Commentary Highlights

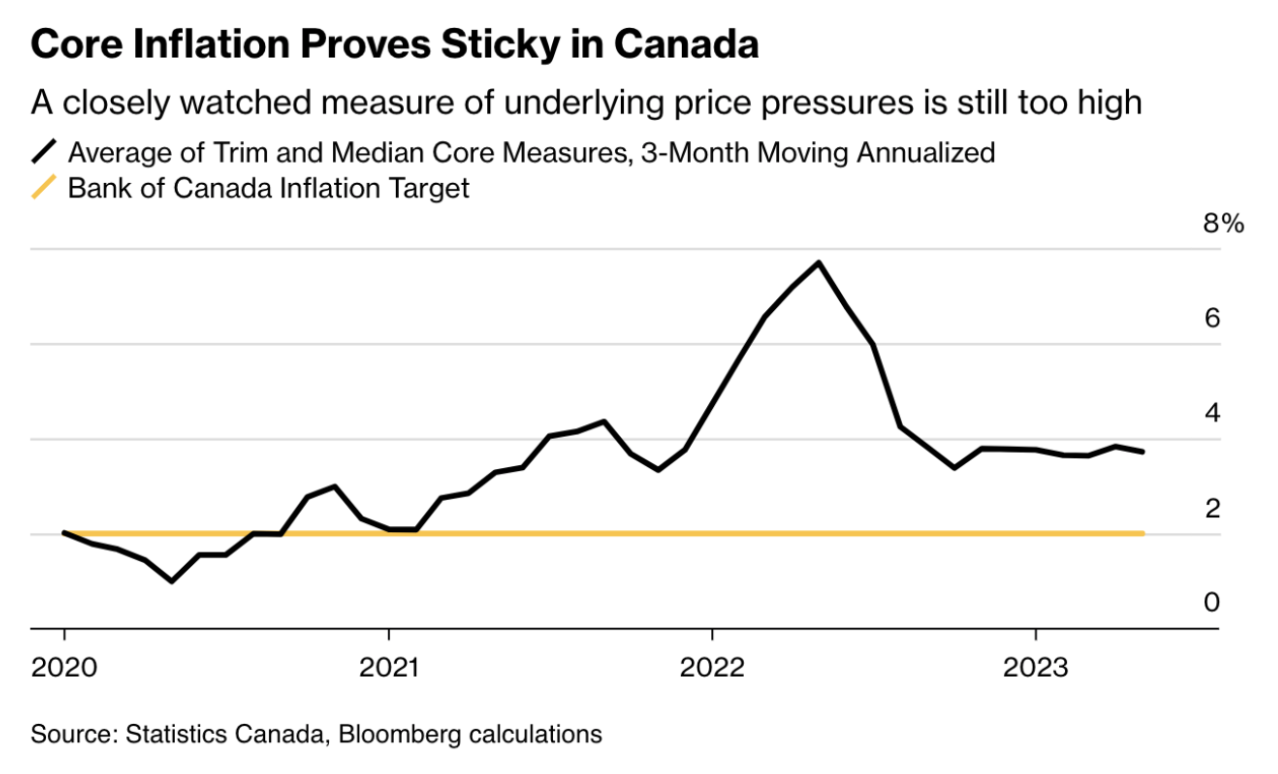

- In North America, inflation numbers descended rapidly, though core inflation numbers were stickier. Central Banks in developed markets continue to hike.

- US and Global equity markets shrugged off the March banking crisis to continue advancing positively.

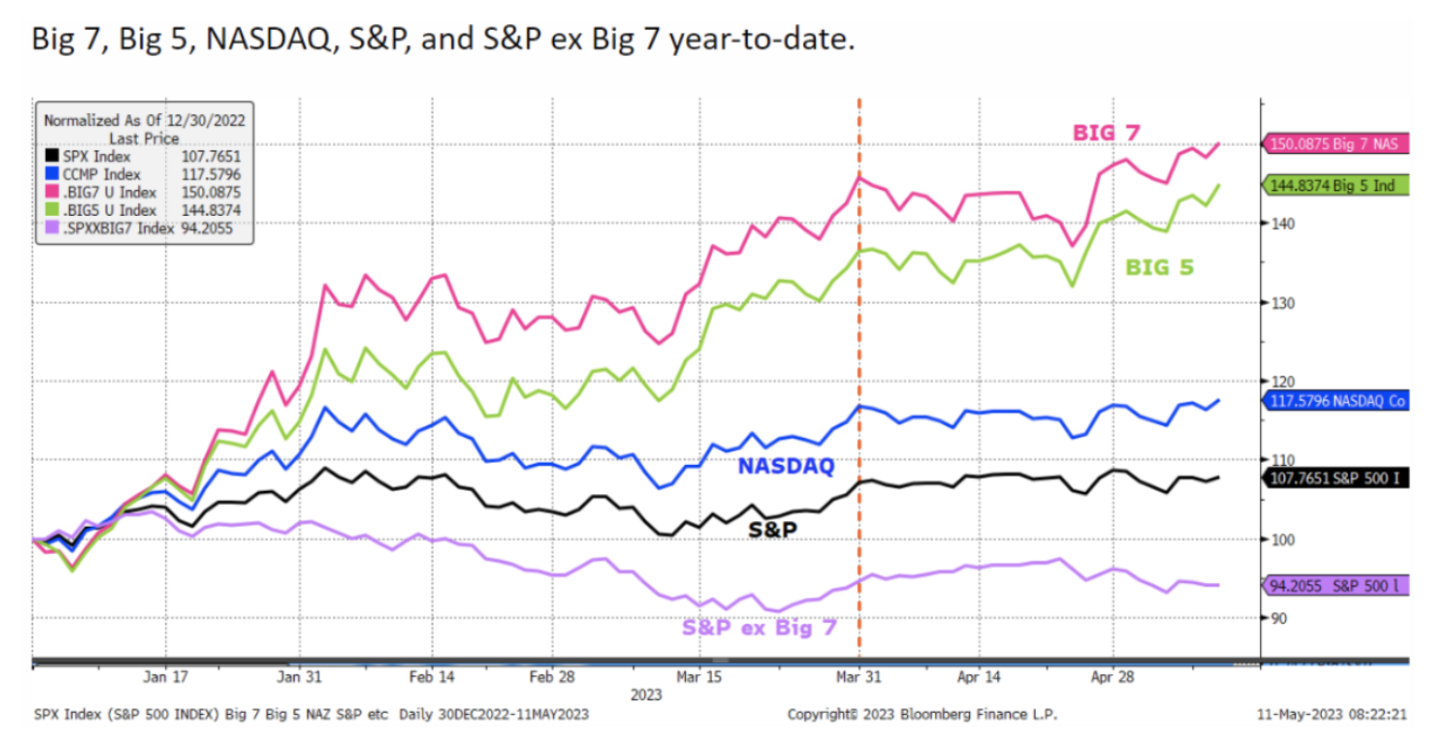

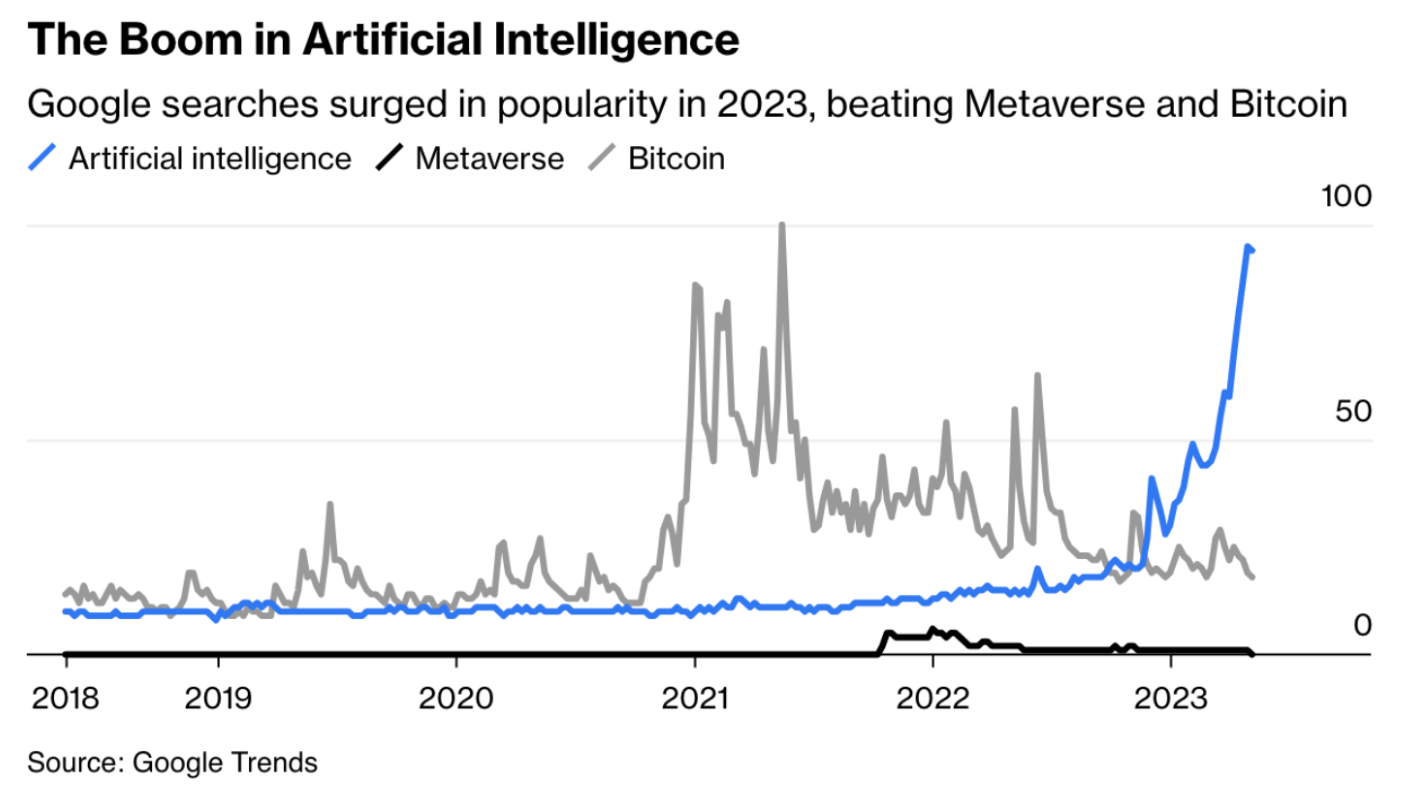

- S&P 500 advance has been impressive but narrow, driven largely by seven large tech companies driven by the artificial intelligence (AI) phenomenon.

- The probability of soft landing improved with CPI coming down quicker than expected, risk of central bank overshoot heightened.

Market Overview

The market keeps its eyes locked on the fight against inflation, which appears to be abating to a level much closer to both the historical average and Central Bankers’ target. In fact, Canadian CPI reached 2.8% annually in June, within the 1 – 3% range target set by the Bank of Canada. Further, mortgage costs driven by interest rates set by the Bank of Canada are the largest positive driver of inflation for the last 12 months. That said, the Bank of Canada delivered another 0.25% increase to the overnight rate, sending prime rates up another .25% and increasing the cost of borrowing further. This is largely due to core inflation (excluding food and fuel) running closer to 4% (again, a significant portion of that being driven by higher mortgage costs due to interest rates).

Notwithstanding the increases in interest rates, GDP, consumer spending, and household savings have been more resilient than expected by many economists and are starting to build a more compelling case for a soft landing (inflation abating without the economy dipping into recession). This has propelled the markets back into the equity markets, with the S&P 500 up 15.6% and the TSX up 3.63% to the end of June.

Canadian Equities

The Canadian equity markets were up 1.1% for the quarter, whereas our position was up 1.8%. The positivity was somewhat overshadowed by the large commodity sectors’ decline, leaving the TSX Composite worse off relative to other regions and down 5% for May. Most commodity prices fell through the month, including oil which fell below $70 for the first time since March on concerns that global growth is likely to slow. As a result, materials and energy were two of the worst-performing sectors, down 11% and 8%, respectively.

US Equities

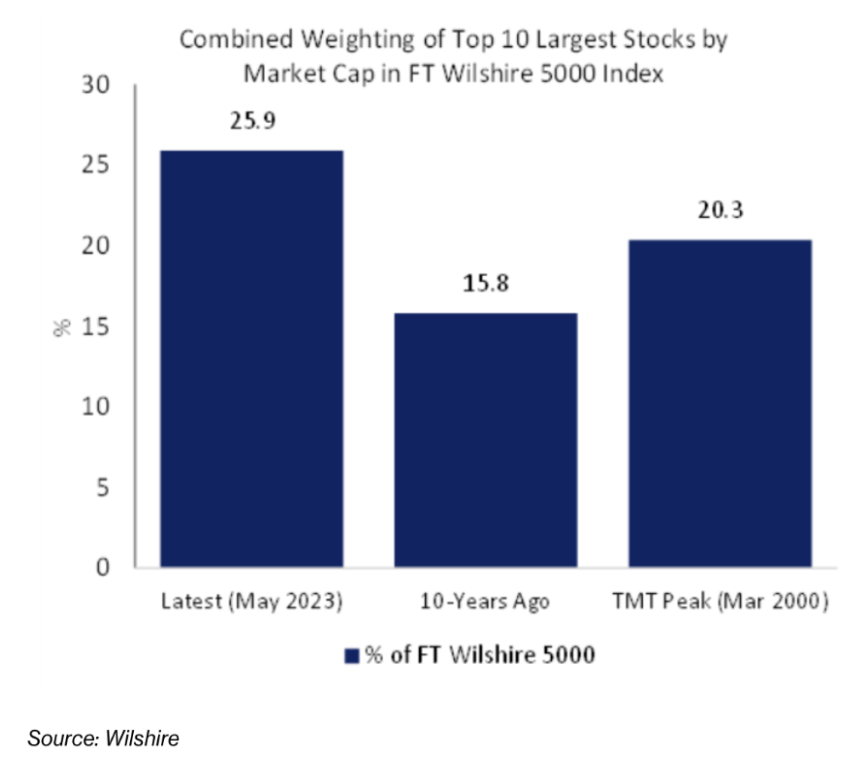

At first glance, US equities had a strong first half of the year, with overall markets rebounding strongly after the harsh 2022. The reality is that the S&P 500 is at its highest level of contraction, at least since the 70s, with the top 7 companies (Apple, Microsoft, Amazon, Nvidia, Alphabet, Tesla and Meta) accounting for ~28% of the index. Apple, the largest market cap of the index, surpassed the market value of the Russell 2000 Index, which tracks the performance of 2000 US small-cap companies.

The reason for these firms’ increasing in value so dramatically is, in some part, the significant pullback in 2022 and the advancement of Artificial Intelligence (AI), which made the news based on the release of ChatGPT and the excitement around these AI tools enhancing productivity. The valuations on these companies have advanced so far that they are, on average, 89% this year compared to their previous valuations, which based on long-term histories, are well above average and seem lofty given the 500-basis point increase in interest rates over the last 12 months.

Fixed Income

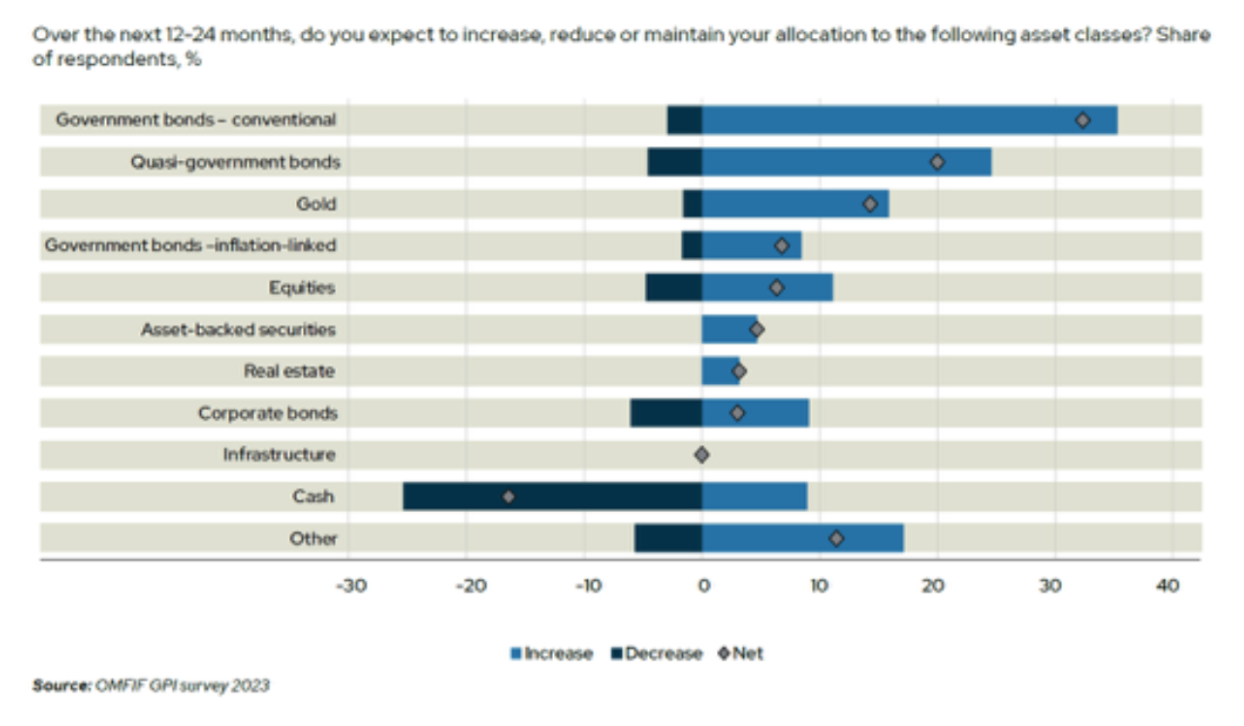

Fixed income has been challenging over the last 18 months but is now starting to look very interesting as an asset class. It was challenging because interest rates increased significantly globally by central bankers. Still, as importantly, expectations around longer-dated bonds have also increased as the market adjusts to the notion that interest rates will be “higher for longer.” That said, interest rates are hovering in ranges we haven’t seen since before the Great Financial Crisis in 2008 (over 15 years ago). As a result, global investment managers intend to invest a greater portion of their asset allocation in fixed income, according to a recent survey (see chart below).

Global and Emerging Markets

The international equities market measured by the MSCI EAFE benchmark was up for the year’s first half. This is largely due to the Russian/Ukrainian conflict having a larger-than-expected effect on Europe (particularly energy prices) and Japan’s significant renaissance after three decades of almost no growth, deflationary pressure, and low yields.

Emerging markets have been a tale of two significant trends. First, China is showing low growth and an emerging credit crisis, and the rest of the emerging markets generally have positive performance, partly due to a weakening US dollar. Overall, emerging markets are up 2.8% YTD.

Portfolio Attribution & Positioning

Growth Portfolio:

During the quarter, the US, International, Canadian equities, fixed income, multi-strategy, long/short and cash all generated positive returns, with US equities leading the way. International equities, in particular, have been the biggest contributor to positive returns this year, with the strategy ahead of its MSCI International benchmark by 5.4% (total return of 9.4%). Negative returns were generated by the Canadian small cap, preferred shares, Tactical return and Long/Short strategies. As discussed above, small-cap equities have not recovered much this year, other than a sliver of technology companies driven by AI momentum. Most impactful to our growth portfolio has been the tactical portfolio, which was a large contributor last year to our portfolio outperformance.

In June, we made the following changes to the Growth Portfolio:

- Increases:

- Preferred Shares

- Canadian Small Cap

- US Small Cap

- Canadian Equities

- US Equities

- Cash

- Decreases:

- Corporate Fixed Income

- Multi-strategy

- Emerging Markets

The equity markets have a growing upside, particularly in small caps. After experiencing severe drawdowns over the last year in the preferred share market in Canada, the tax-preferred dividend yields and the prospect of future capital upside were compelling enough to continue adding. We drew down our multi-strategy allocation, as our view is improving to have more directional exposure to the equity markets and free up cash for some new opportunities in the portfolio.

Preservation Portfolio:

Our Preservation Portfolio benefited most from its fixed income, multi-strategy and smaller US, Canadian and International equity exposure. Overall, the results in the fixed-income market were middling, as the market was surprised negatively by interest rate hikes in Canada, making for a generally flat quarter in our portfolio and the benchmark itself.

In June, we made the following changes to the Preservation Portfolio:

- Increases:

- Short Term Gov’t Bonds

- Long Term Gov’t Bonds

- Corporate Fixed Income

- Decreases:

- Canadian Equities

- US Equities

- Emerging Markets

- International Equities

- Preferred Shares

- Tactical Global

- Multi-Strategy

Our investment committee saw this as a good time to derisk our preservation portfolio and take on additional fixed-income exposure, pushing out our fixed-income portfolio’s duration (sensitivity to rate changes). However, we remain somewhat below the benchmark from a duration perspective. We’ve entered the best fixed-income market we’ve seen since 2007. As a result, we think enhancing the exposure gives investors exposure to higher yields and the prospect of capital appreciation if we see the interest rates decline. We continue to have meaningful exposure to the high-interest savings account, now providing a yield of over 5%.

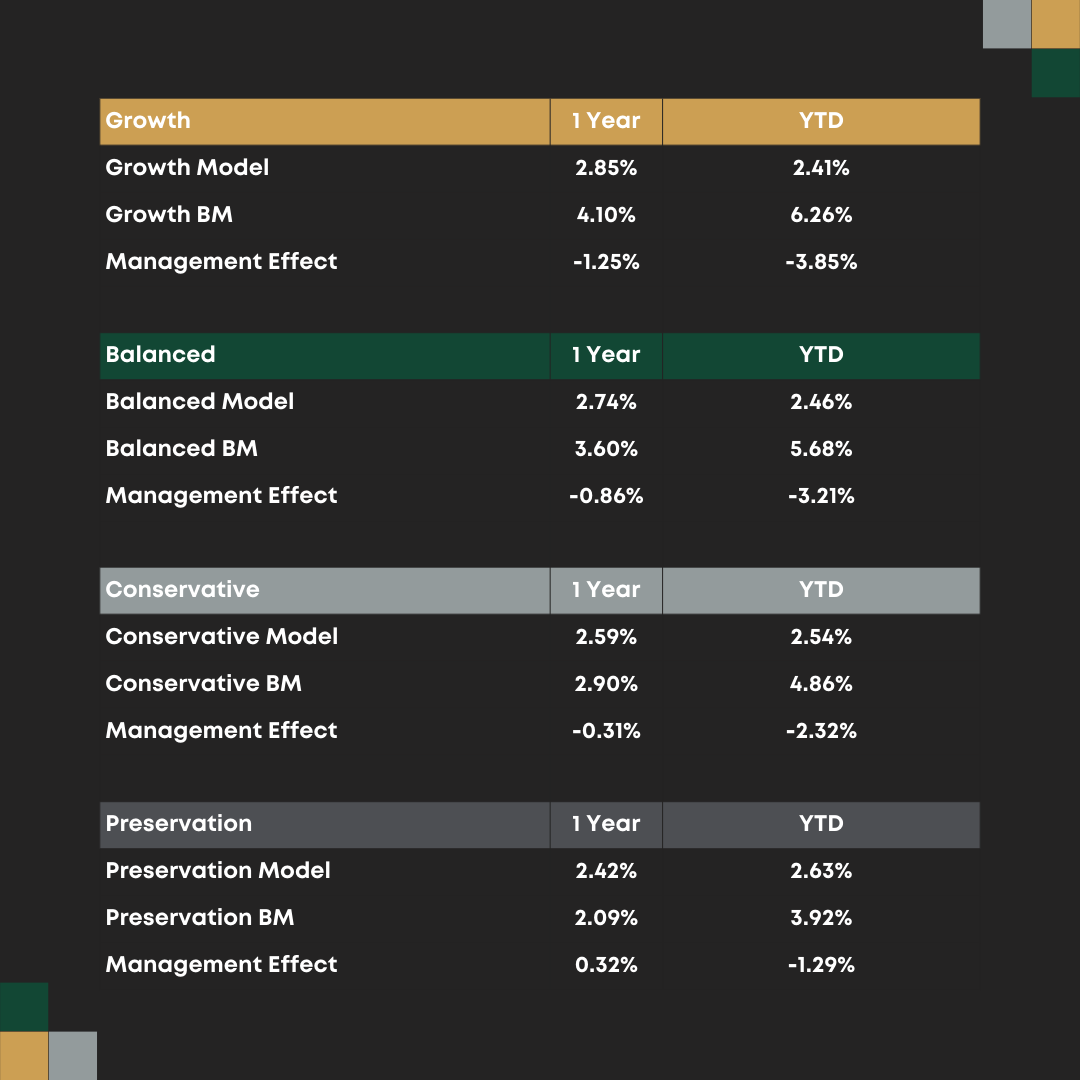

Performance

Statements

Second-quarter statements are now available and can be found in the Raintree Portal accessible here: https://raintreeportal.inf-systems.net/. Please be advised that we have consolidated all account statements into one household statement. We made this change to simplify the reporting. We had previously provided separate statements for each account as per regulatory requirements. All account details will be available within the new consolidated statements If you have any questions or concerns, please contact our team.