Evolving Our Approach

As Raintree Wealth Management (RWM) celebrated its 6th anniversary not too long ago, reflecting on the trajectory of our business journey fills me with pride and a sense of accomplishment. Over the years, we have consistently embraced evolution and change in managing money. From adapting to shifts in market dynamics to incorporating innovative strategies, our commitment to staying ahead of the curve has been unwavering.

The last few years of market volatility in equities and fixed income have made managing risk while seeking growth more challenging. To counteract these challenges early on, we embraced pivoting our portfolios to “pension-style investing.”

Pension-style investing refers to an investment strategy commonly employed by pension funds and other long-term institutional investors to generate steady, reliable returns over an extended period, typically to meet future pension obligations. This approach emphasizes a diversified portfolio comprising a mix of assets such as stocks, bonds, real estate, and alternative investments. The goal is to balance risk and return while aiming for long-term growth and stability.

The benefits of alternative investments like real estate, include improving risk characteristics while providing unique sources of income and capital appreciation. Raintree’s roots were founded in its expertise in alternative investments and offering solutions to Canadians for over a decade. It’s in our DNA. So, it’s only natural that our portfolio solutions evolved. Over the last 18 months, we have added several global managers to fill ever-increasing allocations to alternative investments. Strategies like private credit, real estate, and absolute return have positively impacted our portfolios.

Looking forward, it is clear that we need to make further changes to fully adopt and “lean in” to our conviction of pension-style money management.

So, what does that mean?

RWM has always believed in active management and hiring the best global managers who add value and expertise in their particular part of the investment world. That is not changing. In fact, we want more managers who offer unique investment skills in providing long-term growth while managing risk.

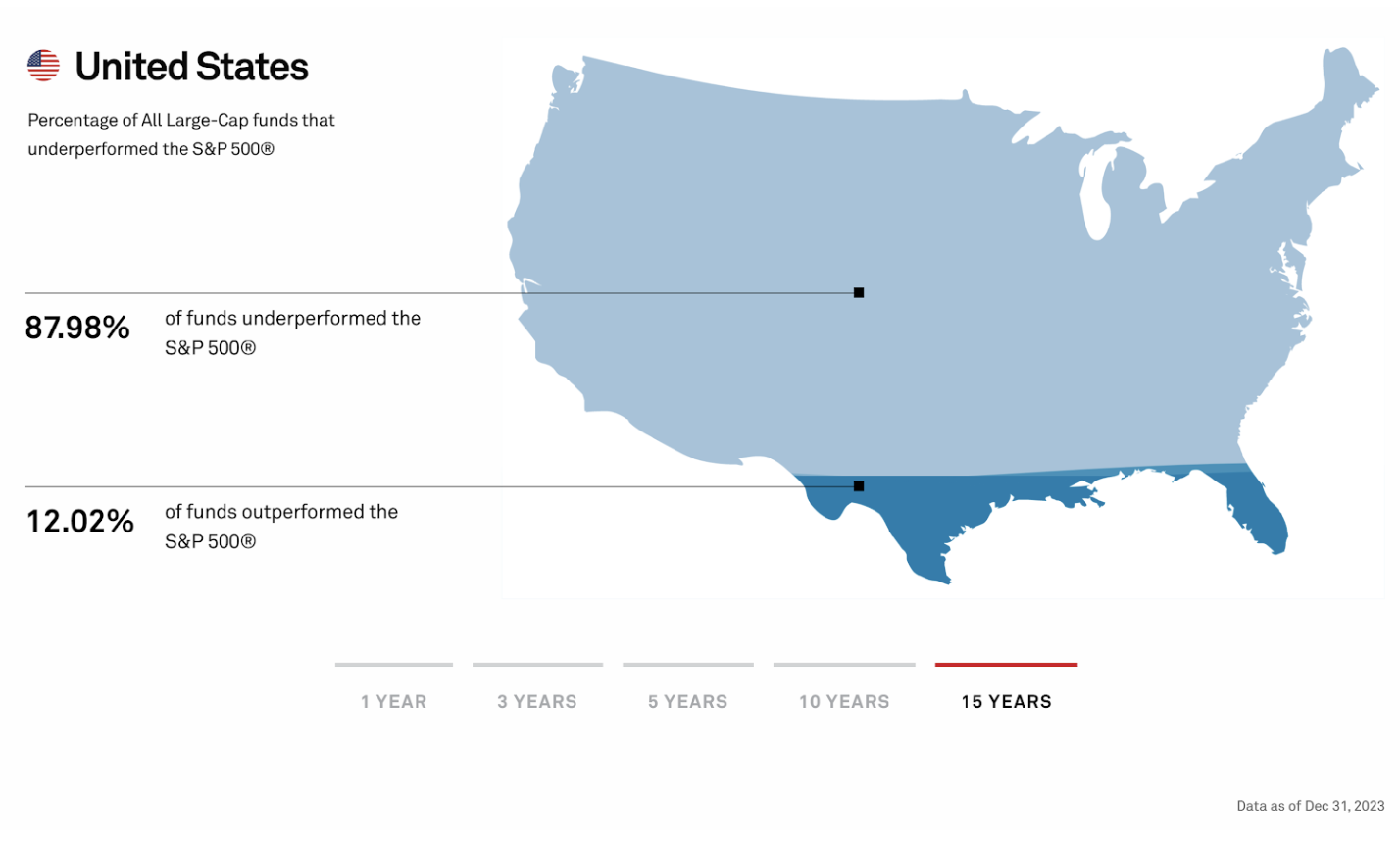

The trade-off is being disciplined around certain markets where managers can struggle to provide value over the long term. Our experience, research, and enough statistical evidence show that the best way to manage active risk and outcomes in certain markets is not to take it. In a recent S&P Global research survey (see below), nearly 88% of active managers fail to outperform the US Large Cap S&P 500 over the last 15 years.

Large-cap and small-cap refer to a company’s market capitalization, calculated by multiplying the total number of outstanding shares by the current market price per share. Large cap companies have a market capitalization typically greater than $10 billion, while small cap companies have market capitalizations generally below $2 billion.

This underperformance by managers in the US Large Cap Equity is not isolated. Similar results of underperformance in managers investing in Large Cap Canada and Europe.

We saw this as an opportunity to reposition our asset allocation focus on active managers that provide the growth and risk characteristics we desire and partner with one of the largest portfolio managers in the world to manage our allocations in equity markets with high efficiencies and active managers tend to lag.

This shift in portfolio positioning will result in greater diversification, one of the core principles of pension-style investing. As a result, we are excited to announce we have partnered with the following new global managers to be part of the Raintree Wealth Management Portfolios.

BlackRock

BlackRock is one of the world’s leading investment, advisory and risk management solutions providers. The firm was founded in 1988 with over 10,000 investment professionals managing over $9 trillion. Blackrock will manage broad global equity allocations on our behalf.

Turtle Creek

Turtle Creek is an investment manager focusing on mid-cap securities in the US and Canadian equity markets. Their unique approach to identifying companies in public equities has translated to strong investment returns. Turtle Creek manages $3.7 billion in assets under management.

Wealhouse Capital Management

Wealhouse is a multi-disciplinary manager who manages both equity and credit strategies. They will invest in their North American long/short equities on our behalf. Wealhouse manages $1.7 billion in assets under management.

Orchard Global

Orchard Global is an alternative asset manager that provides private and public market credit solutions to their investors. We will invest in their Credit Opportunities strategy, focusing on subsectors of the global fixed-income market. They manage over $8 billion in assets under management.

With these new additions, we have one of the most impressive investment lineups in the industry.

We sincerely thank you for your valued partnership and trust in Raintree Wealth Management. Your confidence in our services is deeply appreciated, and we remain committed to delivering exceptional results and tailored financial solutions to support your goals. Thank you for choosing us as your trusted advisor.

If you have any questions or concerns about these changes or any other questions regarding your portfolio, please get in touch with my jbhutani@raintreewm.com.