Market Overview

The third quarter of 2025 delivered broad gains across virtually all asset classes, overcoming cautious economic sentiment. Global equity markets rallied to new highs, supported by strong corporate earnings and growing optimism that interest rates have peaked. Investors largely shrugged off ongoing trade and geopolitical noise, focusing on positive fundamentals. A key catalyst was the shift in central bank stance: expectations for (and the reality of) interest rate cuts provided a tailwind for stocks and bonds. By quarter’s end, most major equity indices were firmly positive. In the U.S., the S&P 500 hit record levels, gaining roughly 8% over Q3 (about 10% in CAD terms). Canada’s S&P/TSX Composite led global markets with an outstanding 12.5% return for the quarter, buoyed by resurgent resource and technology shares. Overseas, European and other developed markets posted more moderate gains (~4% in local currencies), while emerging markets surged nearly +10% on the quarter – continuing their leadership after years of lagging developed markets. This broad strength came alongside lower market volatility through late summer.

There are two primary narratives driving investment performance globally. For example, the leading AI company, Nvidia, is larger than many national stock markets globally, including Canada, the UK, Germany, and Australia. The other theme is “Debasement”: the idea that fiat currencies, government debt, and other forms of financial securities are being “watered down” by inflation. This narrative stokes increasing prices in cryptocurrencies and precious metals like gold and silver.

It was a strong quarter across our portfolios, especially for those models with the greatest Core Equity exposure. Our Enhanced Yield and Alternative Strategies delivered the consistent returns we are targeting. Core Fixed Income provided tepid returns until a very strong September.

Canadian Equity Market: Enduring the Headwinds

Canada’s economy showed resilience in Q3, regaining some footing after a lacklustre second quarter. Early in the quarter, economic data pointed to a modest slowdown – consumer spending was mixed, and the housing market remained subdued under higher borrowing costs. However, by late summer, there were signs of stabilization. Importantly, inflation stayed near the Bank of Canada’s 2% target range, with core price measures gradually easing. This favourable inflation backdrop and softer economic momentum gave the Bank of Canada (BoC) room to become more accommodative. The BoC lowered its benchmark interest rate by 25 basis points in Q3, the first cut since earlier in the year. This policy adjustment was aimed at supporting growth and was welcomed by markets. Short-term bond yields dipped in response, reflecting borrowers’ expectations of further relief.

On the equity side, Canadian stocks enjoyed an outstanding quarter. The S&P/TSX Composite Index surged roughly +12%, outperforming many global peers and reaching new highs. The rally was broad-based but led by the resource and technology sectors. Notably, the materials sector – which includes Canada’s gold and mining companies – soared during the quarter, fueled by a sharp rise in gold prices. Gold jumped over +16% in Q3, nearly doubling in price since early 2024, bolstering earnings and investor sentiment for precious metal miners. Canadian financials also posted solid gains, aided by improved credit conditions as interest rate relief filtered through the economy. In contrast, a few defensive areas like consumer staples lagged slightly or pulled back, reflecting higher costs and tariff-related headwinds. Overall, the quarter’s combination of easing trade worries, strong commodity prices, and a more growth-friendly interest rate outlook created a constructive environment for Canadian equities.

One notable area of the Canadian market that has truly outperformed this year is the TSX Venture Exchange, which comprises smaller companies. The index was up almost ~54% ytd on the back of a renaissance in the mining and minerals sector, driven by inflating precious metal prices (copper and uranium prices have also been solid). RWM’s well-diversified Core Equity, Enhanced Yield and Alternative Strategies portfolios benefited from Canada’s outperformance, as the domestic market’s strength significantly boosted returns.

US Equity Markets: Take a Round Trip

In the United States, the narrative for Q3 2025 was one of steady moderation coupled with continued market strength. The U.S. economy struck a Goldilocks-like balance: growth was neither hot nor cold. After a robust rebound in Q2, economic growth in Q3 appeared to moderate to a more sustainable pace. Consumer spending remained healthy, underpinned by a strong labour market, though there were hints of cooling by late summer as August retail sales came in on the softer side. The unemployment rate held near 4.3%, historically low, even as monthly job creation slowed considerably (averaging only about 25–30k jobs in recent months compared to over 150k earlier in the year). Crucially, inflation continued to trend around the mid-2% range, roughly 2.5–2.9% on core measures, much lower than the peaks seen in 2022. With price pressures largely contained and economic momentum easing slightly, the U.S. Federal Reserve pivoted toward monetary easing. In September, the Fed implemented its first interest rate cut of the year, trimming the federal funds rate by 25 basis points. Fed officials cited cooling labour markets and controlled inflation as justification, and they signalled openness to additional cuts if needed. This policy shift marked a significant change in tone, reinforcing investors’ expectations that the rate hike cycle had definitively ended.

U.S. equity markets responded very positively to these developments. The S&P 500 Index climbed 8% over the quarter, adding to its substantial year-to-date gains. Market leadership remained concentrated in large-cap growth and technology stocks – sectors that have benefited from both the AI boom and the prospect of lower interest rates enhancing future earnings. Indeed, the quarter saw another round of excellent earnings reports from big technology firms, which helped propel the Nasdaq and communication services shares higher. By July, major U.S. indices were hitting fresh record highs amid optimism around AI-driven productivity gains and a tentative U.S.-China trade truce that reduced tariff anxieties. There were brief stints of volatility – for example, a spike in Treasury yields in September prompted a temporary stock pullback – but the overall trend was upward. Roughly 80% of S&P 500 companies beat earnings expectations in Q3, highlighting corporate resilience. Cyclical sectors like industrials and consumer discretionary also posted gains. However, energy shares lagged as oil prices faded after an early-quarter jump. For Canadian investors holding U.S. equities, a slightly firmer U.S. dollar lifted the returns. In sum, U.S. equities delivered strong performance again, supported by a healthy economic backdrop and the market-friendly shift in Fed policy.

International Developed & Emerging Markets

Outside North America, equity performance in Q3 was positive overall, though results varied widely by region. European markets lagged somewhat, seeking smaller gains relative to the global average. The MSCI Europe Index managed only low-single-digit growth for the quarter. Ongoing economic challenges kept European investor enthusiasm in check. The Eurozone’s economy remained sluggish – growth is hovering under 1% annualized – and manufacturing activity in key countries like Germany stayed soft. Encouragingly, inflation in Europe has cooled dramatically, falling back to around the European Central Bank’s 2% target. This allowed the ECB to maintain an accommodative stance after significant rate cuts earlier in the year. Nonetheless, Europe faced headwinds such as political uncertainty (including leadership changes in France) and residual trade disputes. For example, Germany’s equity market dipped into negative territory during Q3, underscoring the region’s fragility. On the upside, the U.K. market delivered modest gains, aided by its international exposure and a weaker pound. Overall, European stocks provided positive but muted returns, offering diversification benefits without the fireworks seen elsewhere.

In contrast, Asian and emerging markets were notable bright spots in Q3. The MSCI Emerging Markets Index jumped by double digits, handily outperforming most developed markets. Within emerging markets, China’s stock market led the charge. A temporary extension of the U.S.-China trade truce and a flurry of policy support for China’s technology sector ignited a rally in Chinese equities. In fact, Chinese technology shares saw explosive gains – for instance, Hong Kong’s Hang Seng Tech Index surged over 20% during the quarter. Investors reacted positively to easing trade tensions and hopes that China’s government initiatives (such as support for domestic chipmakers and measures to boost consumer spending) would reinvigorate growth. This marks a dramatic reversal from the prevailing narrative a year ago, which held that the Chinese equity market was essentially “uninvestable” due to government intervention in the technology sector and a property downturn weighing on Chinese consumers. Japan was another top performer: Japanese equity indices climbed to multi-decade highs in Q3. Stellar corporate results and structural improvements fueled the rally in Tokyo – Japan’s Q2 GDP growth surprised to the upside (approximately +1.0% vs 0.4% expected), and ongoing corporate governance reforms continued to attract foreign investment. A weaker yen also provided a tailwind for Japan’s exporters. Meanwhile, other Asia-Pacific markets like Taiwan and South Korea benefited from the global tech upswing and saw substantial gains. Not all international markets boomed – for example, pockets of weakness persisted in countries facing local challenges – but by and large, international diversification paid off this quarter. Emerging markets demonstrated their value, as their strong performance contributed significantly to global equity returns. Exposure to these international and emerging regions added incremental gains and broadened portfolio strength for Raintree’s globally diversified investors.

Fixed Income Market Summary

It was an eventful quarter in fixed income, although bond returns were relatively modest. Global bond markets experienced volatility as investors digested shifting economic signals and central bank actions. In the end, interest rates generally ticked down in late Q3, resulting in slight price gains for high-quality bonds. The Bloomberg Global Aggregate Bond Index – a broad measure of investment-grade bonds worldwide – delivered a small positive return of roughly +0.6% for the quarter. This marks a turnaround from the declines seen earlier in the year. Government bond yields fluctuated during Q3: for much of the summer, longer-term yields rose amid fiscal concerns and heavy supply, but they pulled back after central banks began cutting rates. In North America, the 10-year Canadian and U.S. Treasury yields initially climbed on robust economic data, then reversed course and fell in September once the BoC and Fed eased policy. Short-term yields dropped more noticeably (reflecting the rate cuts), while longer maturities ended slightly lower as markets balanced growth optimism with worries about government deficits. Government deficits will be a key focus for the remainder of the year as the Carney government delivers its first budget, promising fiscal prudence in ongoing operations and investment in infrastructure development to support industry and economic growth. This would be a welcome shift from the last decade.

Across credit markets, corporate and high-yield bonds outperformed government bonds thanks to improved risk sentiment. Narrowing credit spreads (the difference between government and corporate rates) added to bondholders’ returns. For example, U.S. high-yield bonds returned roughly +2.5% in Q3, handily beating safer bond segments. U.S. investment-grade corporate debt also notched solid gains as investors sought yield in a falling-rate environment. There is also some sentiment in the market that spreads are narrowing and that government debt is looking weaker, following the debasement theme in the market.

In Canada, the iShares Core Canadian Universe ETF: XBB (which tracks our overall bond market and is our benchmark for the Core Fixed Income Fund) moved into positive territory year-to-date, reflecting the first meaningful bond rally of 2025. The BoC’s rate cut helped anchor the short end of the curve, boosting shorter-duration bonds, while stable inflation kept longer-term bonds reasonably well behaved. It’s worth noting that bond market volatility hasn’t vanished – September saw a brief spike in yields as oil prices and fiscal news startled markets – but by quarter-end, stability prevailed. For diversified investors, fixed income assets fulfilled their role by preserving capital and providing income. After a difficult 2022–2024 period, it is encouraging to see bonds finally contributing positively to portfolios again. We maintain a cautious but constructive outlook on fixed income: with central banks now tilting dovish and inflation in check, bonds appear better positioned to deliver modest returns and serve as a reliable diversifier alongside equities, particularly after a very strong three years in the North American equity markets.

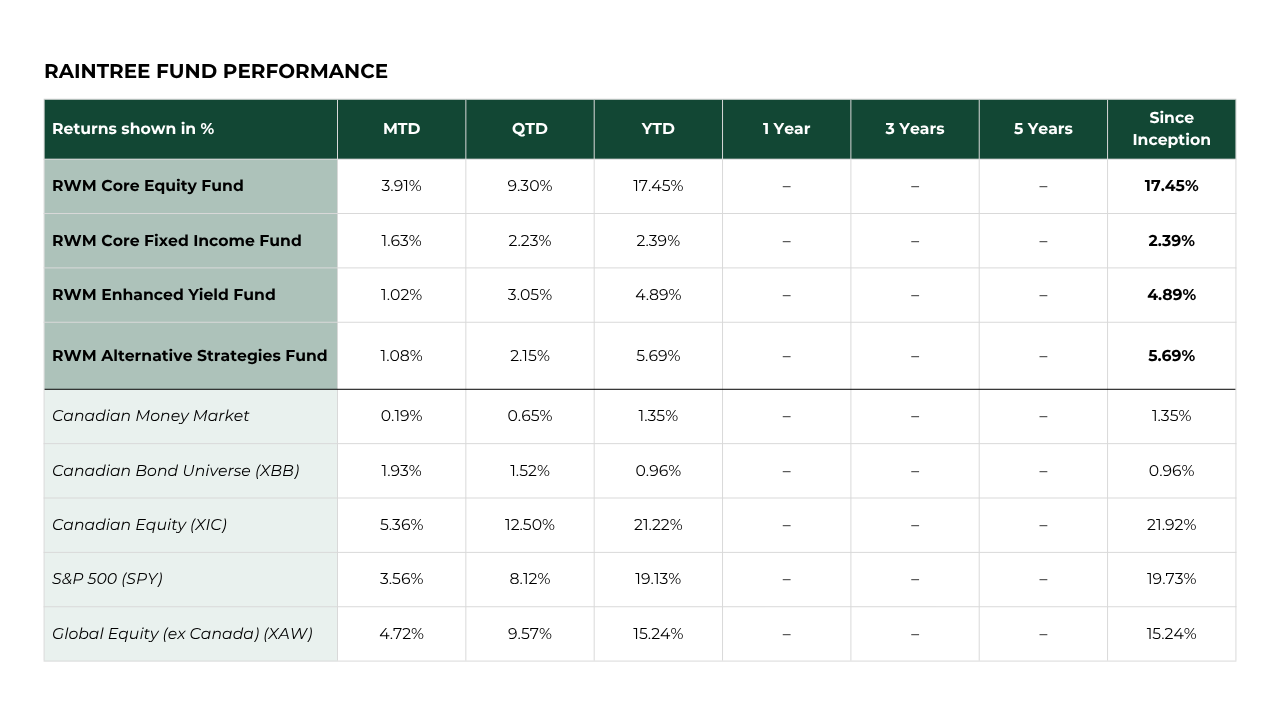

Raintree Fund Performance

- Core Equity Fund: The Core Equity Fund gained +9.3% in Q3, participating strongly in the global stock rally. The fund’s globally diversified holdings – Canadian, U.S., and international equities – contributed to the advance. The Canadian Small Cap exposure provided the most significant quarterly returns, up over 16%. Micro-cap and US Small Cap also offered attractive returns. Voyager, our active global growth strategy, also had another strong quarter – up over 11% – buoyed by the AI theme. Last quarter, our US S&P 500 currency-hedged outperformed, whereas that reversed this quarter – showing the benefit of having some USD exposure in the portfolio. We remain ahead of the benchmark since inception, while maintaining what we would describe as some diversifying strategies in Turtle Creek (a value mid-cap focused manager) and AQR, a multi-strategy fund – delivering softer performance for the quarter. We have been rotating the portfolio to our global equity strategies, slightly reducing exposure to the US large-cap and active strategy.

- Core Fixed Income Fund: The Core Fixed Income Fund finished essentially flat at 2.2% for the quarter, which was driven by a rebound in September. Each strategy in the fund contributed positively in the quarter. Our relatively small dividend equity exposure contributed most positively to the fund in the quarter. Our FGP Preferred Share position also contributed favourably during the period. We added to our Core+ and Corp+ allocations in the quarter. Fixed income may be poised to offer more value moving forward, after a difficult three years. With the Bank of Canada and Federal Reserve cutting rates recently, and equity valuations continuing to reach new highs, we’re mindful that fixed income may renew its role as a volatility mitigator, with regular distributions.

- Enhanced Yield Fund: The Enhanced Yield Fund returned +3.1% in Q3, providing a steady income-driven gain. The fund was a significant beneficiary of the equity upside of the covered-call strategies in the portfolio, which generated its yield, alongside positive contributions from the equity upside – particularly in the financials, technology and gold sectors. Our worst-performing strategy was a position focused on US Business Development Companies (BDCs), which focused on the direct lending private credit industry, and sold off severely in September. The silver lining is that we can continue buying into this softness, currently at a ~20% discount to net asset value and a 13% yield. Other strategies produced their yields with limited volatility. USD currency exposure contributed slightly positively in the quarter, after a difficult Q2. The fund made its monthly, 8% annualized, distributions. We added some attractive new strategies to the portfolio in the quarter, including Espresso Capital (a technology lending strategy), Dawson Partners (an institutional secondaries fund), Invico Diversified Fund (a diversified yield strategy) and Newlook Dental Debentures (an offering from a dental clinic private equity rollup strategy).

- Alternative Strategies Fund: The Alternative Strategies Fund posted a +2.2% return in Q3, continuing with three more positive months of return (six straight now since inception). The strategies that performed the best in the quarter were those funds that we would categorize as “event-driven” and have a long bias. These funds benefited from the significant gains generated in Canada’s mining and resource sector. Meanwhile, the market-neutral strategies struggled, as the market was a little more indiscriminate, and the shorts didn’t perform particularly negatively, and in many cases, positively. Accelerate Absolute Return Hedge Fund HDGE was an exception to this, having a very strong September. For the quarter, Blackstone Private Equity was the strongest performing private investment, benefiting from the momentum in the data centre sector. In the quarter, we added our exposure to private real estate, private equity, and emerging alternatives strategies. Late in the quarter, we said Tract Farmland LP, which had a positive 6% return, driven by farmland valuation increases.

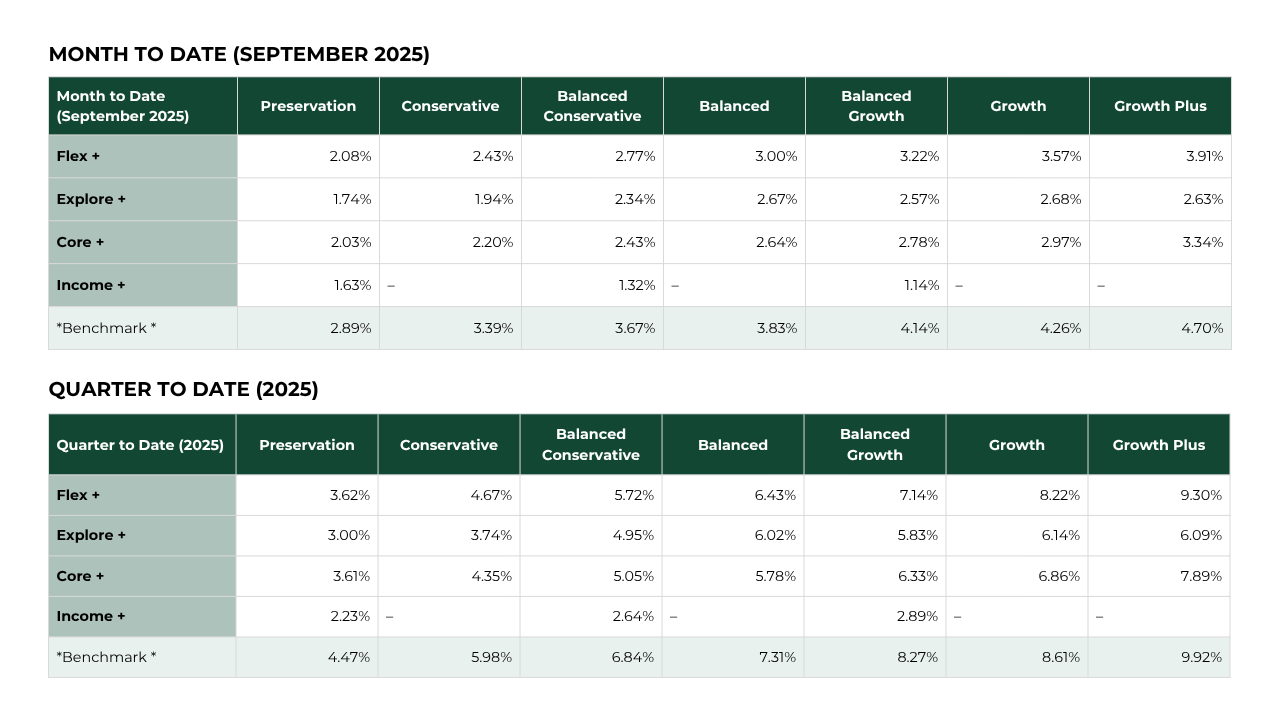

Model Performance

Performance was positive across all Model portfolios. Once again, our performance results aligned with model expectations: the more equity-oriented model portfolios delivered the most substantial returns, while the more fixed-income-focused model portfolios produced more modest performance. The Enhanced Yield and Alternative Strategies funds provided the most consistent return profiles. We are mindful that after a very strong five months in the equity market, we may be “due for a pullback.” Our models can provide strong diversification, mitigating downside if a drawdown occurs.

Overall, we’re incredibly pleased with the Pools and Portfolios’ performance in the first six months.

Your quarterly account statements have been posted to your client portal. If you have any questions about this commentary or your portfolio, please don’t hesitate to contact your advisor or our team. We’re here to help and appreciate your trust in Raintree Wealth Management.