“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.”

– George Soros

How the Results of the U.S. Election Could Impact Financial Markets

The market isn’t solely focused on the current state of the US economy and how much and in what timeframe the Federal Reserve will cut interest rates, although that’s still most important. Another meaningful market risk looms only a few weeks away: who will be the President next year and what implications that person’s policy agenda has on the market. With an unprecedented degree of ambiguity regarding who will win and their policies once in office, the market is struggling to reach any consensus on what is even somewhat likely. What is certain, though, is that the election outcome should have significant implications for many asset classes.

For equity investors, much of the focus will be on each candidate’s stance on taxes and tariffs. Goldman Sachs estimates that a Trump victory, with his plan to lower the corporate tax rate to 15% from the current 21%, could boost S&P 500 earnings by about 4%. This would likely support broad stock market gains, especially in sectors such as banks and technology, which stand to benefit from lower taxes.

On the other hand, if Harris wins, her plan to raise the corporate tax rate to 28% could reduce S&P 500 profits by about 8%, which could weigh on stock prices, particularly for tech and industrial companies. Still, Harris might adopt a more measured tone on trade, reducing the risk of trade war escalation, which would benefit sectors highly exposed to Chinese supply chains. Nvidia, Tesla, and Apple are some of the key ones.

The bond market will also be watching the election closely. A Trump victory is generally seen as inflationary due to his tax-and-trade policies, and we have already seen longer-term Treasury bonds come under pressure as the yield curve steepened during his previous tenure. Investors may anticipate higher spending and inflation, likely leading to rising yields and falling bond prices, especially on the long end of the curve.

On the other hand, a Harris victory might imply more fiscal discipline, but with rising government spending likely under either administration, the U.S. fiscal outlook remains challenging. The composition of Congress will play a critical role in determining the degree of fiscal stimulus, which will affect bond yields.

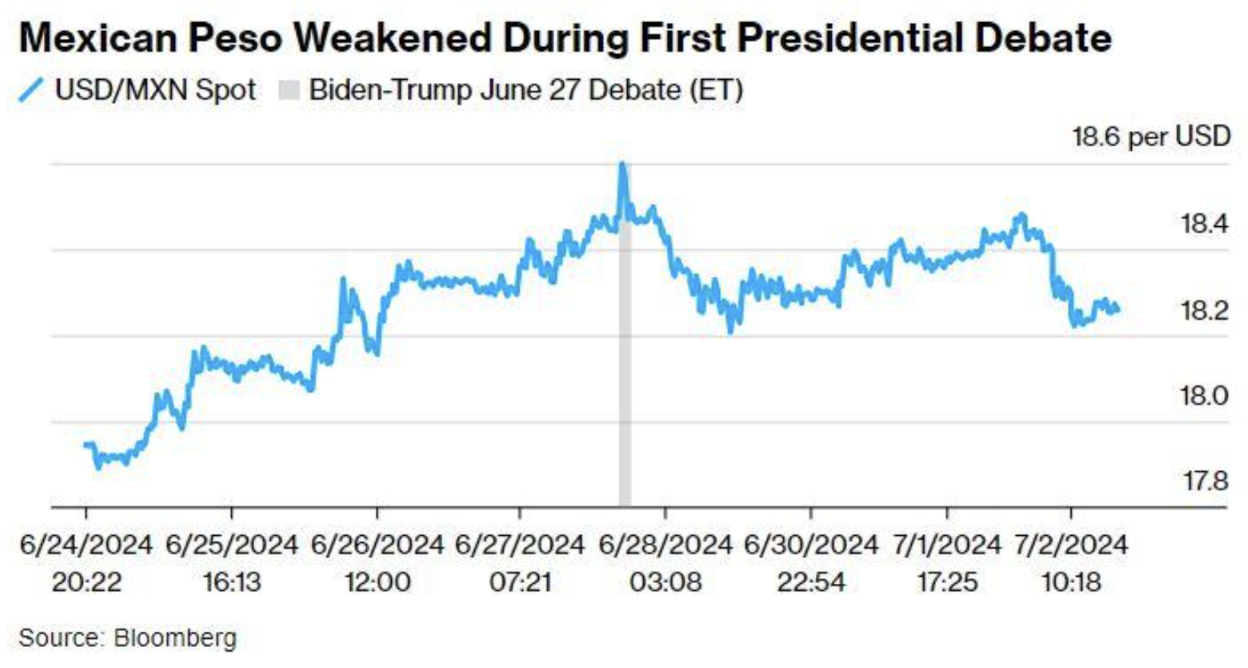

The currency market could see substantial volatility depending on the election outcome. The currencies of U.S. trading partners, especially Mexico and China, are susceptible to Trump’s tariffs and rhetoric around trade. For example, the Mexican peso weakened sharply during Trump’s campaign debates. If Trump pushes for a more aggressive tariff policy, especially his floated idea of a 100% levy on non-dollar-shunning countries, the dollar could strengthen against emerging market currencies.

However, Trump has also expressed dissatisfaction with the strong U.S. dollar, and his efforts to pressure the Federal Reserve to cut rates further could lead to volatility in the dollar’s value. A weaker dollar may be favoured under Trump, but how he balances these competing forces remains to be seen. In contrast, a Harris administration is expected to bring less uncertainty around U.S. trade and immigration policies, which could weigh the dollar as a safe haven asset. Wells Fargo strategists have suggested that under Harris, the expiration of Trump-era tax cuts and potentially more room for Fed easing could drive the dollar lower, creating a more stable global currency environment.

The outcome of the U.S. presidential election will undoubtedly have far-reaching effects on financial markets. For stocks, tax and trade policies will drive sector-specific reactions, while bonds are likely influenced by the degree of fiscal stimulus and inflation expectations. Meanwhile, currencies will react to shifts in trade policies and how each administration manages the value of the U.S. dollar.

Given all this uncertainty, investors should brace for heightened volatility across all these asset classes rather than try to predict an outcome successfully. As more details about the candidate’s policies are revealed and polling becomes more reliable as the election draws near, we should expect to see some large bets being made on the presidency and what it will mean for financial markets.

US Soft Landing Watch after the Fed’s 0.50% Rate Cut

On September 18th, 2024, the US Federal Reserve cut its overnight lending rate for the first time in nearly half a decade by 50 basis points. This is double what most predicted over the last couple of years would be the initial cut amount. Some fear Jerome Powell and Fed members may agree with recent headlines that a US economic downturn is more likely than previously thought, and that a large cut is warranted to provide more substantial financial relief to the economy. However, the latest incoming data suggests that the U.S. economy could still be heading for the elusive “soft landing.” (A situation where high interest rates tame inflation, rates are then lowered back to more economically stimulating levels, all while avoiding a technical recession) Although persistent inflationary pressures remain, there are encouraging signs that the economy may be slowing in a controlled fashion rather than tumbling into recession, as supported by recent data.

The unemployment rate declined in August, with the establishment and household surveys showing resilience in the labour market. While expectations of a slowdown in job creation have been building, these indicators suggest that the labour market remains robust. The notion that a sudden surge in unemployment could destabilize growth seems far-fetched for now.

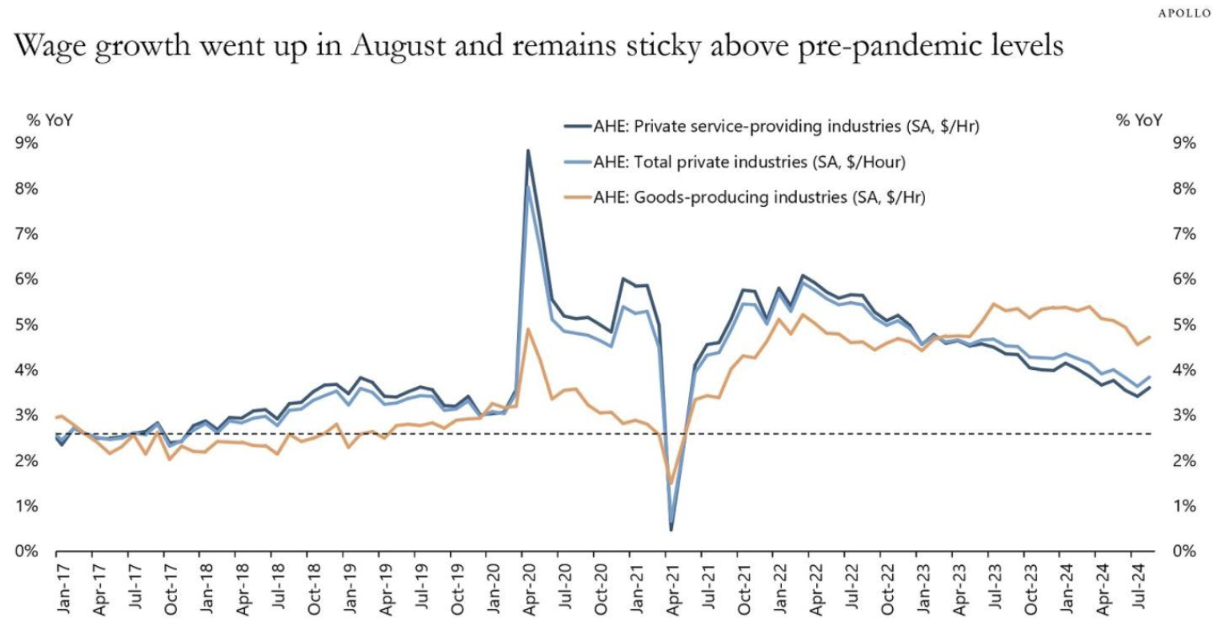

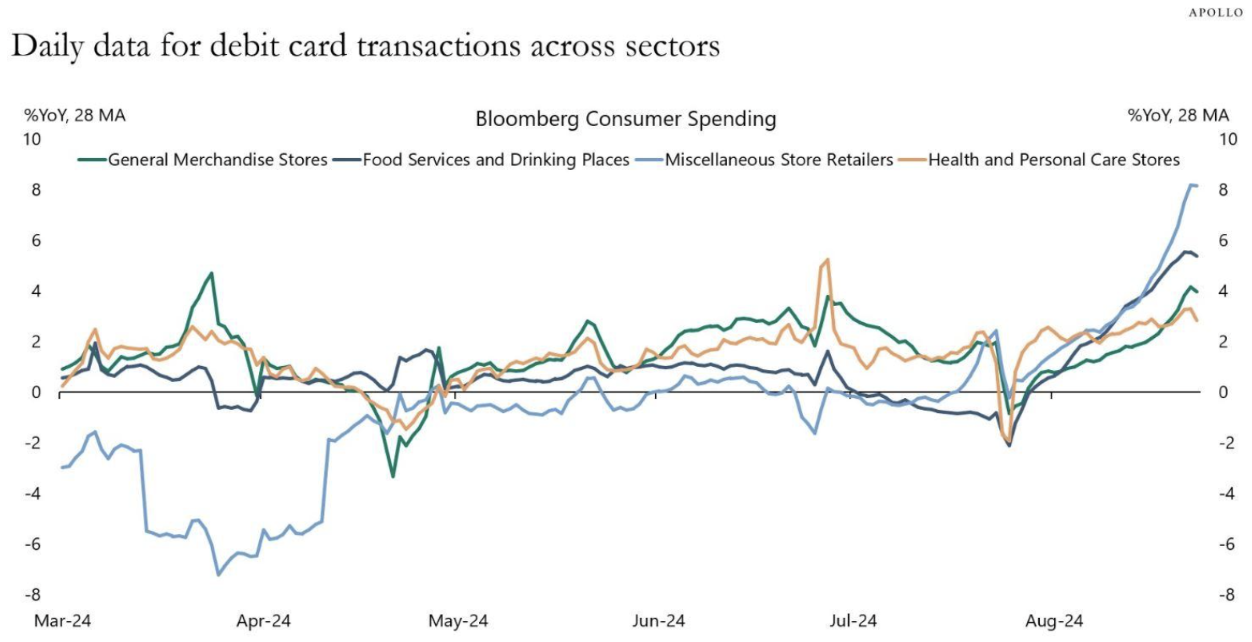

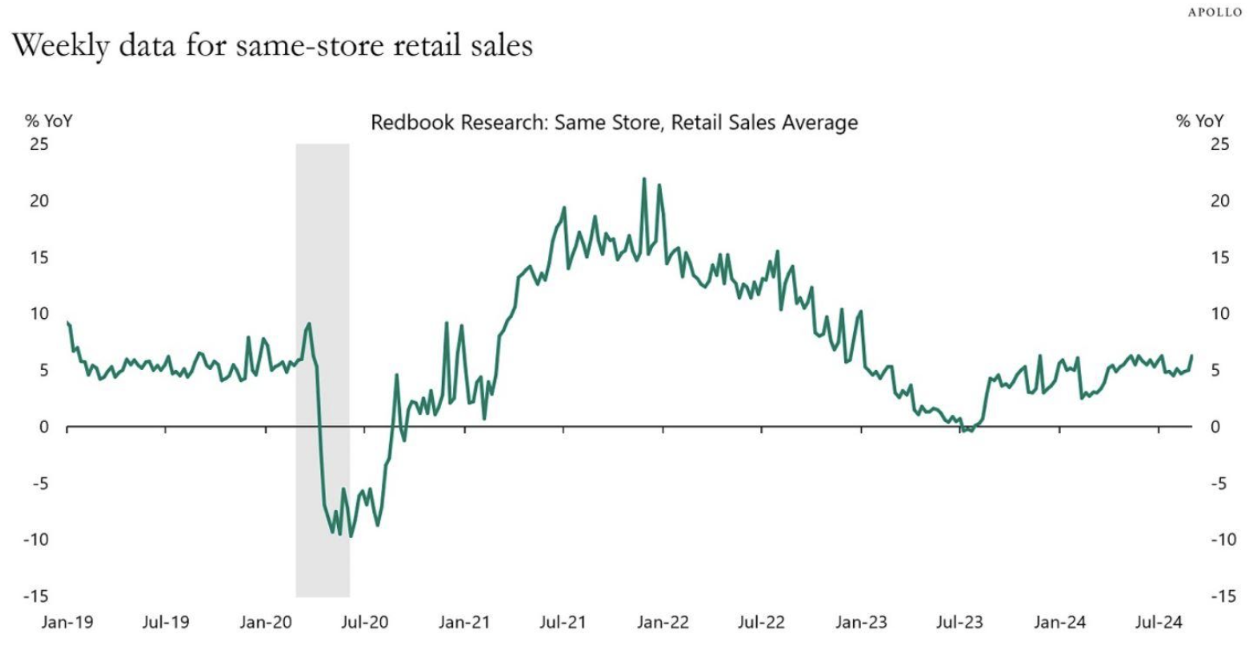

Wage growth, meanwhile, accelerated to 3.8% in August, holding above pre-pandemic levels. This so-called “sticky” wage growth is often seen as a harbinger of inflation, but in this case, it also indicates underlying demand for labour. A wage-price spiral may still be a concern, but wage gains in the context of low unemployment could continue to support consumer spending without sparking runaway inflation. This brings us to the consumer, who is still spending. Daily debit card data shows a recent acceleration in consumer activity, with notable upticks in spending on clothing, food services, sporting goods, and motor vehicles. Retail sales have also been solid, showing strength in the most recent weekly data. The consumer, it seems, remains resilient—hardly the stuff of a looming recession.

Jobless claims in the US have declined for several weeks, and continuing claims have followed the same trend. Historically, increasing these claims is often a leading indicator of economic downturns, so the current downtrend suggests that labour market conditions remain strong.

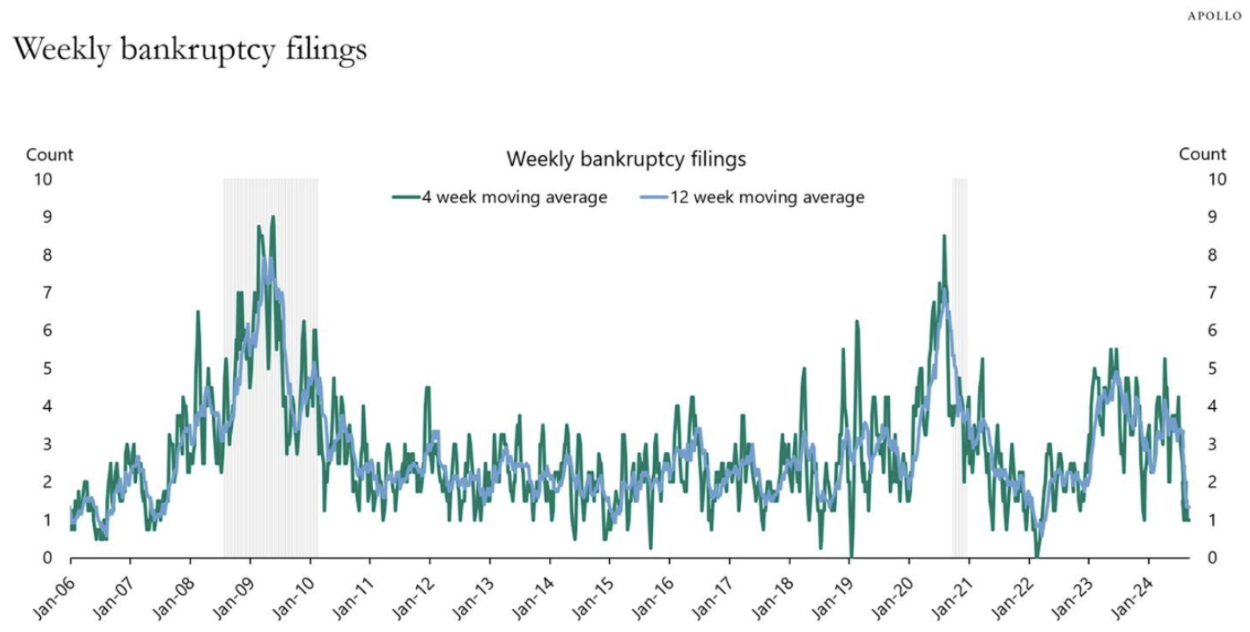

Even on the riskier edges of the market, signs of distress are diminishing. Default rates and weekly bankruptcy filings are declining, which should comfort those concerned about corporate vulnerabilities in the face of high interest rates.

GDP projections are another bright spot. The Fed’s weekly GDP model projects 2.4% growth, and the Atlanta Fed GDPNow tracker suggests 2.1% growth this quarter. This is an impressive outcome for an economy many had written off as recession-bound.

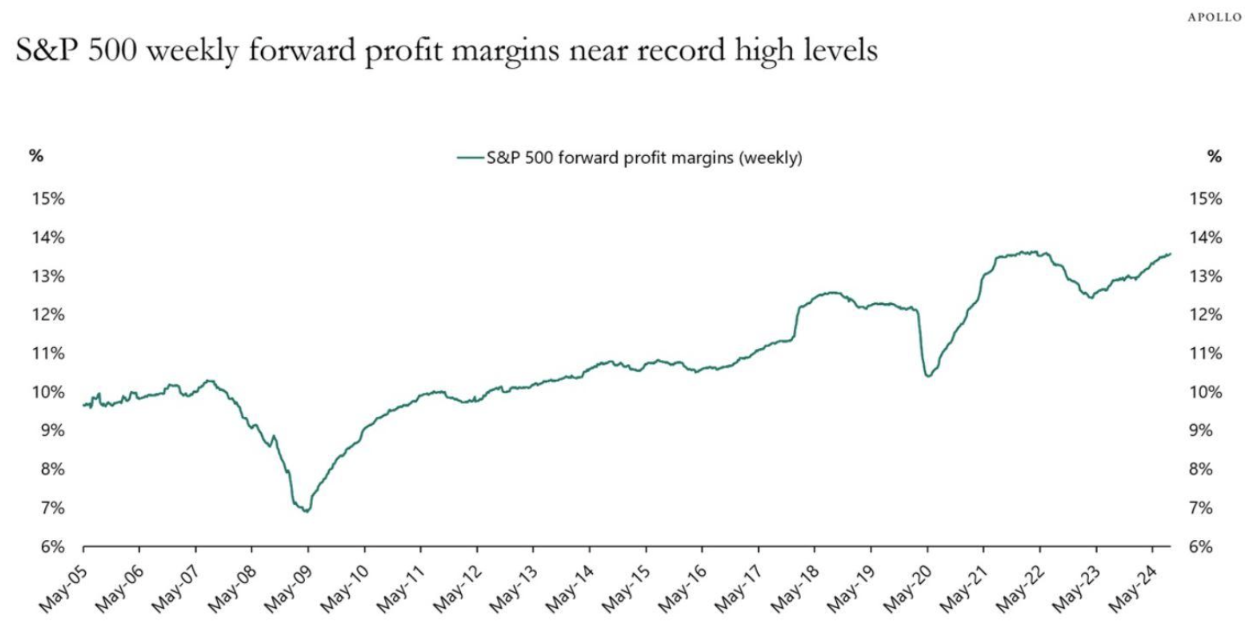

Perhaps the most intriguing signal of stability comes from corporate profitability. S&P 500 forward profit margins remain near record highs, pointing to solid business conditions and pricing power. If margins remain elevated, we could see continued strength in corporate earnings, supporting equities and preventing a deeper market correction.

Together, these data points paint a picture of an economy managing to cool without stalling. While risks remain, particularly if inflation proves more stubborn than anticipated, the odds of achieving a soft landing appear to increase. Investors, businesses, and policymakers will watch closely as the data continues to roll in.

China Remains in Big Trouble

While global markets have experienced bullish sentiment this year, China’s economic troubles continue to deepen, creating a stark contrast. In the last few weeks, JPMorgan was the latest of many large banks, like UBS and Nomura, to cut their China recommendation from Buy to Neutral. Core inflation has cooled to its weakest point in more than three years, further evidence that consumer demand is slowing in the world’s second-largest economy. Société Generale’s Michelle Lam notes that deflationary pressures are becoming more entrenched, suggesting that consumer demand is weakening when policymakers are struggling to stabilize growth.

The effects on the Chinese stock market are profound. The CSI 300 Index recently lost more than 1% and is teetering near a five-year low. The index is down nearly 7% this year and facing an unprecedented fourth consecutive annual loss. An MSCI Inc. gauge of Chinese stocks also shows its longest underperformance stretch compared to global equities since the early 2000s.

The property crisis in China continues to weigh on consumer spending, and ongoing geopolitical tensions with the U.S., particularly as the election approaches, amplify selling pressure. The risk for President Xi Jinping’s government is that continued market weakness could undermine consumer and business confidence, leading to a deflationary feedback loop. To combat this, Beijing has spent billions of dollars through state-backed funds to support stock prices, but the measures have been mainly ineffective.

Many investors are calling for more aggressive government stimulus, yet Beijing has shown little appetite for large-scale interventions akin to those seen in past economic cycles. As Ron Temple of Lazard Asset Management highlights, “The longer the government delays significant demand stimulus, the harder it will be to revive consumer confidence and economic momentum.”

Chinese authorities have tried to stabilize markets by restricting quant trading and short selling while encouraging companies to boost buybacks and dividend payouts. However, such efforts have been underwhelming, with many investors remaining skeptical about China’s trajectory. Despite this, the People’s Bank of China hesitates to cut rates aggressively due to concerns about widening the gap with U.S. rates, which could exacerbate depreciation pressures on the yuan.

Overall, China’s market struggles highlight its uncertain future. With nearly $6.5 trillion wiped from the value of Chinese and Hong Kong stocks since the 2021 peak and earnings per share for the MSCI China Index falling 4.5% in Q2, China seems stuck in limbo, lacking the dynamism of an emerging market and the stability of a developed one. Deflation threatens to spiral further, with corporate revenues and employment suffering as consumers hold off on spending. Many Wall Street analysts now predict China could miss its 5% growth goal, adding further pressure on policymakers.

Bank of America said the US ballot is starting to emerge as a top risk to the global economic outlook, albeit tough to assess. The potential for another trade war between Washington and Beijing weighs heavily on many Chinese exporters.

Even if these short-term problems can be solved, China still faces much larger long-run systemic issues. The Chinese population is shrinking, and the UN forecasts that the Chinese working-age population will decline by roughly 100 million people every decade; losing 10% of your workforce every 10 years, all else being equal, is a real problem. These demographic headwinds are significant and a major drag on growth in China, see below and in our chart book available here. A shrinking population with fewer working-age individuals means fewer taxpayers, more spending on government services for retired people, and overcapacity, as companies can no longer fill existing factories with workers.

As global investors watch closely, China’s economic trajectory will remain a key source of uncertainty in financial markets. The risk of deflation, coupled with Xi Jinping’s reluctance to unleash aggressive stimulus, suggests that the road to recovery may be far more challenging than anticipated.