Overview

Welcome to our first edition of Mike’s Monthly Market Commentary.

Our November analysis delves into the global rally’s exceptional breadth, witnessing strong positive performance across every market sector. From the Bank of Japan’s pivotal policy shift to the nuanced decisions of the US Federal Reserve, we navigate through the month’s key events, including positive US employment data and shifts in inflation indicators. As we explore the intricacies of the US economy, from housing market dynamics to interest rate forecasts, we also touch upon broader economic challenges, including the US debt crisis. Join us for an insightful examination of November’s market landscape, encompassing banking trends, commercial real estate challenges, and notable developments in the IPO market. Our commentary concludes with a thought-provoking addition to the watch list, addressing the widening gap between market giants and an unexpected turn of events at OpenAI.

We invite you to stay informed with our comprehensive market analysis through Mike’s Monthly Market Insights each month going forward.

November’s Global Rally

November witnessed an extraordinary surge in almost all financial markets across the globe. The global rally showcased remarkable breadth, with virtually every market sector demonstrating strong positive performance.

The rally kicked off overnight on November 1st when the Bank of Japan changed its policy and finally allowed their 10-year government bond yields to rise. Subsequently, the US treasury decided to issue less-than-expected treasuries at shorter durations so as not to disturb the long end of the yield curve. This was followed up by the US Federal Reserve’s decision to keep interest rates where they were for the time being and hinted that there may not be any more rate hikes. Positive US nonfarm payroll numbers, only 150k, coupled with a downward revision of September’s numbers, fueled further positive momentum. This was a prelude to the upcoming announcement that the US employment rate had hit a 2-year high of 3.9%, still historically very low but a move in the right direction for the war on inflation. Continued jobless claims reached a 2-year high as well, a third sign that the labour market may be cooling.

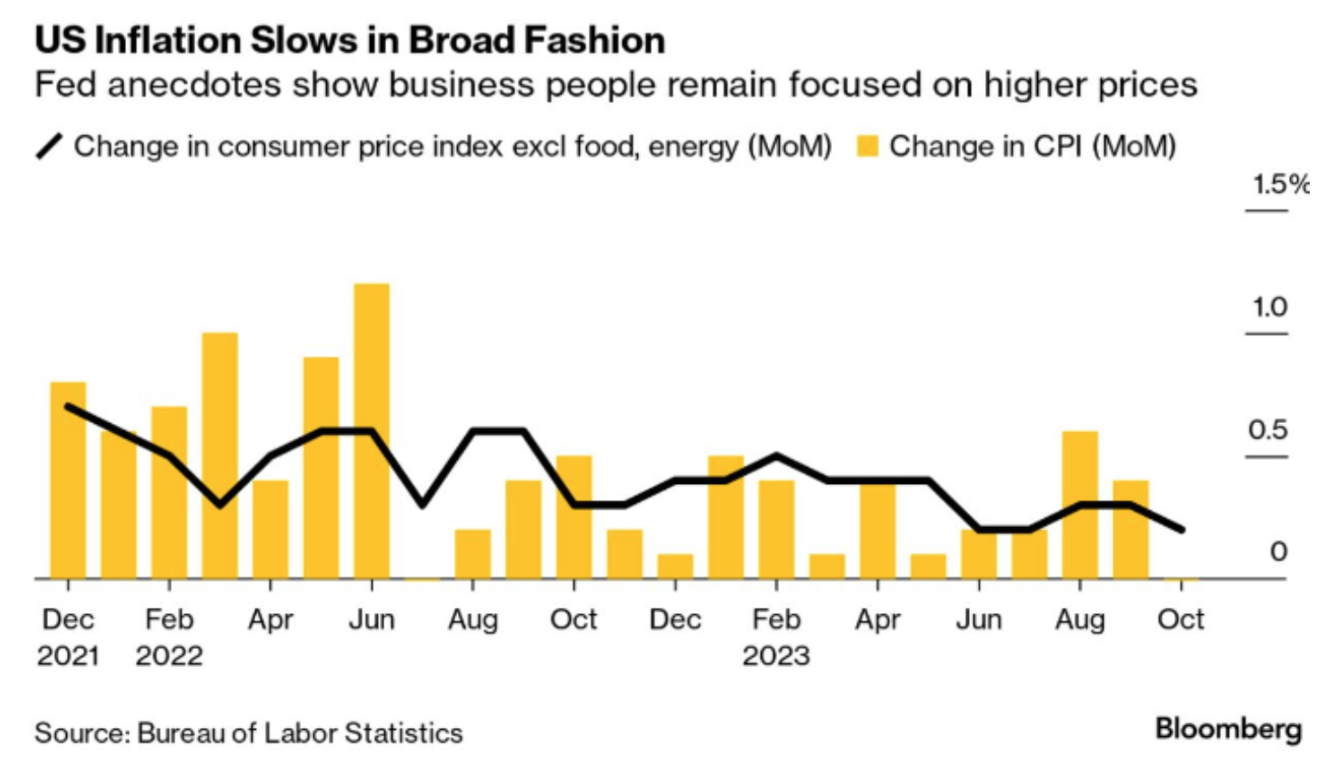

Market euphoria continued when the CPI number for October was announced to be just 0.2% higher than that for September. Later in the month, US producer prices reported a 0.5% decline; however, a deeper dive shows that this decline is mainly from gasoline prices. WTI Oil continued its slide in November, down over 6%.

US GDP Growth, Housing Dynamics, and Interest Rate Speculations

In the third quarter, US GDP hit a robust annualized rate of 4.9%, later revised upward to 5.2%, showing that the growth of the US economy is still not feeling the desired impact of higher rates. However, it is showing signs of weakness. Residential investment in the US as a share of GDP hit all-time lows in Q3. Many US homebuilders are cutting their prices even further in response to poor demand. This is one of the many variables those in the “Soft Landing” camp point to when considering how quickly a downturn in GDP will level off, with the expectation that this industry will recover quickly as soon as interest/mortgage rates decline, contributing once again to GDP.

US mortgage rates dropped from their 23-year high this month, down from 8% to 7%. In the face of these high mortgage rates, US home prices hit an all-time high this month, showing that the rapid decline in housing supply is outpacing the decline in demand. Put another way, people with existing 3% mortgages that are locked in for 30 years are willing to sacrifice just about anything not to break that sweet deal.

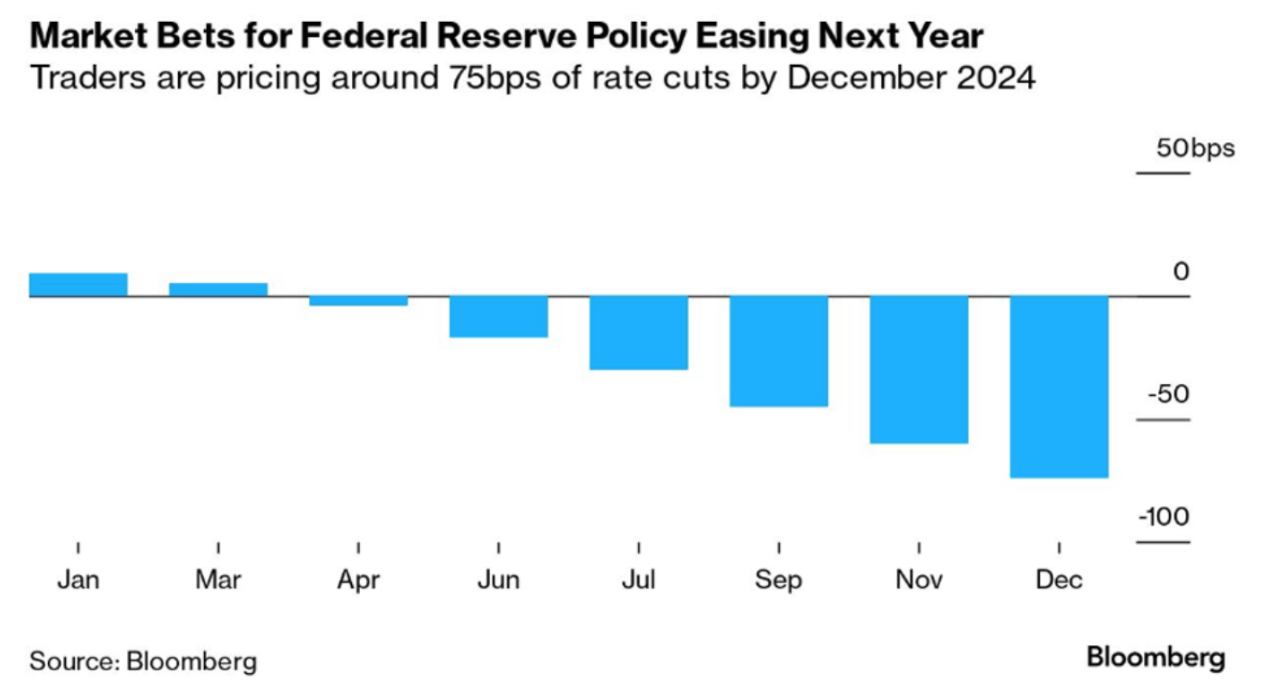

Throughout the month, rate traders forecasted that we have seen the last interest rate raises in the US and that rate cuts may come as early as March, although consensus closed the month with its best guess still sometime in the 3rd quarter. Federal Reserve Chairman Jerome Powell attempted to cool market expectations by reiterating that future hikes are still possible, though the market largely ignored these remarks.

Moody’s Downgrade, Consumer Savings, and Black Friday Trends

Even Moody’s downgrade of the US economic outlook from neutral to negative did not affect the market, showing signs that the market’s sole focus these days is on where interest rates will be in the coming quarters. US Secretary Janet Yellen dismissed this outlook, perhaps to bolster the recent lackluster demand for US treasuries. Sovereign Wealth Funds were net sellers of US treasuries in October.

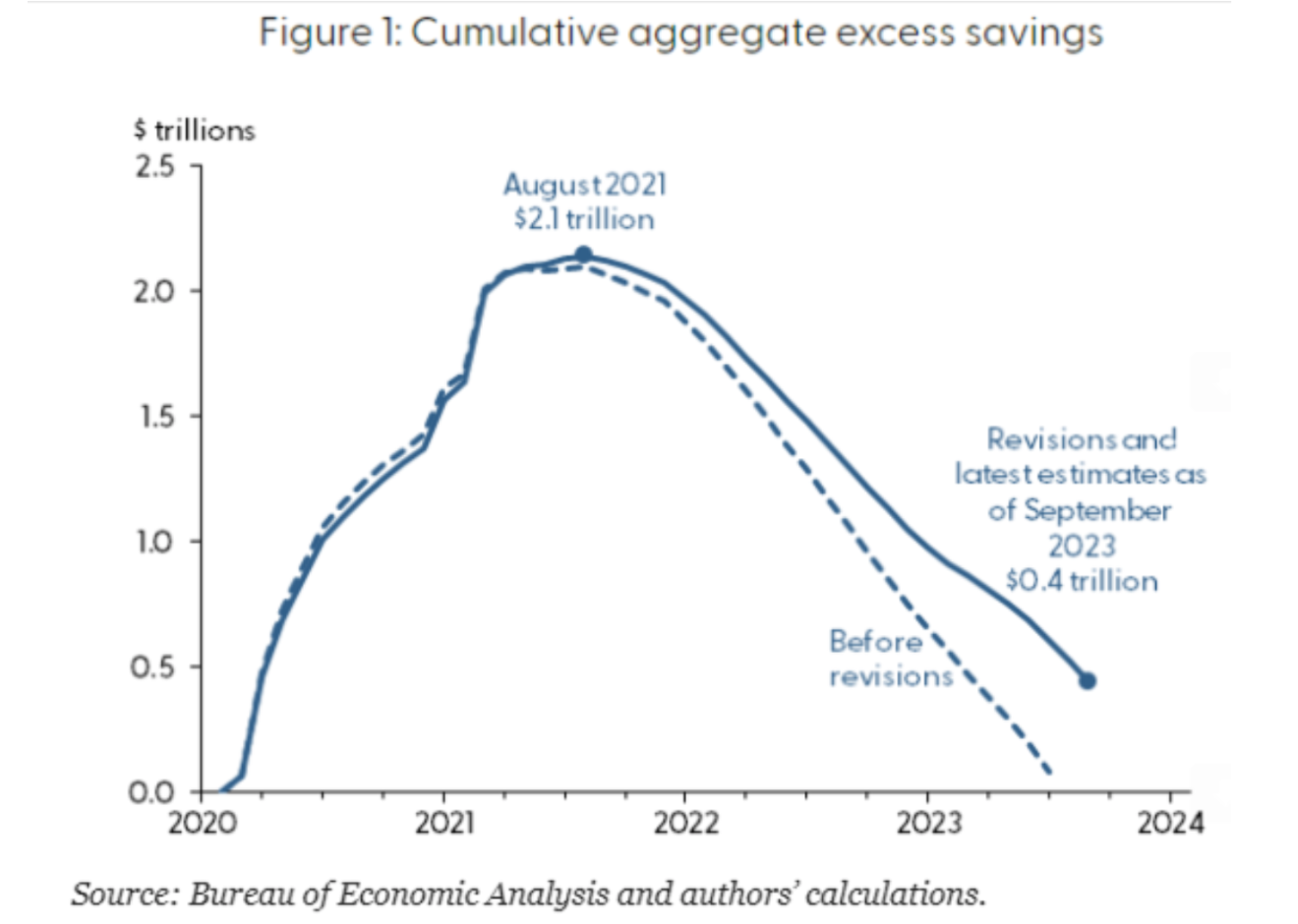

Estimates on remaining consumer savings are still elevated at 430 billion, but that number is expected to decline much quicker during the first half of 2024. Consumer inflation expectations climbed again in November, hitting a seven-month high. If consumers act on their beliefs, then there’s much more value in spending their savings than being able to buy less with them in the future. But of course, the flip side of that coin is that central bankers have made it much more profitable to save on a nominal basis. Retail revenue tallies from this holiday season should give a clear picture. Black Friday had a record regarding online sales; however, most retailers reported less revenue from the day than the previous year.

Banking Challenges, Real Estate Strains, and Market Shifts

The US banks continue to tighten lending standards and fight for quality in the consumer market. The banking crisis in the US seems more and more to be contained to small to medium-sized regional banks, which could still have a sizeable systemic impact in 2024.

Elevated interest rates have put a high level of strain not only on residential real estate but also on commercial real estate; WeWork, the office space rental firm, became its first major victim when it filed for bankruptcy this month.

The IPO market remains unattractive to investors; many companies and investment bankers had pinned many hopes on its revitalization with the ARM IPO, which did not IPO well and saw a further decline this month on poor sales forecasts. The ripple effect of not having a reliable secondary market to sell to at higher valuations is making big waves among private firms and their investors. Private equity firms are starting to come to grips with this new reality and focus more on operations for profit than continuing to rely on higher future valuations down the line. The Venture Capital market has been hit hard over the last 20 months, having to change their valuations to fit this new rate environment.

Private Equity markets may need to follow suit, especially with firms that borrowed against valuations set in 2020 and 2021, now generally accepted as bad vintages in the private equity and private credit world.

The US House of Representatives passed a bill to avoid a government shutdown, which the Senate later passed.

The Bank of Canada’s governing council met this month. They were split on their decision to continue raising rates despite inflation approaching target levels, a -1.1% Q3 decrease in GDP, and a continued increase in unemployment.

Charlie Munger passed away at the age of 99. He was known as Warren Buffett’s right-hand man, but he was a poignant teacher of value and quality-based investing. His knowledge and insight into market dynamics will be missed.

What November Added To The Watch List

- The US debt crisis is a significant problem. The US now has over 30 trillion in debt, with service costs on that debt totaling over a trillion dollars per year, and it is only going to get much higher. What are the potential solutions? US Presidential Candidates? Chime in at any time.

- The Gap between the “Magnificent 7” (Nvidia, Apple, Microsoft, Alphabet, Amazon, Meta, and Tesla) and the rest of the S&P 500 continues to widen. History tells us that this is never sustainable; the market is behaving like it is.

- Sam Altman was fired by his board at OpenAI. He was then rehired at OpenAI. Is this the end of this drama or just the beginning?

Statements

Third-quarter statements are now available and can be found in the Raintree Portal accessible here: https://raintreeportal.inf-systems.net/. Please be advised that we have consolidated all account statements into one household statement. We made this change to simplify the reporting. We had previously provided separate statements for each account as per regulatory requirements. All account details will be available within the new consolidated statements If you have any questions or concerns, please contact our team.