Overview

“I don’t need an economist to declare we’re in a recession; just look around at how much our lives and businesses have changed for the worse over the last year.” – Joseph DiMaria, Canadian Business Owner

We are weeks from the highly anticipated June 5th Bank of Canada’s interest rate announcement. Central Bank Chair Tiff Macklem will announce whether the economy is in rough enough shape to warrant some relief from its economically restrictive monetary policy through an interest rate cut. Let’s take a short glimpse at the current state of the Canadian economy to form opinions on whether the BOC will, should, or should have already cut rates.

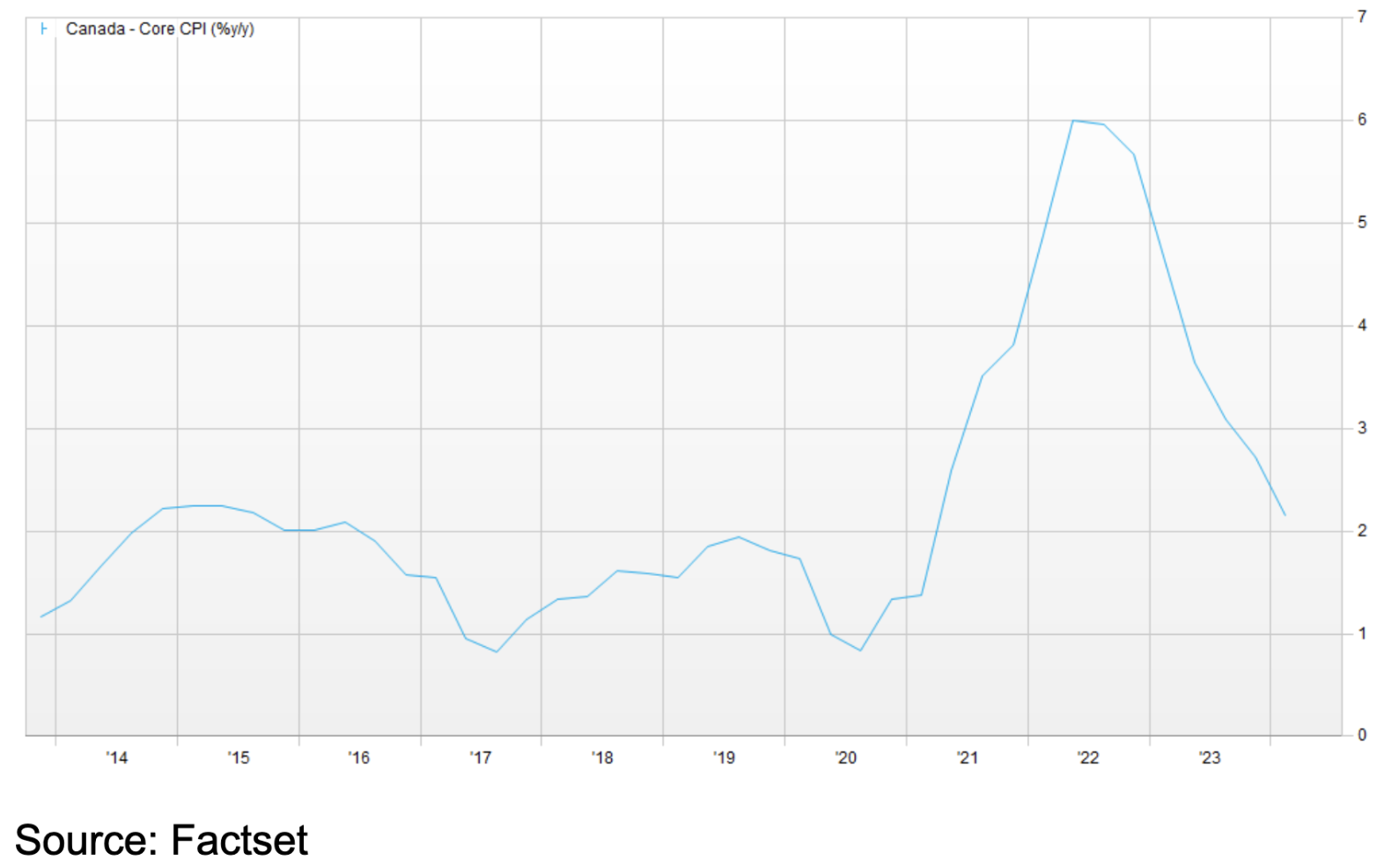

Inflation

The CPIX, which excludes the most volatile segments of the CPI index, is currently at 2.1% year over year, just about at the BOC’s 2% target. Retail sale prices in Canada are no longer inflating at all. Due to excess supply, producer prices in Canada are disinflationary, -0.5% and -0.2%, respectively, for their core inflation index year over year. If the housing component of the CPI is stripped out, inflation will run at only 1.5%, a massive decline from 3.9% a year ago or 6.6% the year before that. This demonstrates how shelter costs are a major factor driving inflation, which in part have been driven higher by higher interest rates. Interest rates impact mortgage servicing costs, a key component of housing costs. An additional factor is the shortage of housing units, which has driven rental rates as the population has grown so dramatically in the last year. Reduced rates would improve the economics of construction financing for developers to deliver new housing units.

Housing

Recent data shows that home sales in Toronto, a usually strong real estate market, were only up 3.4% month-over-month, quite a lacklustre activity considering the 47% increase in new listings created over the last year. The average home sold price in the GTA is up just 0.3% year over year. The probability of a housing bubble flaring up, causing inflation to spike, seems very low. As the biggest housing market in Canada, with some of the highest average home prices, the market seems to be treading water at these rate levels.

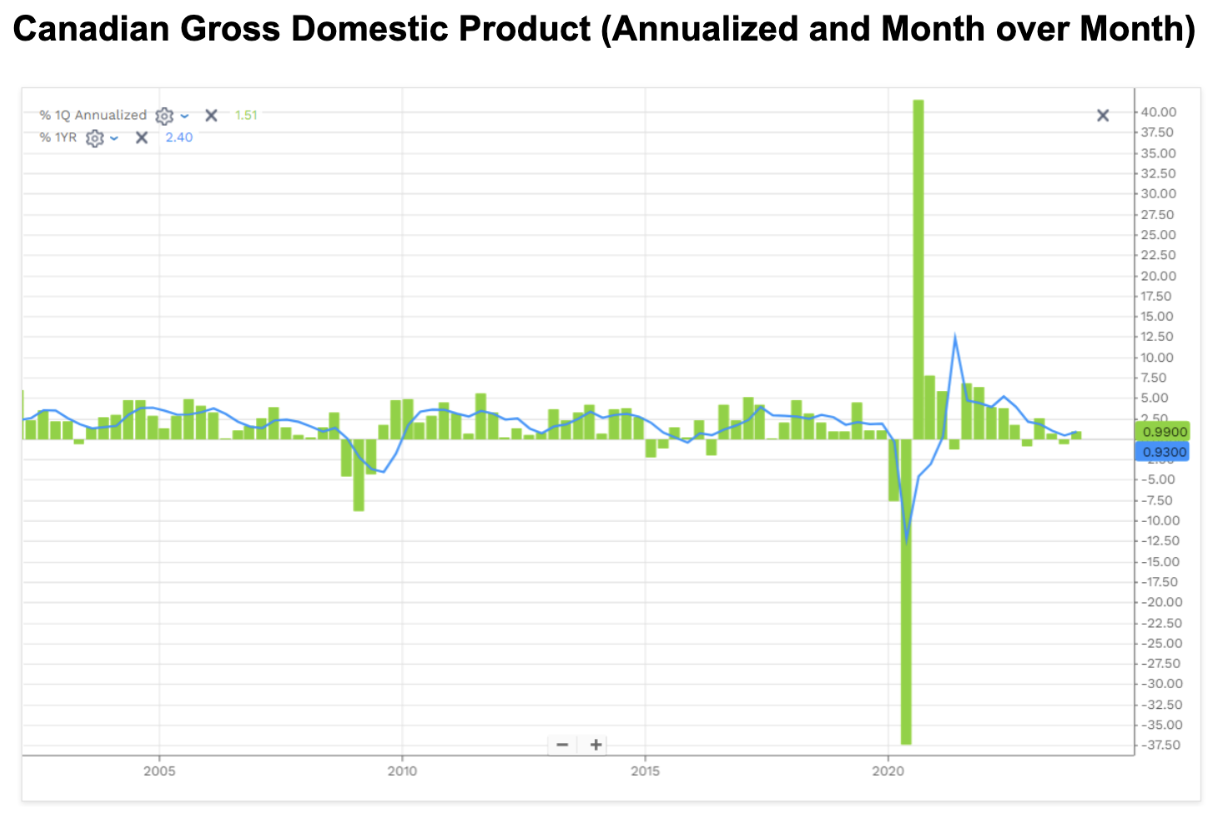

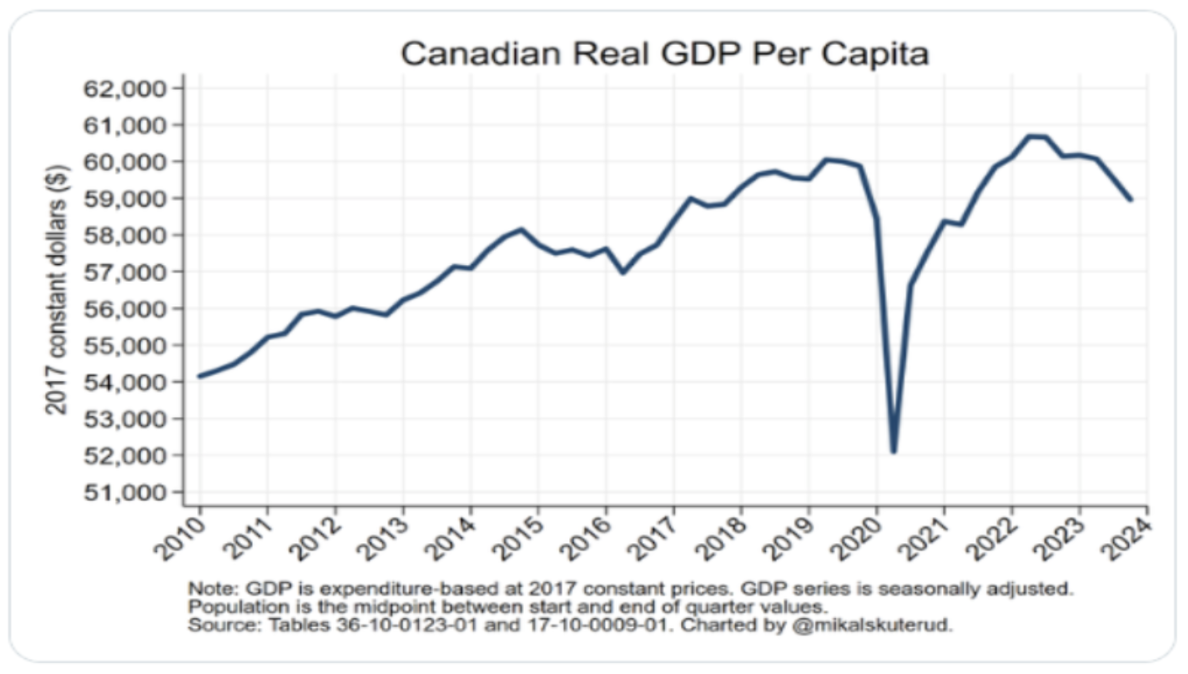

Economic Growth

Real Gross Domestic Product, GDP minus inflation, has been 0.9% over the past year. At first glance, this is not great, but certainly not recessionary. However, when you factor in that immigration policies have led to a population growth of 3.2% in that time period, real GDP per capita is down over -2%. This suggests as a nation, we are becoming less wealthy per person.

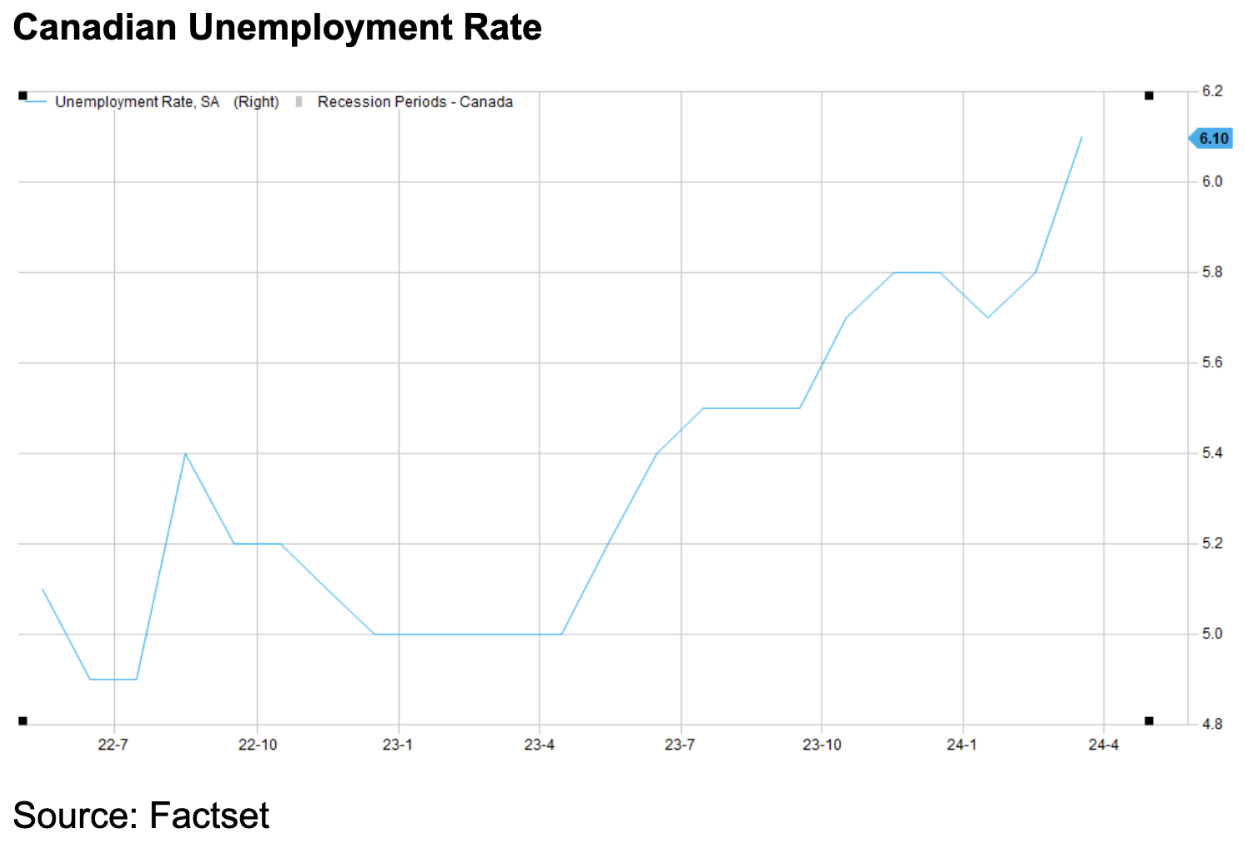

Unemployment

Canadian Unemployment is 6.1%, up 1% in just a year (2.3% higher than the US), and now higher than pre-covid levels. Given high interest rates, unemployed Canadians are in much worse shape today than when this number was last reached. Young adults aged 15-24 are the worst off, and their unemployment rate is nearly 13%. Today, the odds of someone entering the labour force and finding a job within a year are slightly better than a coin flip. This is not the employment market that demands wage inflation moving forward. Wage inflation is far more persistent in the US, which keeps inflation higher south of the border.

Business in Canada

Business insolvencies are up 87% over the past year, a level not seen since the worst of the Great Financial Crisis. Businesses that require debt to grow can not afford the high cost of capital.

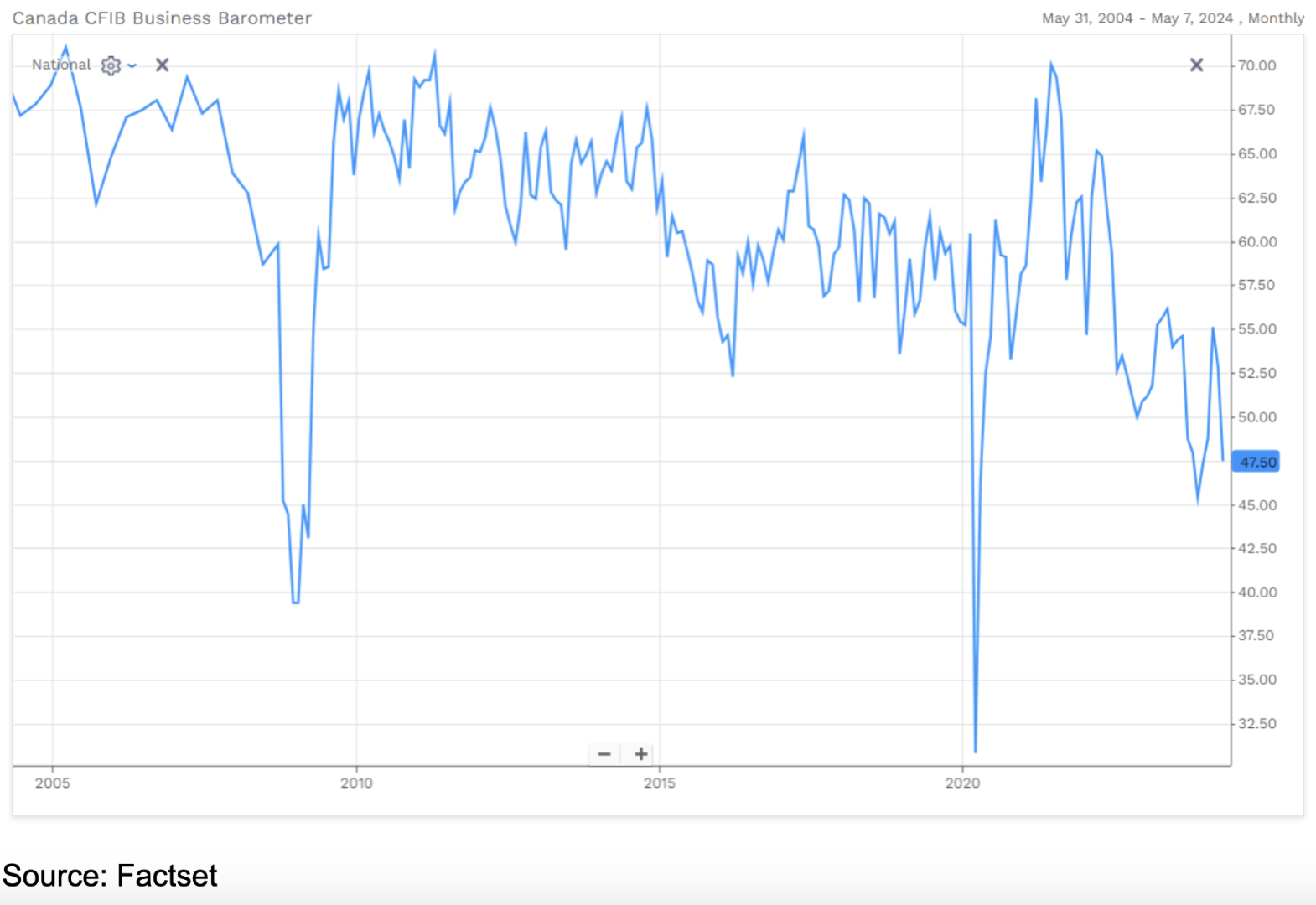

CFIB’s Business Barometer long-term index, which is based on 12-month forward expectations for business performance, has seen a sharp drop in April, now at 47.5. It’s tempting to compare where we are now to the other 2 low points on the below graph, but keep in mind that the first one was in 2008 during the Great Financial Crisis, the greatest threat to capital markets since the great depression, and the Covid pandemic when most business revenues went to zero during the lockdown. Low sentiment reduces business owners’ and managers’ appetite to reinvest in capital assets or human resources.

Cutting Rates Too Early

If you were a commanding general in a war and had your enemy on their last leg, withdrawing your troops before victory was declared and letting your enemy regroup and strengthen would get you fired. The US’s battle with inflation during the 1970s should be a cautionary tale for Central bankers not to declare victory too early and cut rates too soon. During that time, inflation was on the way down but not beaten when they decided to cut rates. Inflation flared back up and was harder to tame the second time, causing a massive productivity slowdown throughout the decade. Tiff Macklem probably doesn’t have any interest in becoming that losing general.

Another potential issue with lowering interest rates is that the US, our largest trading partner, may delay their cuts much further. A strong US economy has the market pricing in the likelihood of the Federal Reserve cutting only rates once this year, if not at all. If the spread between Canadian and US rates gets too wide, it could materially devalue our currency. If the return generated in Canada becomes too low, foreign investment will dry up. Foreign buying of treasury debt is the biggest driver of currency demand for G7 countries. History suggests that around the 50 bps difference in the short end of our yield curves, we could see significant depreciation of the CAD/USD pairing. If this was 50 years ago when we were a manufacturing-dominant country, that might have helped with our exports enough to get us out of our negative productivity gap. (-0.7% was the last reading from Q4). However, 80% of Canadian workers are employed within the service industry, so export growth would be much less impactful. A weak dollar still has some benefits, though, as it keeps our money in our country, improves the return on the sale of our commodities and helps with tourism. It is difficult to estimate if this would be enough to offset the higher input costs we’d face for costlier imports.

The Benefits of a Rate Cut

If rate cuts begin soon, we can expect a much shorter time requirement to get our economy back on track. This is not to say that it will be easy, we face many issues requiring responsible fiscal policies that will probably be unpopular. However, the movement of capital becomes much easier in a lower-rate environment, which is imperative for economic growth. John and Jane Smith will spend more of their hard-earned dollars on their neighbour’s business and less on their mortgage payments. Money will empty from high-interest savings accounts and likely circulate back into local economies. Homes will get built, as it will again become financially viable. People will spend more to grow this country because they are no longer asked not to.

Conclusion

The aggregate Canadian economic data tells us the time to cut interest rate cuts is now. There aren’t many steel-man arguments for the BOC to hold rates at their current levels. Currency manipulation is no longer part of the BOC’s mandate. (See the 1960s). A 2% inflation target is the BOC’s mandate. We’re, by definition, not quite there. However, economic indicators are lagging indicators, and all signs point to being there quite quickly, if not there already. GDP per capita growth is dreadful, and unemployment is soaring. The Bank of Canada was late in recognizing that inflation was a problem in 2021, and they are most likely already late in recognizing that deflation is now a problem. We’ll see on June 5th if it’s finally time to flip the interest rate trajectory or if further caution and patience will be the order of the day.