Overview

In 2024, the spotlight has shifted from the once-revered “Magnificent 7” to the standout performance of the “Magnificent 4” – Nvidia, Meta, Microsoft, and Amazon. Their impressive strides contrast with the subdued performance of Tesla, Alphabet, and Apple. Nvidia’s stellar quarterly report, revealing surging demand for AI accelerator chips, has particularly fueled market enthusiasm. Amidst this, global equities surged by over 6% last month, while bond markets faced volatility due to shifting expectations around central bank interest rate cuts. Uncertainty looms over the trajectory of interest rates, with differing opinions on whether the Federal Reserve will adhere to its guidance of multiple rate cuts in 2024. Dr. Torsten Slok’s contrarian view adds complexity to the economic outlook, emphasizing the imperative of vigilant inflation management against historical precedents and risks of repeating past mistakes. Keep reading to learn more!

The Magnificent 4

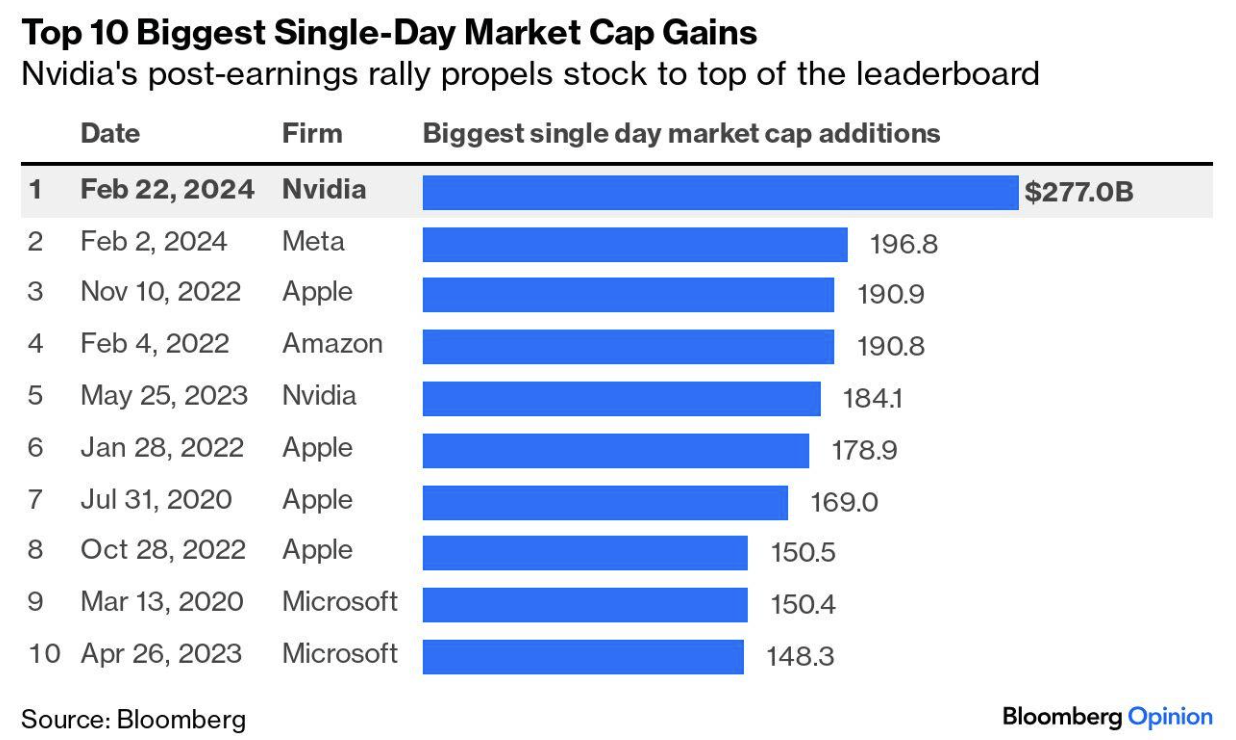

From the “Magnificent 7” to the “Magnificent 6” to the now the “Magnificent 4”? Nvidia, Meta, Microsoft, and Amazon have all had fantastic starts to 2024. Tesla, Alphabet, and Apple? Not so much. Thankfully, for the Mag 7 faithful and those invested in the S&P 500, which is increasingly reliant on these stocks, the success of the 4 has more than carried the group’s weight. We mostly have Nvidia to thank for this when it reported a blowout quarter this month and topped all analysts’ sales forecasts, revealing insatiable demand for its AI (Artificial Intelligence) accelerator chips. The market response was unprecedented, obliterating the previous one-day market capitalization increase set by Meta just 20 days earlier.

Market Dynamics: Equities Surge, Bonds Face Volatility

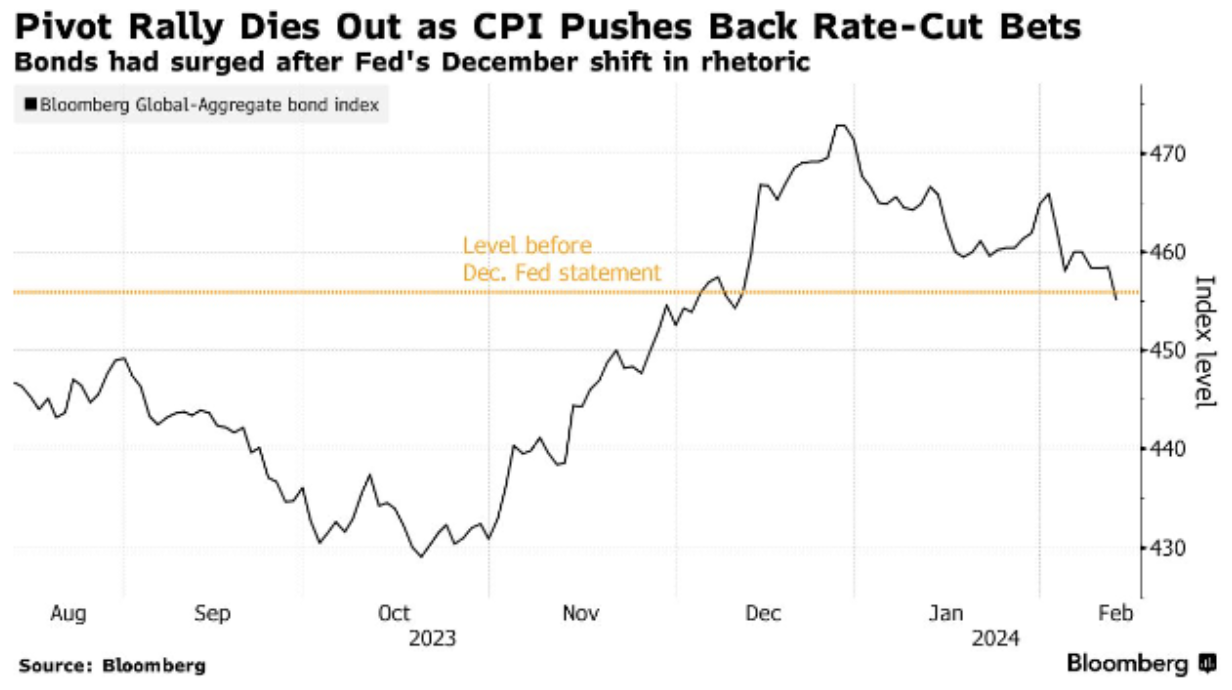

The equity bulls remain well in control of their market; global equities were up a hefty 6%+ last month. Bonds had another negative month (Treasuries have been down 8 of the previous 10 months), which would have been worse if not for a rally in the final week of February. US companies sold a February record of 172 billion in debt, 361 billion this year, also a record. The net result has been a further tightening of bond spreads, now well below the 10-year average.

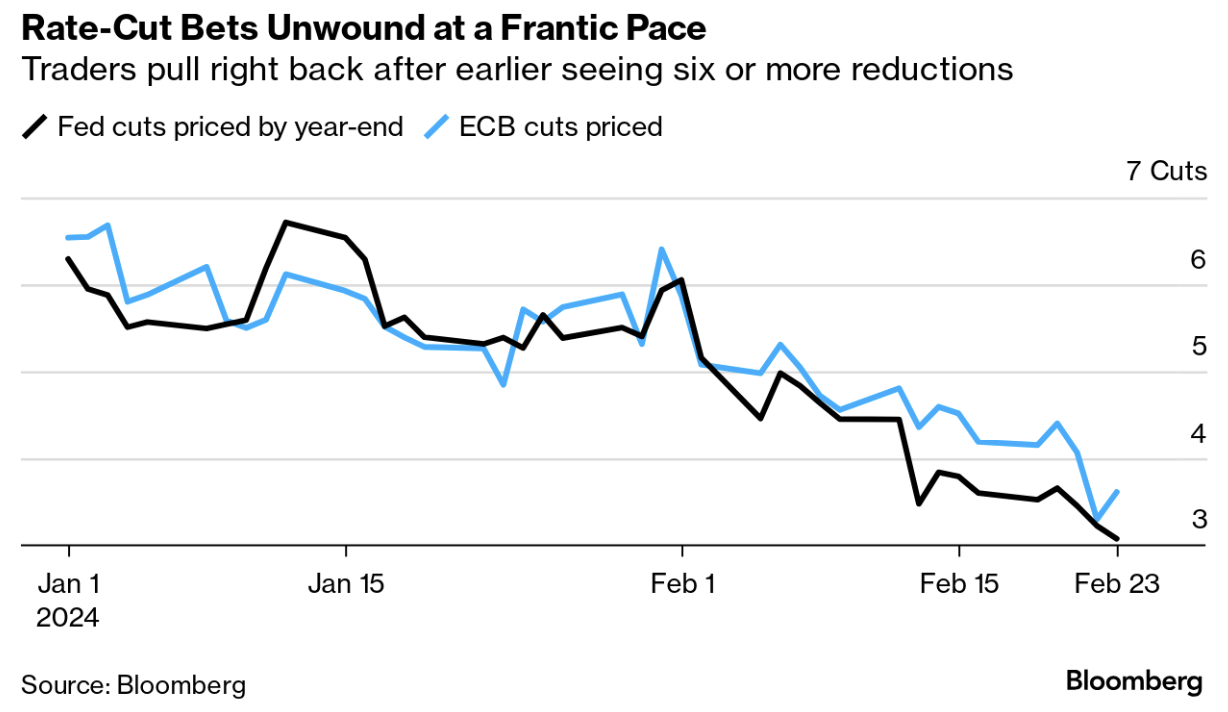

The volatility in February’s fixed-income markets was primarily due to the unwinding of bets on central bank interest rate cuts. Higher-than-expected growth, job, and inflation data have drastically changed the opinion of market participants on the timing and how many initial rate cuts they should expect this year. Given the updated rate cut tempo predictions, the analogy that rates would rise like an escalator and drop like an elevator is much more ambiguous.

All of last quarter’s excitement about a potential rate cut in March has faded, leaving the bond market where it was before the fed’s official rhetoric took on a less hawkish tone. Traders have finally heeded the long-standing Wall Street warning, “Don’t fight the Fed!” and are essentially pricing the central bank to meet its guidance of 3 cuts in 2024.

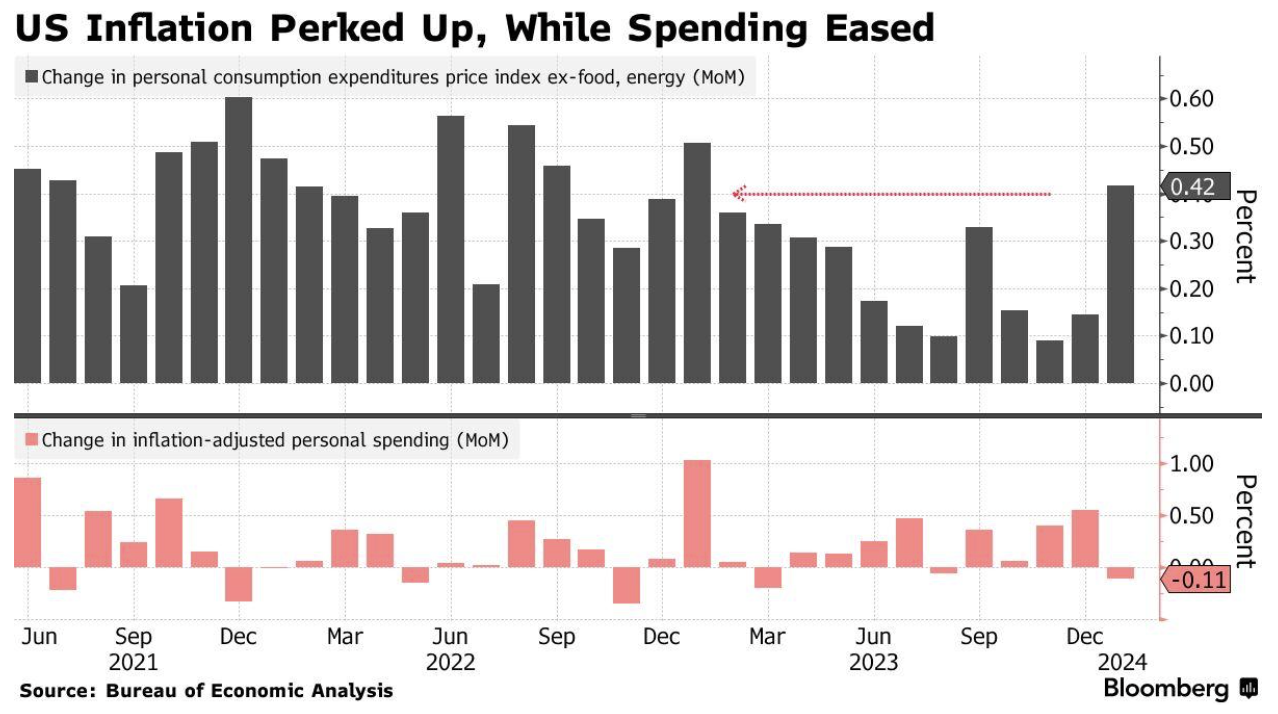

The Fed’s preferred measuring stick of underlying inflation, Core PCE (Personal Consumption Expenditure), which strips out volatile energy and food components, rose 0.4% in January and 2.8% from a year ago.

Upward Tick in US Inflation as Spending Moderates

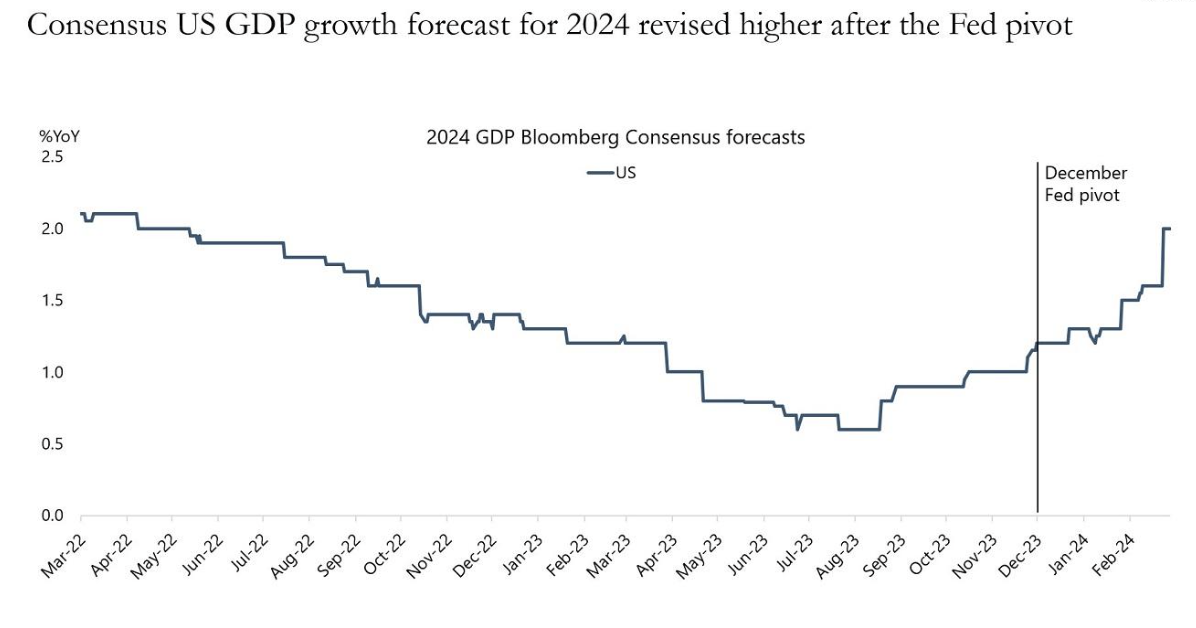

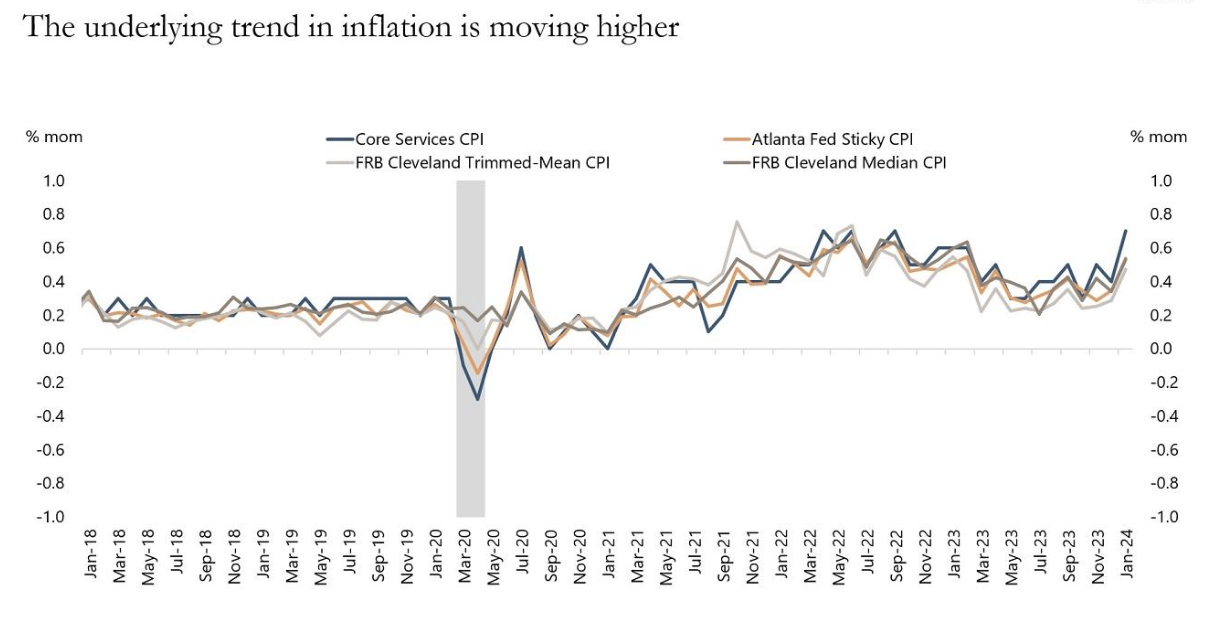

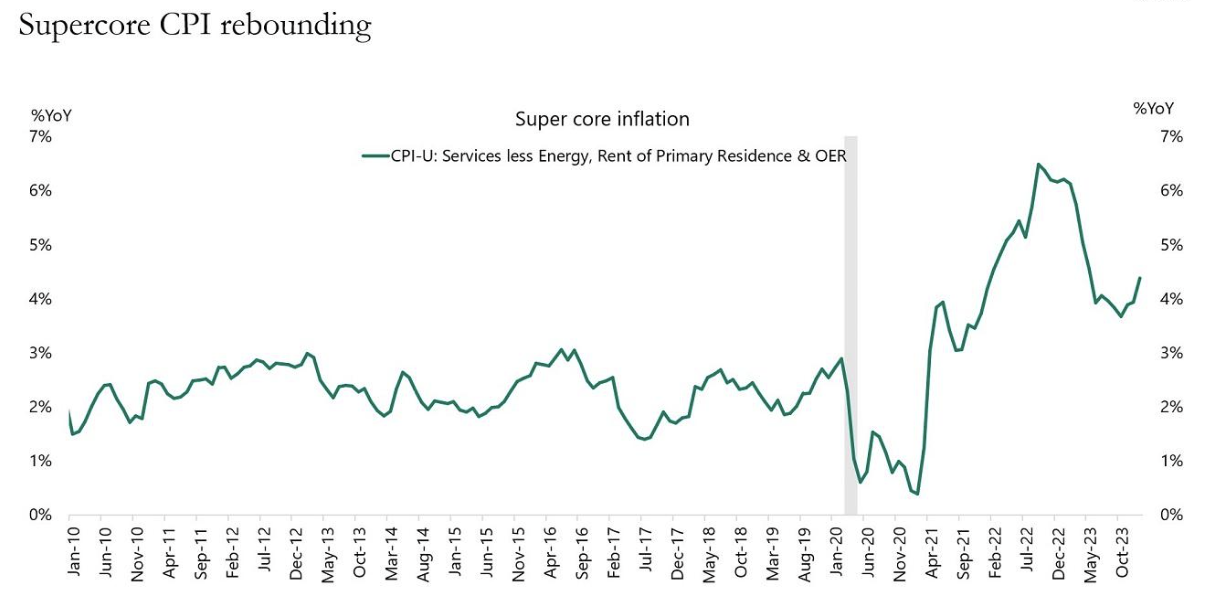

The Fed has always warned of an uneven path to beat back inflation, pointing out potential areas of stickiness. Most see these areas of the economy where there’s not much disinflation and conclude it will just take a bit longer, while others, like Dr. Torsten Slok, Chief Economist at Apollo Group, see these areas in a much more troubling light and suggest that the economy is not slowing down, it’s reaccelerating. This has led him to predict that there will be no rate cut in 2024 and potentially even another hike. The below four charts illustrate part of his, at the very least, thought-provoking argument.

He is right that growth expectations are constantly being revised higher, and the large investment firms are falling over themselves to change their predictions for 2024 on what markets will return. The S&P 500 is already more than a third higher than the original consensus expectation of where it would finish the year.

Reflections on Two Years of High Rates and Yield Curve Inversions

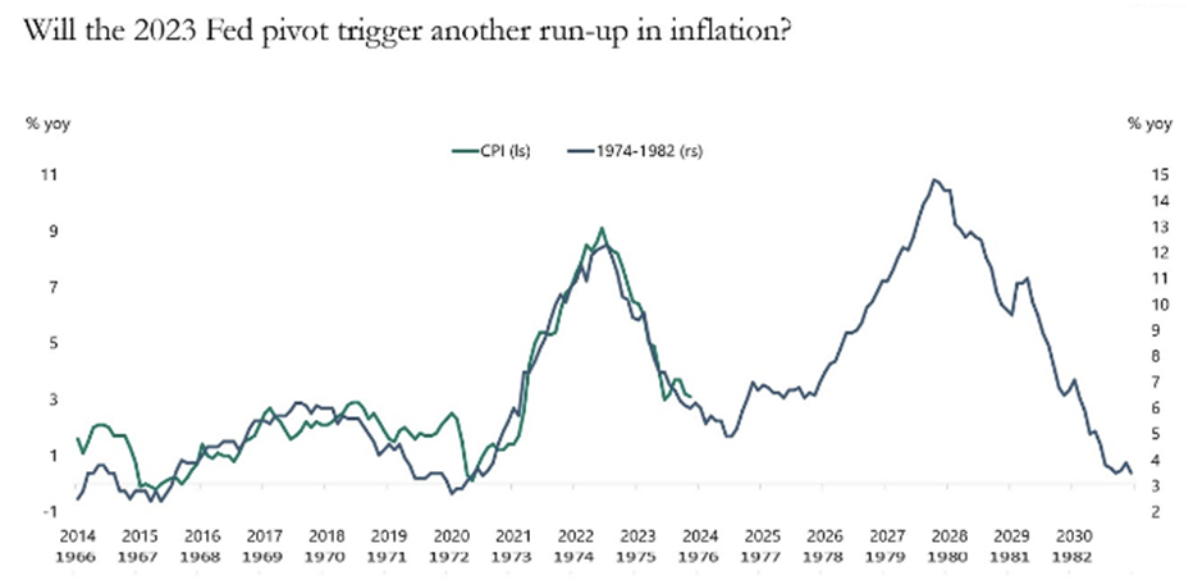

If it feels like we’ve been living in a high-rate environment for some time now, it’s because we have. This month marks the two-year anniversary of the first Fed hike, leading to the most prolonged period of yield curve inversion since 1942. In that time, an inversion “has signalled a recession within 19 months on 9 out of 10 times,” Deutsche Bank researcher Jim Reid wrote in December 2023. We’ll now have to update that stat to 9 out of 11. The previous inversion record holder is from the 1970s, a period of high inflation that was very challenging for the Federal Reserve. There were two fed chairs in the 1970s, Arthur Burns and later Paul Volcker, who have been criticized heavily for their errors during that time. Especially Burns, who declared victory on inflation way too early and cut rates when inflation was trending downward but still high; this was an economic disaster. The chart below compares that period with our recent fight against inflation and warns us not to make the same mistakes.

Central bankers are undoubtedly highly aware of this history and should be much more cautious than their predecessors. The central bankers’ sole focus must be suppressing inflation below their targets, regardless of outside pressure from markets and politicians to ease financial conditions.