CEO Message

Commentary Highlights

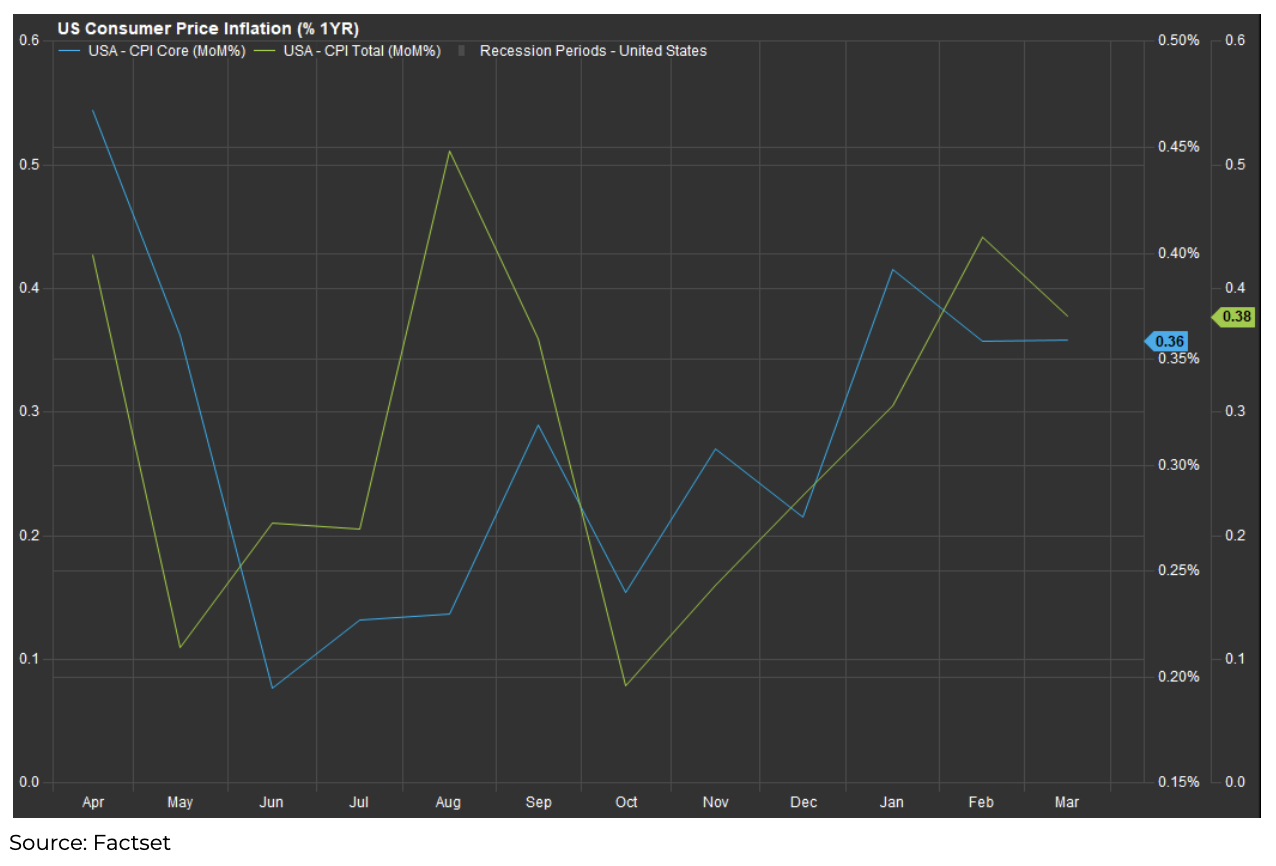

- Inflation data for the quarter showed that even though central bank policy rate decisions are restrictive, the free market’s creation of easier monetary conditions has further slowed the fight against inflation.

- As a result, North American central bank rate cut projections for 2024 are down considerably.

- Bonds fell from their Q4 highs, but stocks continued their extraordinary bull run.

- Geopolitical tensions around the world are at the highest level in decades.

Market Overview

The first three months of the year saw a continuation of the market froth that formed in Q4 of 2023 but with less breath. Q4 was the everything rally, and Q1 was almost everything minus fixed income (and fixed income-related securities). Equities took center stage once again, but this year, they have not just been soaring on the backs of a few mega-cap stocks but saw many more companies contribute. Evidently, with the US Mid-Cap 400 outperforming the Nasdaq 100 this quarter, both indexes were up over 10%.

As has been the focus of the last couple of years, future interest rate levels, inflation concerns, and economic strength remain the most significant question marks. High-interest rates are significantly delayed in slowing down the economy and inflation, leaving many worried about when we might see more moderate rate levels again. Rate cut expectations for North America this year are continuously being revised lower with every hot inflation print and strong economic growth metric.

The above chart shows the US’s month-over-month Total and Core Inflation changes. These numbers do not support any optimistic narrative that inflation is near the Federal Reserve’s 2% target and that Powell will begin cutting rates any time soon. The first-rate cut, once thought to occur in March, now has a less-than-likely chance of happening in June.

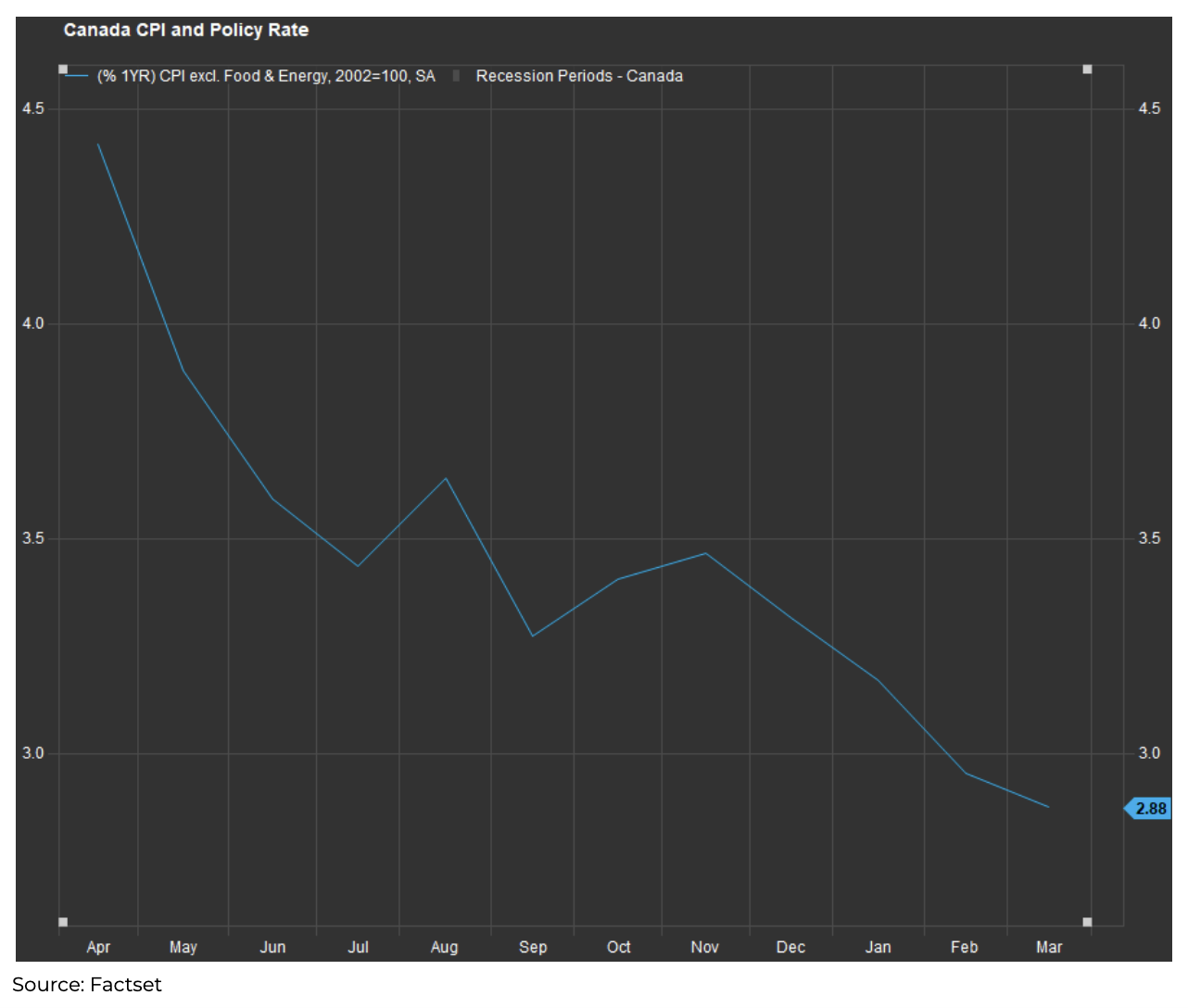

Our path to lower inflation and rates in Canada looks slightly better, as Canadians appear to be much more rate-sensitive.

Although total CPI in Canada and the US has not looked significantly muted to date, the critical metric, core inflation, which strips our food and energy, looks much better than our neighbors.

Fixed Income

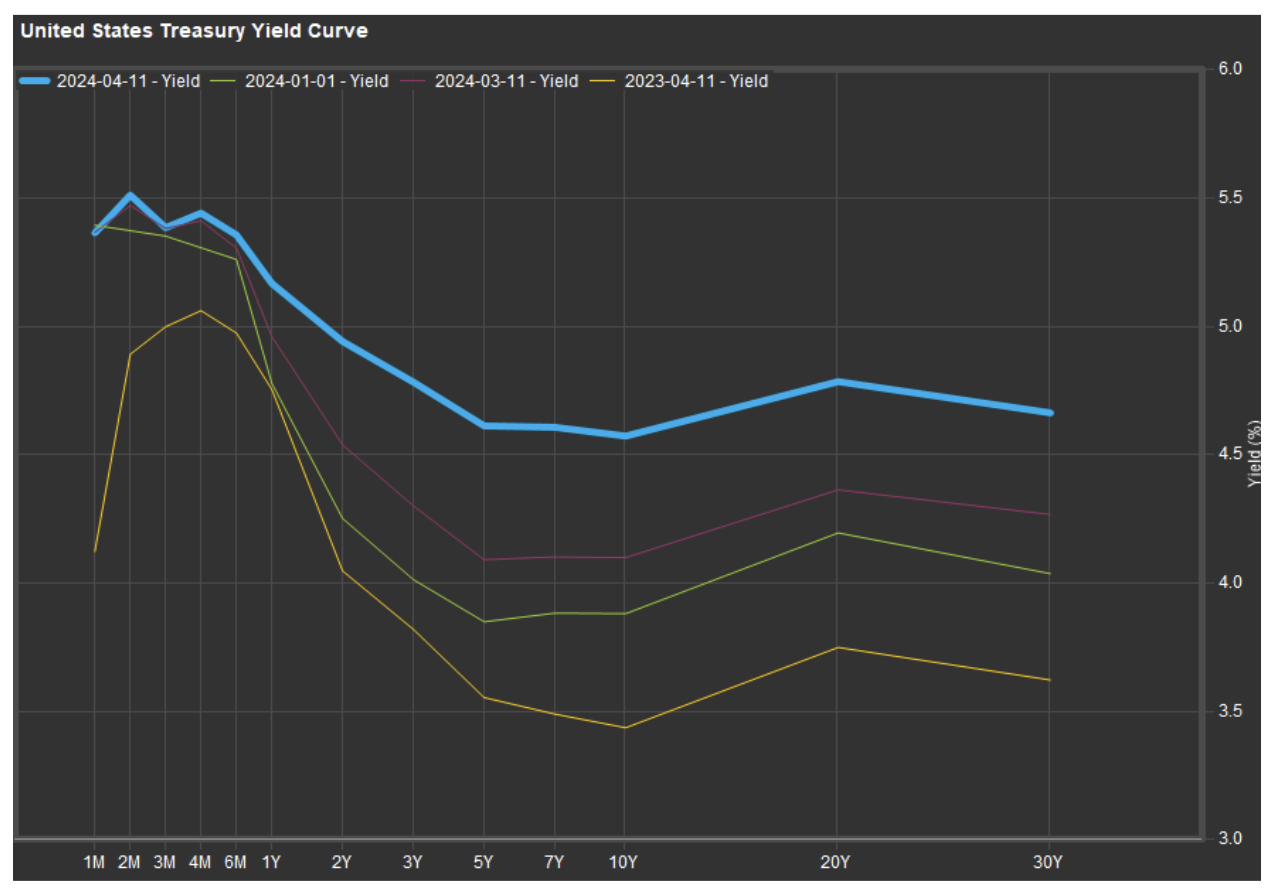

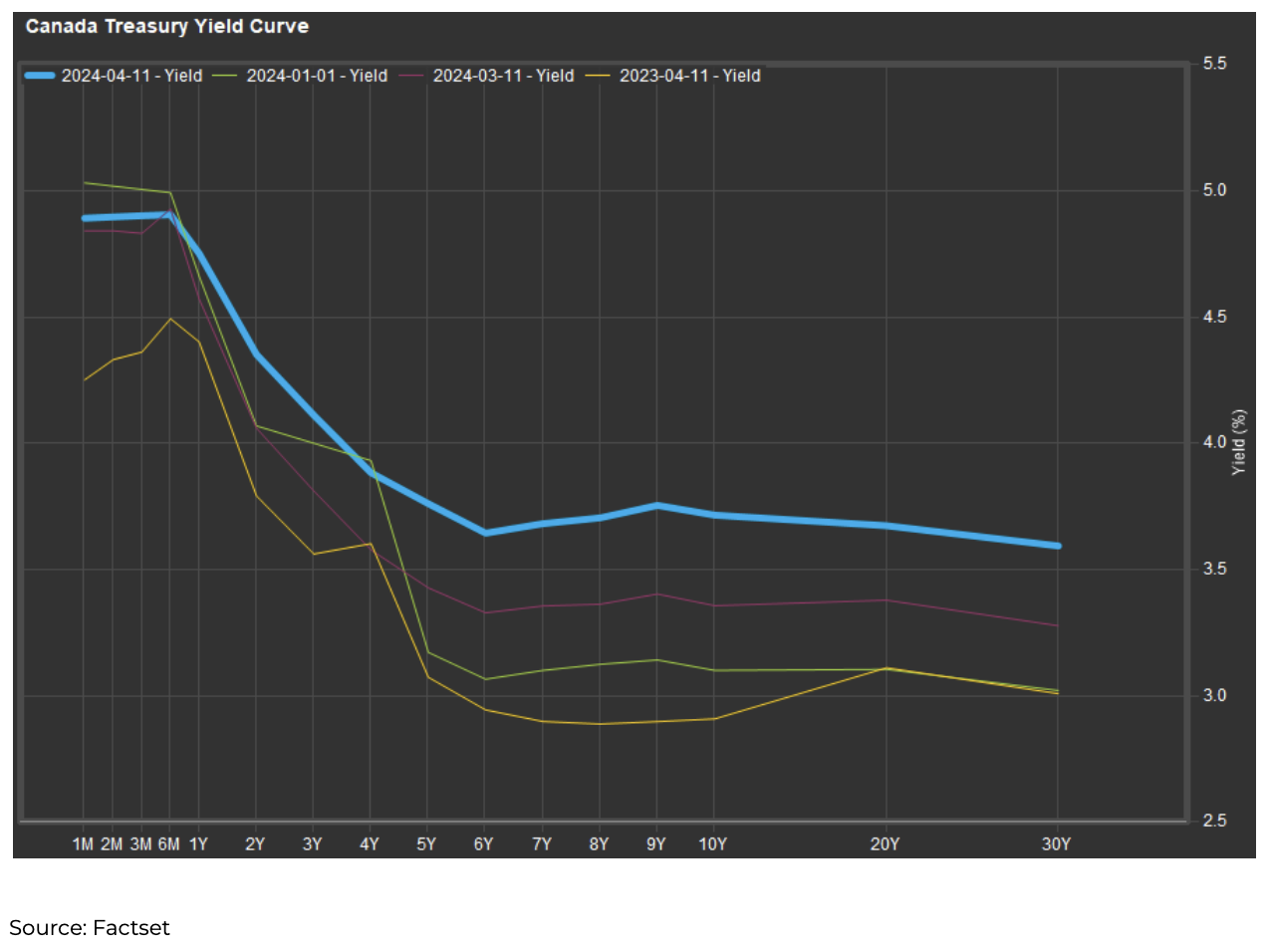

Bond yields rose (bond prices fell) this quarter as inflation resilience showed its ugly head. Rate markets continue to price in higher rates for longer, as evident in recent shifts in our yield curves.

The differences between the Canadian and US yield curves are becoming more distinct and tell a tale of two economies: a stagnant Canadian rate-sensitive economy and a robust rate-insensitive economy whose sovereign debt issues are becoming more concerning to would-be buyers of US treasuries, especially as geo-political tensions rise across the globe.

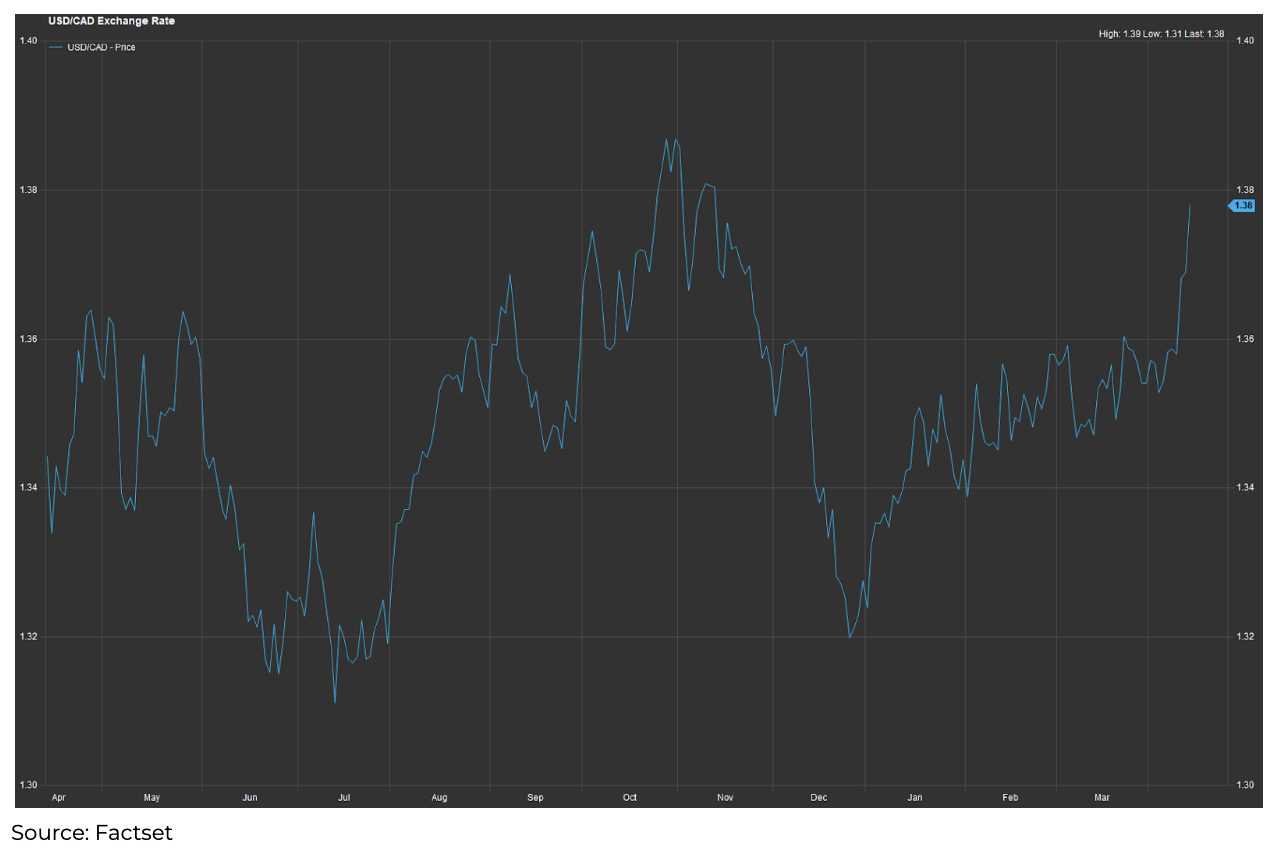

For Canada, a lower comparative yield offering may deter foreign investment, especially if the greenback continues its recent strength, as shown in the chart below illustrating the relationship of the USD/CAD currency pairing.

Canadian Equities

Canadian stocks performed exceptionally well in Q1, adding roughly 5% of market value. This is most likely due to a combination of momentum left over from the Q4 rally, risk on equity-seeking behavior, and the resilience of the Canadian economy to continue to avoid a recession, increasing the odds of a Canadian “soft landing.”

US Equities

As mentioned, the US stock markets had an exceptional Q1, with the S&P 500 returning over a 13% total return in Canadian dollar terms. Mid-caps lead the charge, and large caps weren’t far behind, but the returns generated from small capitalization companies struggled to keep us, as they have in recent quarters. The higher-for-longer interest rate narrative dictates that companies with smaller balance sheets will be hurt the most by the higher cost of borrowing. The longer it takes for rates to drop, the more these companies, as a group, will suffer.

Global and Emerging Markets

International and Emerging Market equities were up around 7% last quarter. Emerging Markets had India and China to thank for their performance. India continued its consistent bull march toward higher valuations, and Chinese large-cap stocks climbed out of the hole dug when China fell deep into oversold territory in January.

Japanese equities returned over 14% last quarter, over 23% for the savvy investors who hedged out their exposure to the falling Yen, a popular trade. Renewed optimism in Europe over future growth outlooks and inflation was another driver for international equities. A large part of this attribution comes from Germany, up over 10%.

Portfolio Attribution & Positioning

Growth Portfolio:

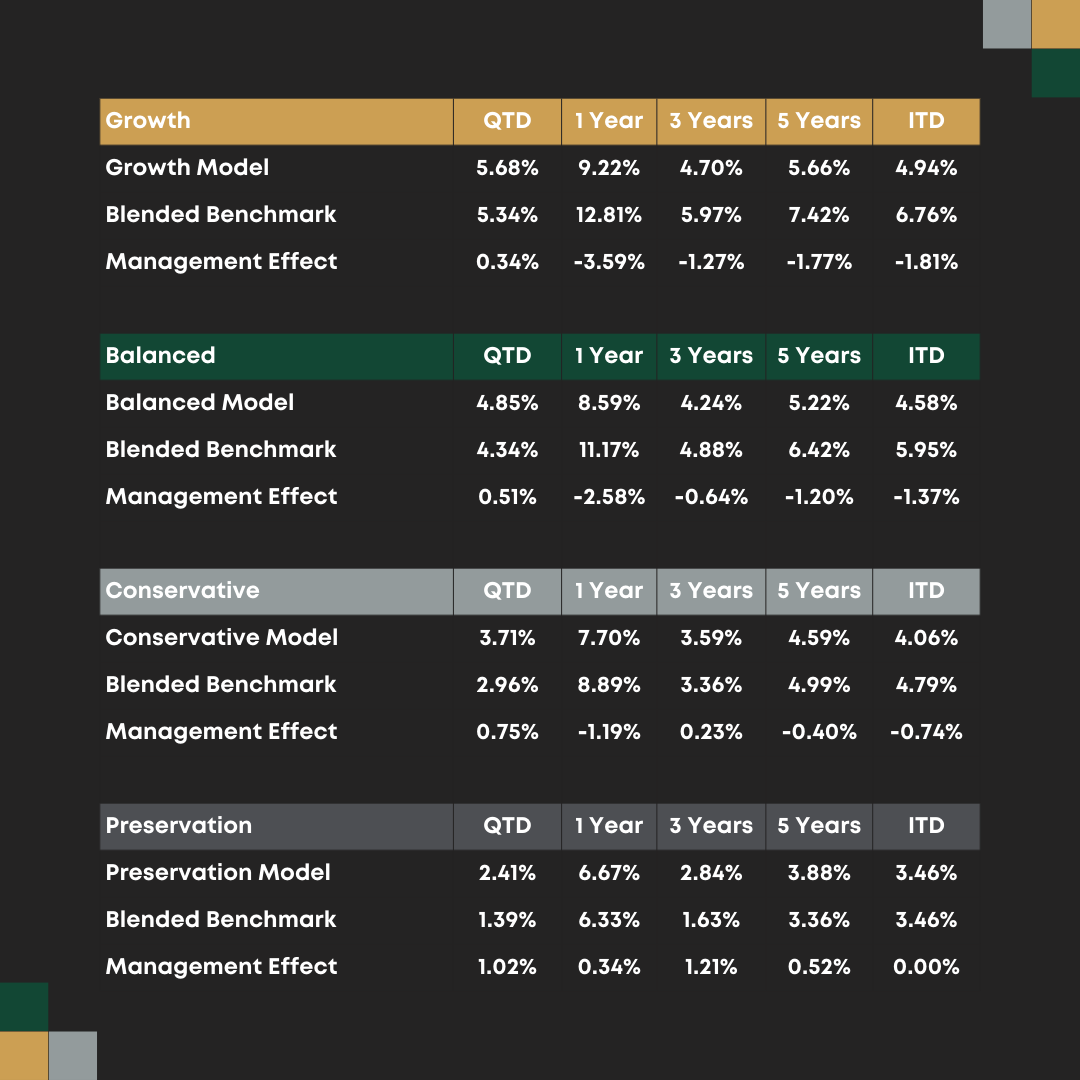

The Growth fund had an excellent quarter, up 5.68% vs its benchmark return of 5.34%. The positive performance was driven by our allocation to public equity (up nearly 7%), preferred shares (up over 14%), and absolute return strategies (up over 5%). Our fixed income and real estate holdings were nearly flat in the quarter.

In Q1 2024, we made the following changes to the Growth Fund.

Increases:

- US Equity

- Canadian Equity

- Private Real Estate

- Private Credit

Decreases:

- Emerging Market Equity

- International Equity

- Tactical

- Preferred Shares

- Long/Short Equity

- Multi-Strategy

- Cash

So far this year, we as an Investment Committee have been modifying our Growth fund to hold a higher level of global equities, which can better reflect the equity profile of a Balanced Growth fund. We have also continued to add real estate and private credit as we gauge those asset classes to hold plenty of value and opportunity for price appreciation. This quarter, we have also realized some gains from our preferred shares, international equities, and absolute return strategies. We continue to hold investments that, to date, have not participated in this period of increasing valuations. These asset classes should do well if the market were to rotate or add more breadth to its rally.

The growth fund is well-positioned to take advantage of further upside in equity markets while limiting the risk of holding equities outright. We continue to strive for the valuable downside protection Raintree Wealth Management has gained a reputation for delivering.

Preservation Portfolio:

The Preservation fund was up 2.41% in Q1 vs our benchmark of 1.39%. The quarter’s positive performance mainly came from our allocation to equities and absolute return strategies. We also had superior returns from our fixed-income sub-managers, who handily beat the bond market, returning positive results while their benchmarks did not.

In Q1 2024, we made the following changes to the Preservation Fund:

Increases:

- Canadian Equity

- US Equity

- Global Equity

- Sovereign Bonds

- Multi-Strategy

Decreases:

- Long/Short

- Investment Grade

- Bonds

- Cash

The Investment Committee added equity exposure to the Preservation Fund and made a tactical decision to add some duration to the fixed-income portion of the fund. This decision is designed to help increase interest rate sensitivity, which should improve the return potential if interest rates fall.

Year-to-Date Performance & Outlook

Last year, markets were priced to reflect “higher for longer” until the Fed pivoted away from that narrative in Q4 and suggested a rate drop as soon as March was possible. The market was caught off guard and scrambled to reprice risk securities to reflect this new information. This past quarter painted a very different picture, showing an economy that may need a higher for the much longer environment to complete the job of taming inflation (more so in the US than Canada). If true, the market needs to be repriced lower, right? We’re not seeing that to date. So, as much as we enjoy this rally in equity, we remain cautious and protective of your capital.

Our standard deviation (volatility) of returns over this quarter was 2.19 for the Growth fund and 1.54 for the Preservation fund; this was about half the volatility of our benchmark. Demonstrating an ability to outperform major markets while taking on less risk.

As of March 31st, 2024

On the social side of our business, we had a headline sponsor of the Women + Wealth Gala, celebrating International Women’s Day in early March. It was a fantastic event; we’re pleased to have done that for the last nine years.

Also, late last year, we announced a sponsorship of a collegiate golfer, Ethan Wilson, who’s playing for the University of Illinois. He placed second in a qualifying regional tournament and followed that up with his first top-10 finish in a big tournament. We’re really excited for Ethan; he’s doing great things, and it’s been fun for us to watch him make progress. You can see some of the videos we’ve done interviewing Ethan on our website, and we’ll do another one after his season is over to catch up with him on his program.