate cuts in March look less likely for Canadians as well. Canada avoided a technical recession in 2023, as the economy likely expanded 0.3% in December, putting its annualized fourth-quarter growth rate at 1.2%, much improved from its -1.1% third-quarter contraction. Bank of Canada Governor Tiff Macklem does not expect the economy to dip into a recession. Rate hikes have succeeded in moving Canada’s inflation from a multi-decade high of 8.1% in June 2022 to 3.4% in December. However, a return to the BOC’s target of 2% is now not expected until 2025. Wage growth is hovering between 4-5% in Canada but is expected to decline. The BOC reiterated their belief that the Canadian economy is much more sensitive to rate hikes than other nations due to our higher debt levels and shorter duration mortgages. A stronger than expected rise in housing prices is one of the main risks that could drive inflation higher. According to MLS, the national average home sale price was up 5.1% year over year in December, to $657,145. Consensus forecasts predict a 2.3% increase for 2024, which should become more accurate in the spring when housing activity peaks in this country.

The Magnificent 7 May Need a Name Change

Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla, were responsible for 75% of the total returns of the S&P500 in 2023. Their combined market cap of ~12 trillion is more valuable than the entire Japanese, Canadian and UK equity markets combined. The gap between them and the other 493 stocks in the S&P 500 has never been larger, leading analysts to compare current market conditions with those present during the Dot Com bubble. So far in 2024, the market seems to be making more discernible judgements about which of these seven companies will reap the benefits of artificial intelligence and which no longer deserve their prestige. Tesla narrowly missed earnings last month, and Elon suggested they would be expanding less this year. The market reaction was severe, erasing enough market value to knock it from 7th to 11th on the S&P 500, a market cap-weighted index. Alphabet was also hit hard in January when it reported earnings and missed estimates for its advertising business, even though its cloud business beat forecasts. Traders were also quick to hit the bid on Apple shares when they reported less-than-expected sales in China, even though overall sales beat estimates. This is not to say that the Mag 7 are becoming out of favour, far from it. Microsoft, Nvidia, and Meta are having tremendous starts to the year, continuing to prop up the indexes. Meta recorded the largest one-day market cap gain in history when it reported its strongest revenue growth since 2022 from its AI products.

Whether you believe these companies are overvalued or not, the fact that they are competing more with each other for capital is a good sign of a healthy market, which certainly lowers the probability they will create an asset bubble.

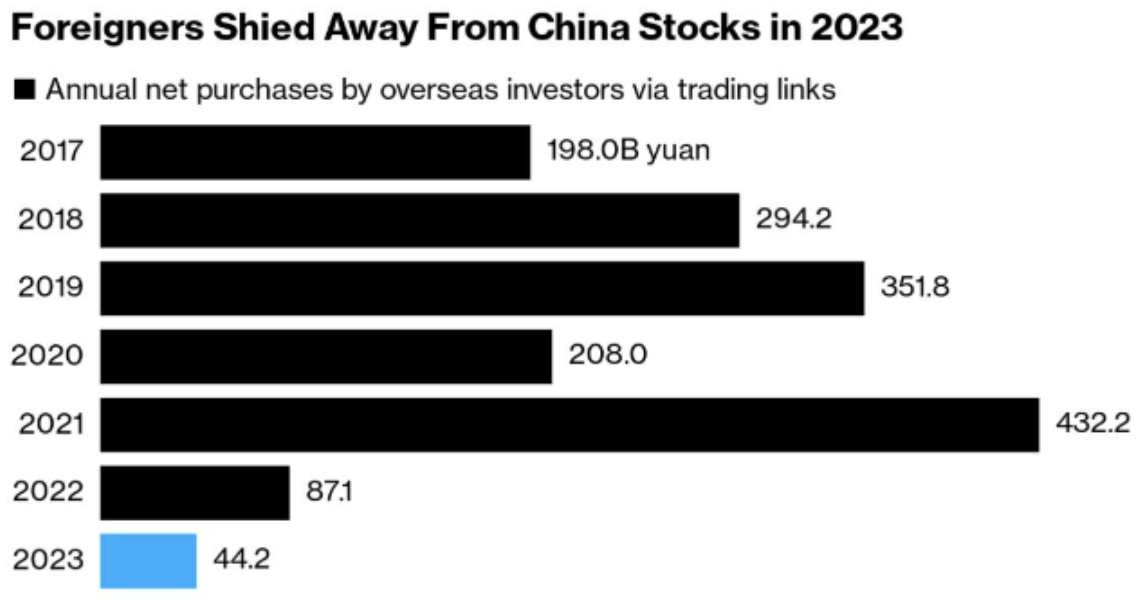

China is Not Winning Back Foreign Investment, Regardless of Their Stimulatory Policy Decisions

While the vast majority of the globe deals with rising prices from strong economies, China sits on the opposite side of the spectrum, dealing with price deflation from a struggling economy. The financial and demographic problems that China faces aren’t new anymore. Chinese equity is down over 50% in Canadian dollar terms since its peak in 2021. During that time, foreign investment dried up, as no one seemed satisfied with the People’s Republic of China’s policy efforts to fix their systemic problems.

China finally got the message and went on a stimulus policy rampage last month, which included a policy designed to help rental housing.

– 1 trillion yuan in special long bonds to fund food, energy, supply chains, and urbanization projects.

– State buying of equities.

– 2 trillion yuan of stock rescue packages.

– Lower reserve requirement ratio for lenders, releasing 1 trillion more Yuan.

– Further real estate funding to aid developers.

– Lowered down payment requirements to boost housing demand.

– Short selling restrictions on securities.

This is to name just January’s action items alone.

The market reaction to this unprecedented economic stimulus was to bring down the index another 8%. China’s poor track record when it comes to financial intervention, its 286% debt-to-GDP ratio, and the fact that more people died last year in China than were born (a trend that will continue for some time) remain unacceptable risk factors for most foreign capital. Although probably never the growth China of old (see India), at some point, surely the world’s second-largest economy will offer enough deep value and strong enough stimulus to overcome these headwinds.